Tesla (TSLA) is set to announce its third-quarter 2020 financial results tomorrow, October 21, after the markets close. As usual, a conference call and Q&A with Tesla’s management is scheduled after the results.

We’ll take a look below at what both the street and retail investors are expecting for the quarterly results.

Tesla Q3 2020 deliveries

As usual, Tesla’s vehicle deliveries drive most of its earnings results, since vehicle sales represent the automaker’s main revenue stream at the moment.

Tesla already released its Q3 2020 numbers confirming that it delivered 139,300 cars and produced more than 145,036 vehicles between July and September.

This is a new record for Tesla who met Wall Street expectations with the results, which were fairly high amid the COVID-19 pandemic.

Tesla Q3 2020 revenue

Wall Street’s revenue consensus for Tesla during the first quarter is $8.276 billion, and Estimize, the financial estimate crowdsourcing website, predicts a higher revenue of $8.433 billion.

Unsurprisingly, the market is expecting a significant quarter-to-quarter jump in revenue due to the new delivery record.

The predictions for Tesla’s revenue over the past two years: Estimize predictions are in blue, Wall Street consensus are in gray, actual results are in green:

Tesla Q3 2020 earnings

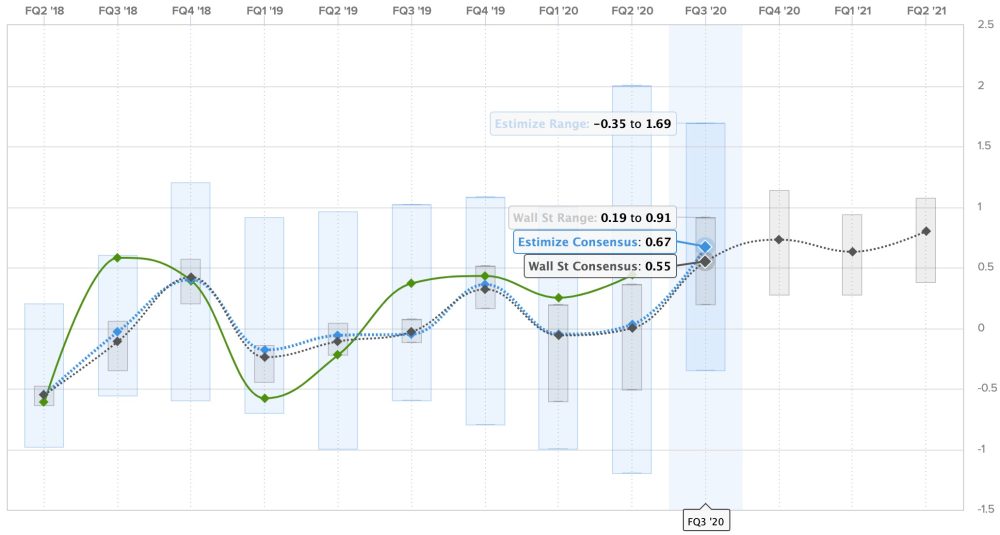

Now for earnings per share, or possible loss per share, the Wall Street consensus is a gain of $0.55 per share for the quarter, while Estimize’s prediction is slightly higher with a profit of $0.67 per share.

The earning estimates are much higher this quarter, both likely due to the higher revenue and the fact that Tesla has been consistently beating earning estimates over the last several quarters.

Earnings per share over the last two years: Estimize predictions in blue, Wall Street consensus in gray, actual results in green:

Other expectations for the TSLA shareholder’s letter and analyst call

One could argue that expectations are high this quarter with an estimated $2 billion increase in revenue quarter-over-quarter and higher profits.

While more deliveries generally means higher revenue, it depends on Tesla’s average share price per vehicle.

The expectation is that even though deliveries of higher price Model S and Model X vehicles are falling, Model Y will account for a large number of sales in the Model 3/Model Y mix in Q3, which should be positive for Tesla’s revenue.

However, it could have a negative impact on Tesla’s profits unless the automaker made some progress on Model Y gross margins.

I think that’s going to be an area of focus for investors during the earnings. They are going to want to monitor closely how Tesla is improving Model Y gross margins.

Other points of interest are likely going to be progress on the construction of Gigafactory Berlin and Gigafactory Texas as well as the timeline for Model Y production at Gigafactory Shanghai.

These are the main drivers of Tesla’s growth over the next year, and the market is monitoring those projects closely.

On the energy front, we expect another good quarter for energy storage, but we are still waiting for Tesla to accelerate solar power deployment.

Even after completely revamping its solar business over the last year, we have yet to see more solar deployment, and Q3 2020 could show something on that front.

What else are you looking for during Tesla’s earnings? Let us know in the comment section below and join us tomorrow afternoon for an extensive coverage of the earnings.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Fred Lambert

Source: Electrek