Statistics recorded on April 15, 2023, show that the number of coins in circulation for the stablecoin BUSD dropped below the 7 billion range to 6.68 billion, marking the lowest number of BUSD in circulation since April 2021. Furthermore, data indicates that the supply of BUSD has shrunk by 19.8% over the past 30 days.

BUSD Stablecoin Supply Hits Lowest Point in Two Years

BUSD, which was once among the largest stablecoins, remains the USD-pegged token. However, on February 13, 2023, Paxos that the New York State Department of Financial Services (NYDFS) had directed the company to stop issuing BUSD. On that day, around 16.1 billion BUSD tokens were in circulation, and since then, 9.42 billion stablecoins have been redeemed.

Between March 15 and April 15, 2023, BUSD’s supply decreased by 19.8%. In mid-November 2022, BUSD’s market capitalization was at its highest point ever at $23.49 billion, with a global trade volume of over $11 billion within a 24-hour period. However, on April 15, 2023, with its much smaller market valuation, BUSD’s 24-hour global trade volume is approximately $2.61 billion.

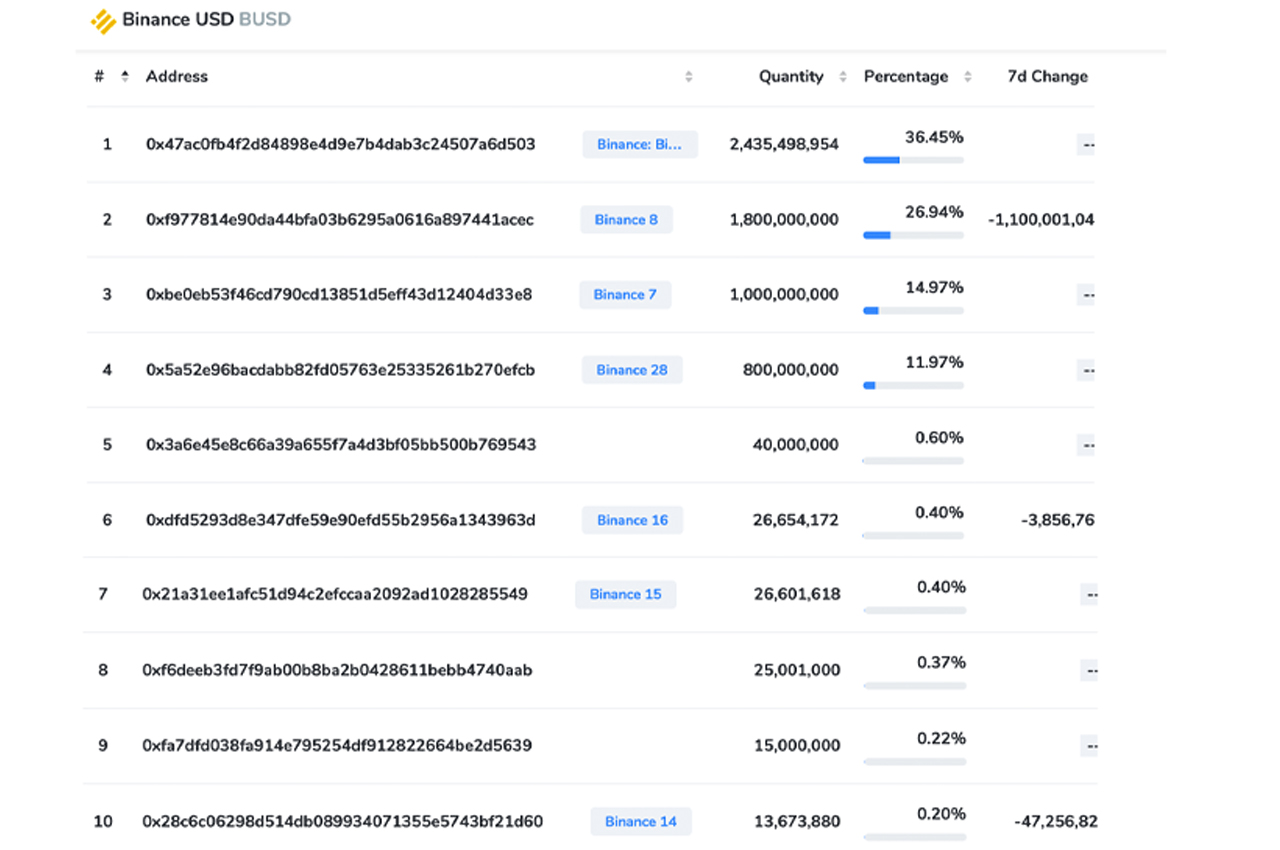

Nansen’s reveal that Binance, the largest crypto exchange by trade volume, holds 6.1 billion BUSD, according to Nansen’s exchange portfolio tool that shows the trading platform’s reserve balances. The shows that the top ten holders, including Binance’s stash, hold 92.52% of the circulating supply out of that hold BUSD. Furthermore, the top 100 BUSD holders own approximately 96.09% of the stablecoin’s current supply.

Binance-associated addresses control seven out of the top ten largest BUSD addresses. Current data suggests that if the redemptions continue, the stablecoin issued by the Makerdao protocol DAI will soon surpass BUSD’s current number of tokens in circulation. Presently, there is $5,016,181,138 DAI in circulation, but the DAI supply has also decreased over the past 30 days by .

What do you think about the number of BUSD removed from circulation since February 13? Share your thoughts about this subject in the comments section below.

Source: Bitcoin