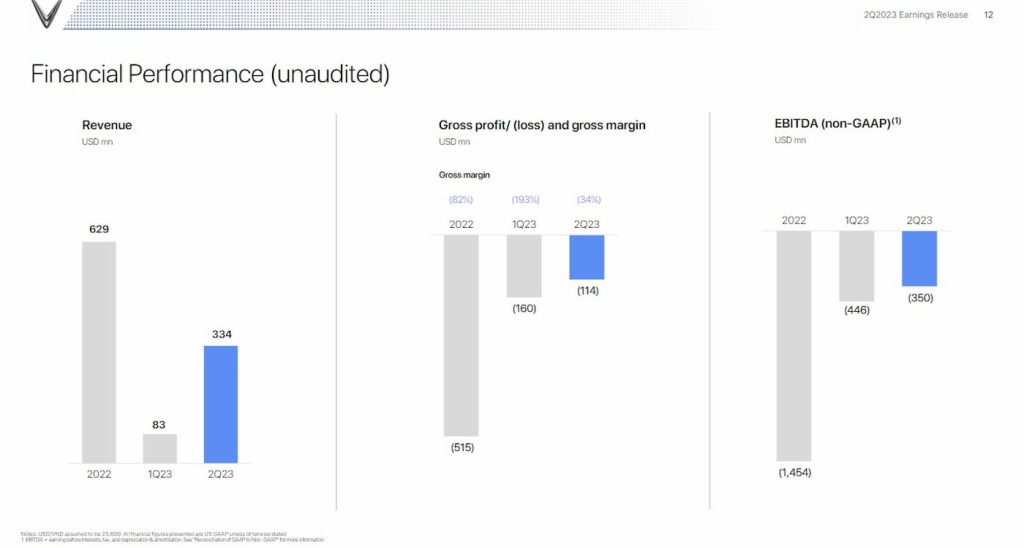

Vietnamese EV maker VinFast (VFS) released its Q2 earnings Thursday, its first report since going public, showing 303% revenue growth from the first quarter.

VinFast revenue rises in Q2 on higher deliveries

The growth comes amid VinFast’s EV deliveries rising over 400% in Q2. VinFast delivered 9,535 electric vehicles between April and June, bringing its total to 11,315 for the first half of the year.

VinFast also delivered 10,182 e-scooters, up 4% from the previous quarter (9,757). At the end of June, VinFast had 122 EV showrooms globally in addition to 245 showrooms and service workshops for e-scooters.

With deliveries rising significantly, vehicle sales reached $314 million, up 387% from Q1. VinFast’s revenue rose over 300% in Q2, primarily from higher EV deliveries, reaching $334.1 million.

As VinFast ramps output, margins are also improving. Gross margins advanced to (-34.1%) compared to (-73.4%) in the first quarter.

VinFast’s deficit improved by 11%, with a net loss of $526.7 million. As of June 30, 2023, the EV maker had $67.3 million in cash and equivalents. The company says funds from deSPAC and investments from the chairman of Vingroup will “give us sufficient runway to grow in the coming years.”

EV delivery growth

Although electric vehicle deliveries rose 435% in Q2, driving revenue growth, the majority of VinFast’s sales were to a related party.

Of the 11K EVs delivered through the first half of the year, roughly 7,100 were to Green and Smart Mobility (GSM). GSM was established by Vingroup, VinFast’s parent company, as a green transport rental and taxi service to expand its brand in the region.

Vehicle sales to GSM accounted for around $236 million of VinFast’s $379 million in total vehicle sales through the first half of the year.

GSM has agreed to purchase up to 200,000 e-scooters and 30,000 EVs, of which 7,100 have been delivered.

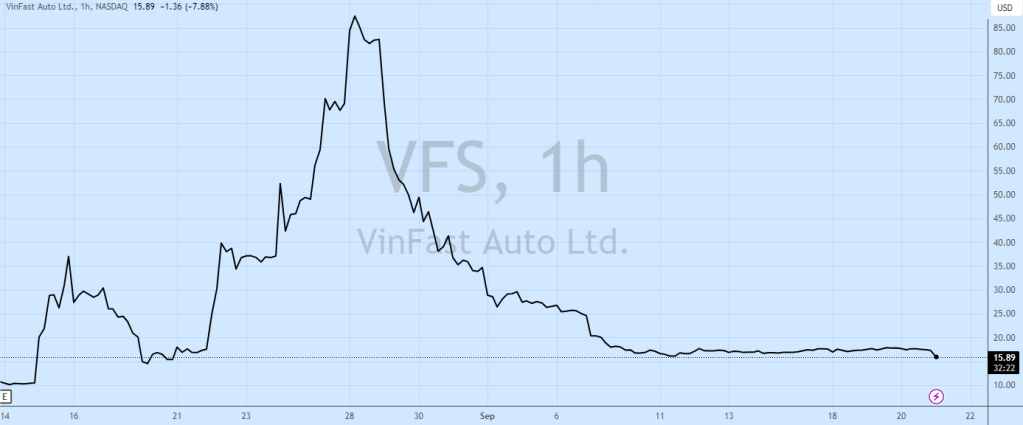

VinFast shares began trading on the Nasdaq under ticker “VFS” on August 15 in an explosive debut. After a drastic rise in share prices, VinFast was worth $215 billion, more than Ford, GM, VW, and Rivian combined.

Currently, VinFast is worth around $38 billion, which is still higher than Rivian ($23B) and Lucid ($13B).

After hitting a peak of $93 per share in intraday trading, VFS shares have slipped over 80%. After the earnings release, VinFast stock is down another 3.5% in Thursday’s trading session.

The company says it’s approaching the next phase of development, which will begin in 2024. VinFast is targeting an additional 50 markets to import and distribute electric models.

VinFast reaffirmed its 2023 delivery target of 40,000 to 50,000 vehicles. In the US, VF 9 deliveries are expected to begin by the end of 2023.

VF 6 deliveries will also begin in Vietnam by the end of the year. Next year, VinFast will start rolling out the VF 7 and VF 3 models.

Author: Peter Johnson

Source: Electrek