As sales of electric vehicles continue to surge entering 2021, many new and prospective customers have questions about qualifying for federal tax credit on electric vehicles.

Whether you qualify is not a simple yes or no question… well, actually it sort of is, but the amount you may qualify for varies by household due to a number of different factors. Furthermore, there are other potential savings available to you that you might not even know about yet.

Truthfully, this information is out there in the internet ether, but only available by piecemeal and thorough searching. Luckily, we have compiled everything you need to know about tax credits for your new or current electric vehicle into one place.

The goal is to help ensure you are receiving the maximum value on your carbon-conscious investment because, let’s face it, you’ve gone green and you deserve it.

How does a federal tax credit work for my EV?

The idea in theory is quite simple — “All electric and plug-in hybrid vehicles that were purchased new in or after 2010 may be eligible for a federal income tax credit of up to $7,500,” according to the US Department of Energy.

With that said, you cannot simply go out and buy an electric vehicle and expect Uncle Sam to cut $7,500 off your taxes in April. In reality, the amount you qualify for is based on both your income tax as well as the size of the electric battery in the vehicle you own. Here’s how it works.

How much is the federal tax credit?

First and foremost, it’s important to understand three little words the government slips in front of the $7,500 credit – “may” and “up to.” As in, you may qualify for up to $7,500 in federal tax credit for your electric vehicle. At first glance, this credit may sound like a simple flat rate, but that is unfortunately not the case.

While the credit amount is based on battery size, the amount of that credit you can receive is based entirely on your federal income tax and is implemented as such. For example, if you owned a Nissan LEAF and owed say, $3,500 in income tax this year, then that is the federal tax credit you would receive. If you owed $10,000 in federal income tax, then you would qualify for the full $7,500 credit.

It’s important to note that any unused portion of the $7,500 is not available as a refund, nor as a credit for next year’s taxes. Bummer.

Other federal rules to note as an EV owner

Hopefully you now understand how the government determines its tax credits for individuals based on your federal income tax and vehicle, but it’s important to stay aware of additional fine print. This is the US government, after all.

First, understand that these federal tax credits will not last forever, and they may have already expired for your vehicle. As the demand for electric vehicles increases, sales push certain manufacturers over the predetermined threshold of qualified sales. For example, US automaker Tesla topped over 200,000 qualified plug-in electrics sold a few years ago, and as a result no longer qualifies for any federal tax credit. Fear not, Tesla owners, there are still ways to save money on your EV purchase! See the “tax incentives Tesla owners” section below.

Another important rule to keep in mind is that the federal tax credit cannot be passed on. This credit applies to the original registered owner only. That means any used EVs you already have or are going to purchase are already disqualified.

Same rules apply to any lease on an electric vehicle as well. In this case, the tax credit goes to the manufacturer that’s offering the lease to you. However, an automaker might be willing to apply the tax credit into the cost of your lease to help lower your payments, but that’s not guaranteed. It’s definitely worth an ask!

Does your electric vehicle qualify for tax credit?

Now that you understand what hurdles you may have to overcome to qualify for the federal tax credit, let’s see how much that EV in your driveway might be able to save you this year.

Please note that these qualifying vehicles are relevant at the time this post has been published. We will update this page as the vehicles and their designated credits change.

All-electric vehicles

| Make and Model | Full Tax Credit |

| Audi e-tron Sportback | $7,500 |

| Audi e-tron SUV | $7,500 |

| BMW i3 Sedan | $7,500 |

| BMW i3s | $7,500 |

| Fiat 500e | $7,500 |

| Ford Focus EV | $7,500 |

| Ford Mustang Mach-E | $7,500 |

| Hyundai Ioniq Electric | $7,500 |

| Hyundai Kona Electric | $7,500 |

| Jaguar I-Pace | $7,500 |

| Kia Niro EV | $7,500 |

| Kia Soul Electric | $7,500 |

| Mercedes-Benz B-Class EV | $7,500 |

| MINI Cooper S E Hardtop (2020-2021) | $7,500 |

| Mitsubishi i-MiEV | $7,500 |

| Nissan LEAF | $7,500 |

| Porsche Taycan 4S | $7,500 |

| Porsche Taycan Turbo EV | $7,500 |

| Smart fortwo Coupe | $7,500 |

| Smart fortwo Cabrio | $7,500 |

| Volkswagen e-Golf | $7,500 |

| Volkswagen ID.4 EV | $7,500 |

| XC40 Recharge Pure Electric | $7,500 |

Plug-in hybrid electric vehicles

Note: Here are some of the more popular models. The US Department of Energy offers the full detailed list on its website.

| Make and Model | Full Tax Credit |

| Audi A3 e-tron (2016-2018) | $4,502 |

| Audi Q5 55 TFSI e Quattro PHEV | $6,712 |

| Audi A7 55 TFSI e Quattro PHEV | $6,712 |

| BMW i3 Sedan w/ Range Extender (2014-2021) | $7,500 |

| BMW i8 Coupe/Roadster (2018-2020) | $5,669 |

| BMW X3 xDrive30e (2020-2021) | $5,836 |

| BMW 330e xDrive | $5,836 |

| BMW 530e xDrive (2020-2021) | $5,836 |

| Chrysler Pacifica Plug-In Hybrid (2017-2021) | $7,500 |

| Ford Escape Plug-in Hybrid | $6,843 |

| Honda Clarity Plug-in Hybrid | $7,500 |

| Hyundai Ioniq Plug-in Hybrid | $4,543 |

| Hyundai Sonata Plug-in Hybrid | $4,919 |

| Jeep Wrangler PHEV (2021) | $7,500 |

| Kia Optima Plug-in Hybrid | $4,919 |

| Land Rover Range Rover /Sport PHEV (2020-2021) | $6,295 |

| Lincoln Aviator Grand Touring | $6,534 |

| Lincoln Corsair Reserve Grand Touring PHEV | $6,843 |

| Mercedes-Benz S560e EQ PHEV | $6,462 |

| MINI Cooper S E Countryman (2020-2021) | $5,002 |

| Mitsubishi Outlander Plug-in (2018-2020) | $5,836 |

| Mitsubishi Outlander Plug-in (2021) | $6,587 |

| Porsche Cayenne E-Hybrid | $6,712 |

| Suburu Crosstrek Hybrid | $4,502 |

| Toyota Prius Prime Plug-in Hybrid (2017-2021) | $4,502 |

| Toyota RAV4 Prime Plug-in Hybrid (2021) | $7,500 |

| Volvo XC60 (2020-2021) | $5,419 |

| Volvo XC90 (2020-2021) | $5,419 |

Other tax credits available for electric vehicle owners

So now you should know if your vehicle does in fact qualify for a federal tax credit, and how much you might be able to save. Perhaps, however, you plan to buy the newly refreshed Tesla Model S or you already drive a 2017 Chevy Bolt and no longer qualify for any tax credit. Don’t worry! Before giving up hope on your tax break quest for the year, keep in mind the other incentives offered in each state.

State tax incentives

In additional to any federal credit you may or may not qualify for, there are a number of clean transportation laws, regulations, and funding opportunities available at the state level. For example, in the state of California, drivers can qualify for a $2,000-$4,500 rebate or a $5,000 grant (based on income) on top of any federal credit received. Furthermore, states like California offer priority driving lanes and parking spots for EV drivers who qualify. In New York, residents can receive either a $500 or $2,000 rebate depending on the base price of the EV purchased.

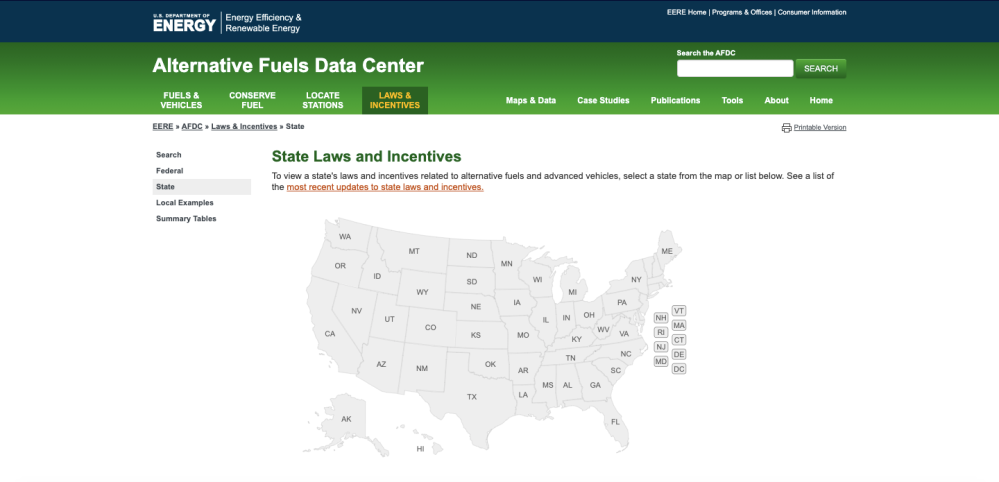

Again, these incentives vary by state, and much like the federal tax credit, are contingent on multiple factors. To check what incentives you may qualify for, the Alternative Fuels Data Center is a great resource from the US Department of Energy. This page allows you to tap or click your respective state and research what options might be available to you and your electric vehicle.

Tax incentives for Tesla buyers

If you’re a current or prospective Tesla owner and have read this far, you’re probably not super psyched right now. Tesla’s record number of sales is great for the automaker, but not for your tax return, right? Although Tesla’s federal tax credit has driven off toward the sunset like its first-generation Roadster, drivers still have potential incentives at their disposal.

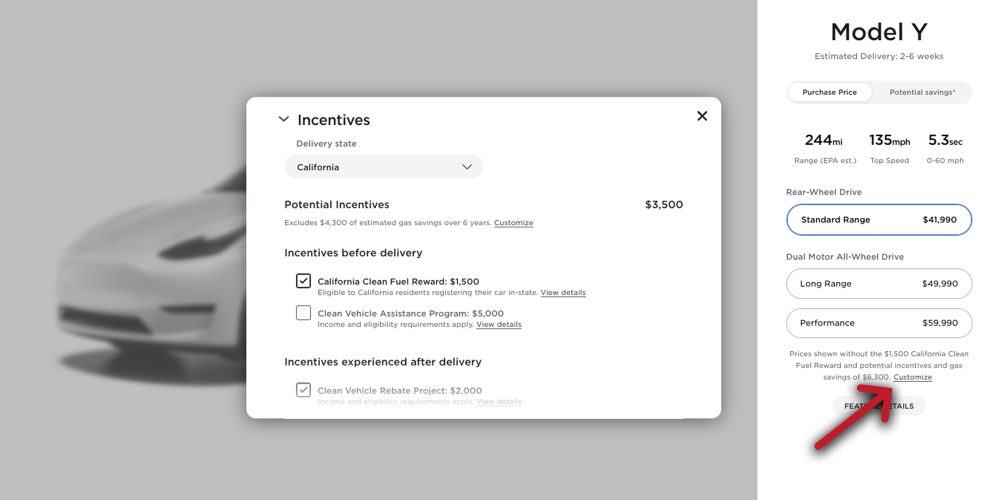

In fact, Tesla has compiled its own database of resources by state to help its customers calculate their potential savings before they even commit to buy. Additionally, you can tap or click the “customize” link on any Tesla model purchase page. In addition to the “gas savings” tab, you can view “incentives” to check what tax credits may be available to you.

It’s also important to note that all incentives mostly apply to purchases by cash or loan only. Incentives for customers leasing a Tesla are currently only available in California, Colorado, Massachusetts, New York, and Tennessee.

Tax incentives on electric vehicles are worth the research

Hopefully this post has helped to incentivize you to use the resources above to your advantage. Whether it’s calculating potential savings or rebates before making a new EV purchase or determining what tax credits might already be available to you for your current electric vehicle, there is much to discover.

Ditching fossil fuels for greener roadways should already feel rewarding, but right now the government is willing to reward you further for your environmental efforts. Use it to your full capability while you can, because as more and more people start going electric, the less the government will need to reward drivers.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Scooter Doll

Source: Electrek