XRP market positioning is tightening as open interest climbs above recent norms and volatility expands, signaling cautious accumulation that has historically set the stage for decisive price moves as traders prepare for potential expansion.

XRP Open Interest Climbs Steadily as Market Gears up for Expansion

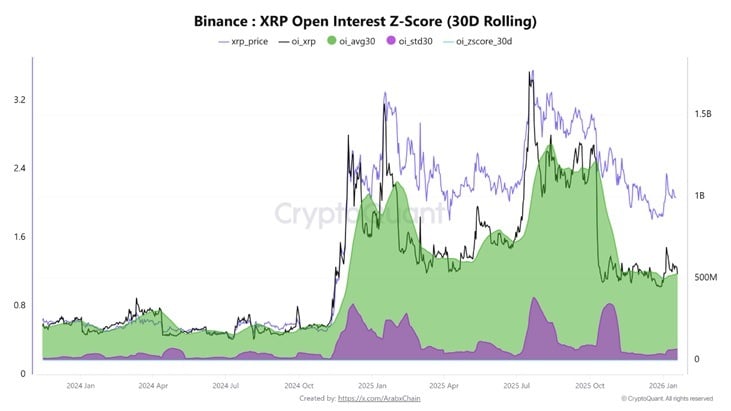

Digital asset derivatives indicators often signal shifts in trader behavior before price trends become clear. Blockchain data firm Cryptoquant an analysis on Jan. 20 examining XRP derivatives activity on Binance, focusing on open interest dynamics, volatility expansion, and leverage conditions as participation increased.

The analysis opens with the observation:

“ XRP open interest surpasses the 30-day average as volatility rises to its highest level since November.”

It further details that XRP’s total open interest rose to about $566.48 million, surpassing its 30-day moving average of roughly $528.84 million. “This positive difference indicates that new positions are entering the market, but at a measured pace, reflecting a cautious approach among traders rather than a strong rush,” the analysis notes.

Data visualized in the 30-day rolling chart supports this interpretation, with total open interest consistently holding above its rolling average while avoiding the abrupt spikes that characterized earlier speculative phases in late 2024 and mid-2025. During those prior periods, leverage expanded rapidly and then unwound just as quickly. By contrast, the current structure shows steadier accumulation even as XRP price fluctuations have widened, pointing to increased engagement without aggressive risk-taking. Such patterns often emerge when traders anticipate future volatility but remain divided on directional conviction, leading to gradual positioning rather than momentum chasing.

Read more:

Volatility dispersion indicators offer further insight into market structure. The analysis identifies the most significant development as the rise in the 30-day standard deviation of open interest to around $65.7 million, reaching its highest level since November. This increase reflects a notable expansion in open interest volatility relative to its average and is commonly viewed as an early signal of potential price expansion in the period ahead.

At the same time, leverage conditions remain statistically balanced, as noted by the assessment, “Conversely, the Z-score remains around 0.57, a relatively moderate level, indicating that the market has not yet entered a state of extreme leverage or excessive speculation.” The analysis concludes:

“The current situation can be characterized as a cautious accumulation phase with a gradual increase in risk.”

Such phases are frequently followed by strong price movements, making close monitoring of open interest volatility alongside price action important for assessing the next potential direction of XRP’s price. Historically, comparable market structures preceded sizable expansions once sentiment aligned, reinforcing why derivatives-based risk and positioning metrics continue to draw close attention.

FAQ 🧭

- What does rising XRP open interest above its 30-day average signal to investors? It suggests new capital is entering XRP derivatives markets at a controlled pace, indicating cautious accumulation rather than speculative excess.

- Why is the increase in open interest volatility important for XRP’s price outlook? Higher open interest volatility often precedes major price expansions, making it a potential early signal of upcoming directional moves.

- How do current leverage levels affect XRP’s risk profile? Moderate , reflected by a Z-score of around 0.57, implies the market is not overheated and reduces the risk of sudden forced liquidations.

- What does the current derivatives structure indicate about XRP’s next market phase? The data points to a cautious accumulation phase that historically has preceded strong price movements once trader sentiment aligns.

Author: Kevin Helms

Source: Bitcoin

Reviewed By: Editorial Team