Tesla (TSLA) is set to announce its second-quarter 2022 financial results on Wednesday, July 20, after the markets close. As usual, a conference call and Q&A with Tesla’s management is scheduled after the results.

Here we’ll take a look below at what both the street and retail investors are expecting for the quarterly results.

Tesla Q2 2022 deliveries

As usual, Tesla already disclosed its Q2 vehicle delivery and production numbers, which drives the vast majority of the company’s revenue.

Earlier this month, Tesla confirmed that it delivered just over 254,000 electric vehicles during the second quarter of the year.

This is the first time in a long time that Tesla’s deliveries were down and it is due to lockdown restrictions in Shanghai forcing the automaker to shut down Gigafactory Shanghai for weeks during the quarter.

Delivery and production numbers are always slightly adjusted during earning results

Tesla Q2 2022 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers, but it is harder this quarter to adjust down instead of up this time.

The Wall Street consensus for this quarter is $16.521 billion, and Estimize, the financial estimate crowdsourcing website, predicts a significantly higher revenue of $17.186 billion.

It’s rare that the range is this significant, but it is to be expected with this quarter’s conditions. It is also interesting that revenue estimates are not that far off from the previous quarter, despite already knowing that Tesla delivered about 50,000 fewer vehicles this time around.

Here are the predictions for Tesla’s revenue over the past two years: Estimize predictions are in blue, Wall Street consensus are in gray, actual results are in green:

Tesla Q2 2022 Earnings

Tesla always attempts to be marginally profitable every quarter as it invests most of its money into growth, and it has been successful doing so over the last two years now.

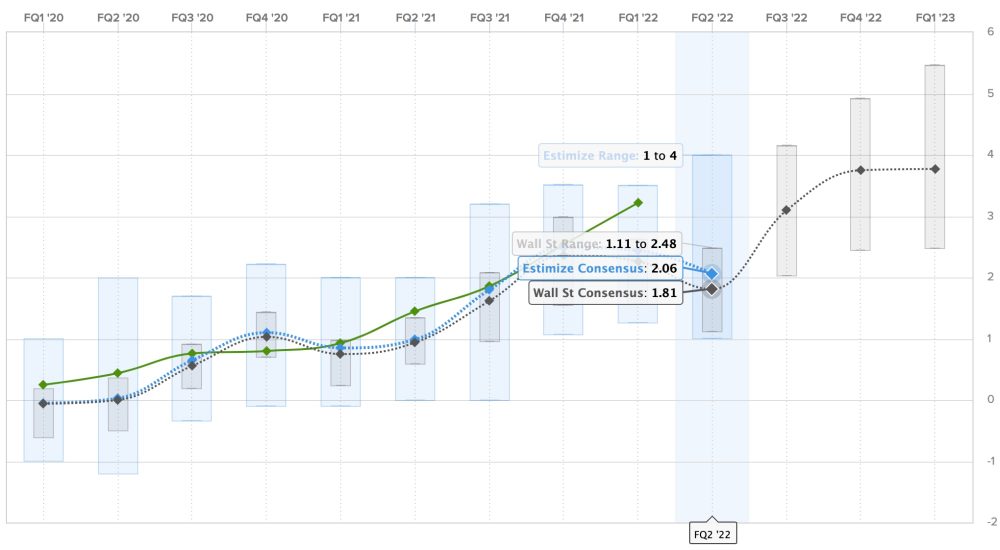

For Q2 2022, the Wall Street consensus is a gain of $1.81 per share, while Estimize’s prediction is higher with a profit of $2.06 per share.

These earnings estimates are even more surprising than the revenue estimates since they point to Tesla barely slowing down on the earnings side of things despite the challenges during the quarter with Shanghai being shut down for weeks and Texas and Berlin losing a lot of money while trying to ramp up production.

Here are the earnings per share over the last two years: Estimize predictions in blue, Wall Street consensus in gray, actual results in green:

Other expectations for the TSLA shareholder’s letter and analyst call

In the shareholder’s letter and the following conference call, Tesla generally shares additional details about not only financial results, but also other important metrics on how the company is doing.

While the quarter was difficult for Tesla, it looks like it’s already behind them with Tesla already reporting that June was the automaker’s best month for production ever.

I think a lot of the questions are going to look forward to things like production ramps at Gigafactory Texas, Berlin, and Shanghai.

The level of information coming out of the earnings will likely depend a lot on whether or not Musk is going to be on the call, which he said he will not always be on going forward. He would make sense for him to be on this time considering that Tesla has let go of many employees this quarter and shareholders and analysts are likely going to have a lot of questions about that.

If Musk is there, I think he will have to field some questions about Tesla’s upcoming AI Day on September 30, which is likely going to be Tesla’s next big event.

When it comes to Tesla Energy, we do have some rare data ahead of the results. Electrek reported that Tesla had its best quarter in years for residential solar in the US with 71.5 MW. The final number will be higher with some deployment in the commercial market and other regions.

We also reported that solar roof deployment is still exceptionally slow and shareholders should ask questions about that considering Tesla has previously mentioned that this is going to be an important product.

The FSD Beta program is also critical and investors will want an update on that front.

What else are you looking for during Tesla’s earnings? Let us know in the comments section below, and join us Wednesday for our extensive coverage of the earnings.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Fred Lambert

Source: Electrek