According to veteran pro trader Peter Brandt, bitcoin may have peaked when it achieved a new all-time high of $73,835. However, there is a possibility that it could now decline to the mid-$30s or even lower, Brandt said. Interestingly, Brandt suggests that such a decline could be the “most bullish thing” from a long-term perspective.

The Exponential Decay Factor

In his recent blog post, veteran trader Peter Brandt suggests that Bitcoin (BTC) might have already reached its peak during the current bull cycle. Brandt said he now anticipates a decline back to the mid-$30s or even the lows seen in 2021. Brandt attributes this expected pullback to a phenomenon known as exponential decay, which he believes will impact the crypto asset which recently achieved a new all-time high of $73,835.

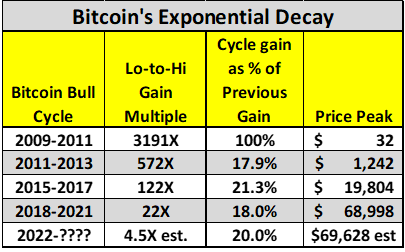

Drawing on data from the last four BTC bull cycles, Brandt asserts that approximately 80% of the exponential energy from each successful market cycle has dissipated. Looking ahead, the veteran trader predicts an exponential advance of around 4.5 times the current value.

Although he acknowledged the potential positive impact of the halving on BTC’s value, Brandt emphasizes that traders should closely monitor the occurrence of the so-called exponential decay.

“But for now we need to deal with the fact of Exponential Decay. It has happened. It is real. You may not want to believe it, but I place a 25% chance that bitcoin has already topped for this cycle,” Brandt said.

Still, despite contradicting many bitcoin enthusiasts’ projections, the veteran trader said the decline in BTC price may turn out to be the “most bullish thing” from a long-term perspective. Brandt argued that this perspective is best supported by a gold chart from August 2020 and March 2024.

Concluding his seemingly unpopular analysis, Brandt stated that he does not want to believe it, but the compelling data is impossible to ignore.

Do you agree with Peter Brandt’s latest BTC price analysis? Let us know what you think in the comments section below.

Source: Bitcoin