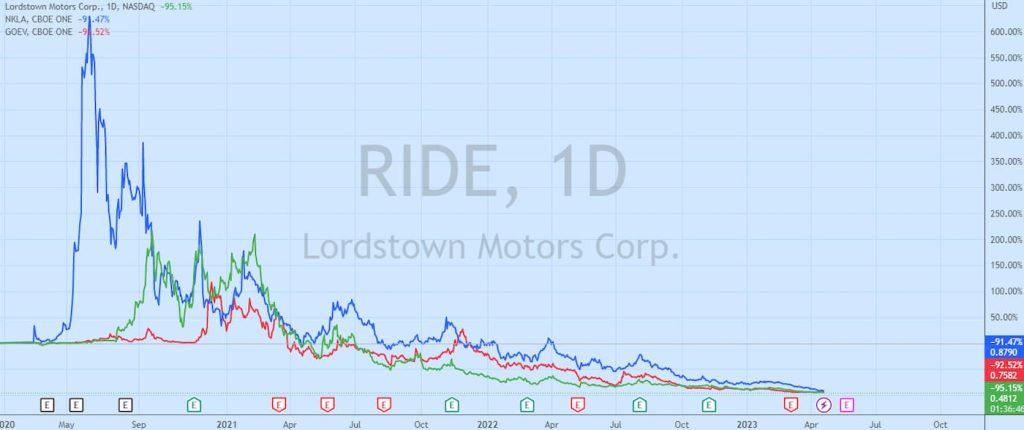

EV startup Lordstown Motors (RIDE) said it had received a notice of delisting from The NASDAQ Stock Market LLC Wednesday due to its falling stock price. Lordstown and other EV startups have seen their stock prices crater since going public, falling over 90% in many cases.

Founded in 2018, Lordstown has faced a significant amount of hurdles in getting its first product, the Endurance electric truck, to market.

Lordstown went public on the NASDAQ exchange in 2020 through a reverse merger with special acquisition company (SPAC) DiamondPeak Holdings. The company was one of several EV startups that took advantage of the ease of access to capital through a SPAC merger during that time, along with names like Nikola (NKLA), Canoo (GOEV), Faraday Future (FFIE), and Arrival (ARVL).

Many of which are in a similar situation as Lordstown. Rising interest rates and ongoing supply chain disruptions are hindering growth and contributing to higher-than-expected losses.

As a result, investors are fleeing to safer, more predictable assets amid the more challenging economic environment.

With stock prices crashing, access to cheap funding is drying up, and with little production, cash is also becoming a concern.

Despite several cash injections from Taiwanese electronics manufacturer Foxconn, Lordstown is still losing money, with net losses widening to $102 million in the fourth quarter of 2022.

Although Lordstown said the initial batch of 500 Endurance models was out for delivery last November, the company halted production in February due to a voluntary recall over quality issues.

Lordstown resumed Endurance production this week, but the company has now been issued a stock delisting notice.

Lordstown receives stock delisting notice from NASDAQ

According to an 8-K filing Thursday, Lordstown (RIDE) received a written statement from The NASDAQ Stock Market LLC on April 19, 2023.

The notice states that the company was no longer in compliance with the NASDAQ’s minimum price bid requirement due to Lordstowns stock price falling below $1.00 for 30 consecutive trading days.

Lordstown says the notice does not immediately affect the company’s stock and does not affect its SEC reporting requirements. The company has 180 calendar days (or until October 16, 2023) to regain compliance with the $1.00 requirement for a minimum of ten consecutive business days.

If the company fails to do so, it may be eligible for an additional grace period, according to the SEC filing, which would require transferring its stock listing to The Nasdaq Capital Market.

Lordstown is evaluating current solutions to regain compliance, including a potential reverse stock split. In anticipation of the notice, the company included a proposal for the company’s upcoming annual shareholder meeting to put a reverse stock split into effect. The reverse split will ratio will range from 1:3 to 1:15.

Shareholders can vote on the proposed reverse stock split at Lordstowns annual shareholder meeting on May 22, 2023.

Electrek’s Take

Although Lordstown is among the first to receive the stock delisting notice, several other EV startups are in the same boat.

For example, Canoo’s stock price is hovering around $0.76 as of Thursday and has been below $1.00 for around two months. Faraday Future’s stock price is currently around $0.23 while Nikola’s is around $0.88.

However, it’s not just electric vehicle startups, its essentially any high-growth, non-profitable company that went public through a SPAC merger.

SPAC’s were fueled by low interest rates in 2020 leading to bloated stock prices. With the Federal Reserve raising interest rates at a pace not seen since the 80’s, geopolitical tension rising, and calls for a recession heightening, investors fled for safer assets last year, leading to a fallout in the SPAC market.

Author: Peter Johnson

Source: Electrek