Global asset manager Wisdomtree has filed for an XRP ETF in Delaware, marking a potential breakthrough amid regulatory shifts.

Regulatory Shifts Loom as XRP ETF Eyes Breakthrough Moment

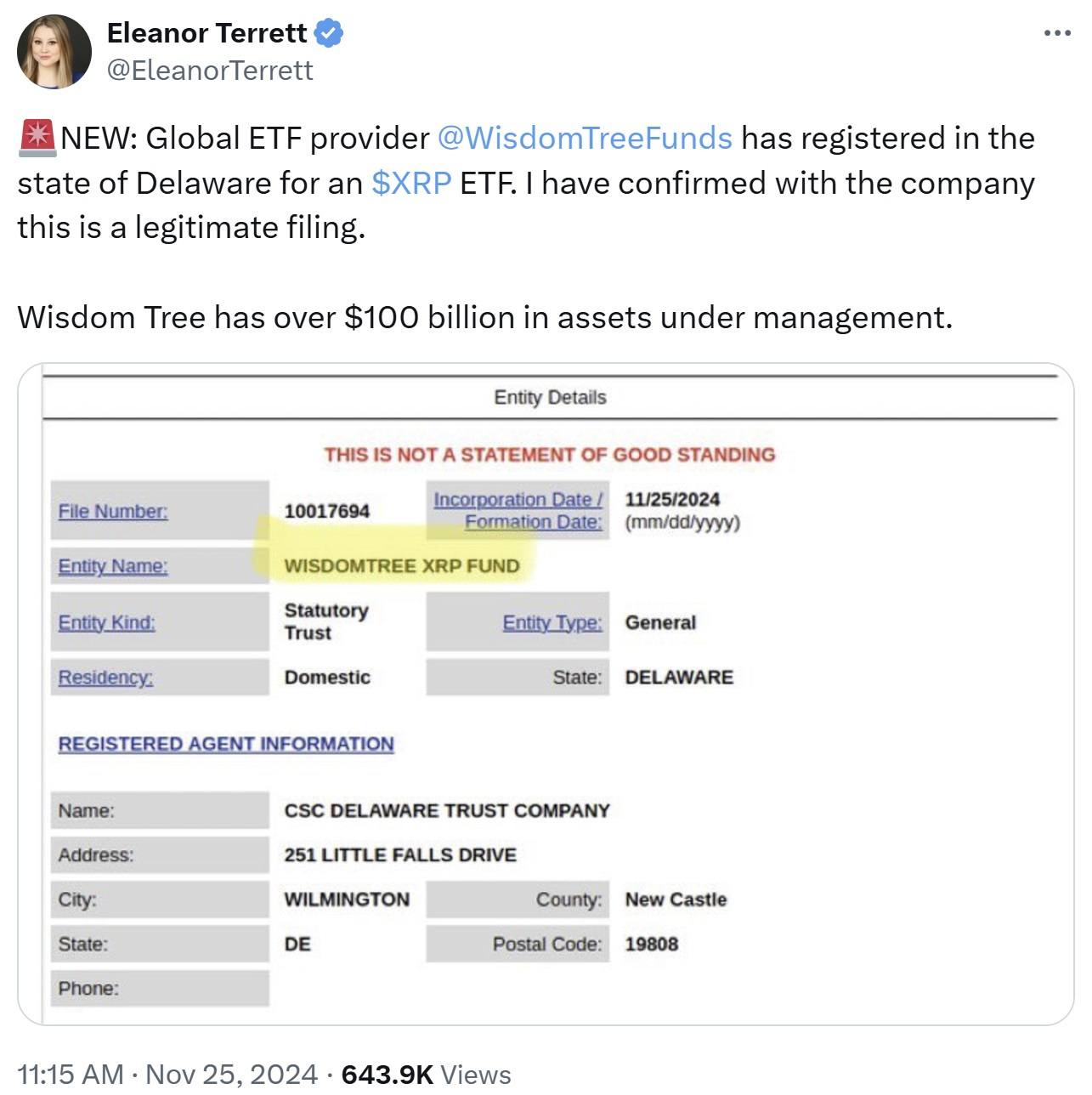

Global investment management firm Wisdomtree, renowned for its extensive range of exchange-traded funds (ETFs), has filed with the state of Delaware to establish an XRP ETF. Fox Business has confirmed the authenticity of this filing with the asset management firm, signaling Wisdomtree’s growing interest in expanding its reach into the digital currency sector. Wisdomtree currently has approximately $113 billion in assets under management (AUM) globally.

This development comes after the asset management firm launched the Wisdomtree Physical XRP (XRPW) on prominent European exchanges, including Deutsche Börse Xetra, Six Swiss Exchange, and Euronext in Paris and Amsterdam. The firm has positioned XRPW as the most cost-effective European offering for XRP exposure. Designed to simplify access to XRP investment, the fund aims to provide a secure and efficient means for investors to track XRP’s price.

Regulatory oversight for cryptocurrencies in the U.S. has been tough and enforcement-centric. In December 2020, the U.S. Securities and Exchange Commission (SEC) accused Ripple Labs of selling XRP as an unregistered security. A pivotal moment arrived in July 2023 when Judge Analisa Torres ruled that XRP sold on public exchanges was not a security, marking a major victory for Ripple. The SEC appealed this decision in October, aiming to reassert its regulatory authority over digital assets.

However, the crypto industry may see regulatory relief as SEC Chair Gary Gensler plans to step down in January 2025, aligning with President-elect Donald Trump’s inauguration. Gensler and SEC Commissioner Jaime Lizárraga, both known for their stringent crypto policies, will leave their roles, potentially opening the door to a more favorable regulatory environment. Trump has suggested initiatives like creating a national bitcoin reserve and forming a cryptocurrency advisory council, hinting at significant policy changes.

After the Delaware filing, the next steps typically involve obtaining regulatory approval from the SEC, which is necessary to legally offer and operate the ETF. Ripple CEO Brad Garlinghouse has expressed confidence in the approval of an XRP ETF, citing strong demand for crypto investment products. He noted the trend of integrating digital assets into traditional finance, despite ongoing regulatory hurdles.

Source: Bitcoin