Roughly a quarter of Tesla’s earnings last quarter were due to recognizing a $600 million gain on Bitcoin. Tesla still came short of expectations.

Tesla and Bitcoin

Tesla is among the few large public companies that invested some of their cash into cryptocurrency.

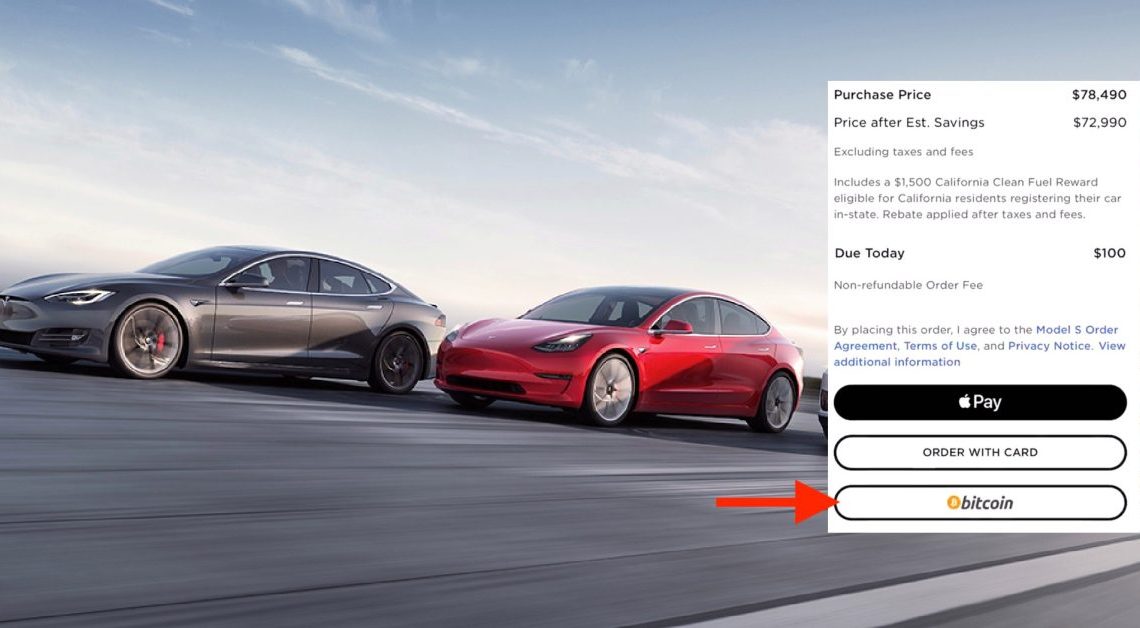

Early in 2021, Tesla invested $1.5 billion in Bitcoin. Shortly after, the automaker started accepting the cryptocurrency as payment on new vehicles.

However, a few days later, Tesla took a step back with crypto by removing the Bitcoin payment option. The company noted concerns over the energy needs of the Bitcoin network:

Tesla has suspended vehicle purchases using Bitcoin. We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.

This is a concern that many Tesla community members shared when Tesla first announced its Bitcoin investment, and many were angered by the fact that the company didn’t think about it in the first place.

At the time, Tesla noted that they were not selling their stake in Bitcoin and that they planned to resume taking Bitcoin payments once the network showed a higher mix of renewable energy.

Last year, Tesla made some moves that pointed to starting to take Bitcoin payments again, but it has yet to happen.

A year after the initial investment, Tesla’s Bitcoin holding increased to $2 billion, but the cryptocurrency lost a lot of its value in 2022 and the automaker’s position suffered – though the automaker also divested about 75% of its Bitcoin position during that time.

Tesla reported over $1.2 billion in proceeds from selling Bitcoins, but the automaker still sits on a good amount.

Tesla’s Bitcoin move in Q4 2024

Last quarter, Tesla moved its bitcoins around into new wallets, triggering a lot of speculation. We suspected that it might be moving things around to comply with the latest crypto accounting regulations.

Sure enough, with the release of Tesla’s Q4 2024 earnings yesterday, the automaker confirmed that it moved the Bitcoin to comply with the adoption of ASU 2023-08.

The move enabled Tesla to record a $600 million mark-to-market gain, accounting for a significant part of its $2.3 billion net income in Q4, which was already down 70% year-over-year.

Tesla disclosed in a SEC filing today:

Other income (expense), net, changed favorably by $523 million in the year ended December 31, 2024 as compared to the year ended December 31, 2023 primarily due to remeasurement of our bitcoin digital assets to fair value in 2024 (see above), partially offset by unfavorable fluctuations in foreign currency exchange rates on our intercompany balances.

If it wasn’t for Bitcoin, Tesla’s net income would be down 78% in Q4 2024 compared to Q4 2023.

If you remove regulatory credit, it would be down 86% and Tesla’s earnings would add up to barely more than $1 billion compared to its more than $1 trillion valuation.

Electrek’s Take

Bitcoin literally saved Tesla’s quarter. Unless there’s another major run-up in Bitcoin, that won’t happen again because Tesla has benefited from not measuring Bitcoin’s value for more than a year.

It was great timing for Tesla, but it won’t be able to save the company in Q1 2025, which is expected to be more challenging as it transitions its Model Y to the new version.

But based on the stock price today, it appears that Elon still has strong shareholders support as they still believe in his AI-related predictions.

Author: Fred Lambert

Source: Electrek

So if you take out Bitcoin and regulatory credits, Tesla’s P/E ratio would be over 1000 and a 0.5% dividend would push them into the red