A new study by Chainplay and Strorible reveals that nearly 45% of venture capital (VC)-backed crypto projects have shut down, and 77% fail to generate $1,000 in monthly revenue.

Top-Tier VC Firms Not Spared

Nearly half (45%) of venture capital (VC)-backed crypto projects have ceased operations, while 77% fail to generate $1,000 in monthly revenue, a new Chainplay and Strorible study has determined. The study of 1,181 projects, which received funding between Jan. 1, 2023, and Dec. 31, 2024, also found the VC firm Polychain Capital had the highest rate of investment failures, with 44% of its projects dead.

According to the study report, these findings challenge the notion that VC backing guarantees a project’s success. The findings also undercut the argument that crypto projects backed by top-tier VC firms fare better than those backed by second- or third-tier venture firms. To illustrate this point, the study found that from promising projects backed by top-tier VC firms, 37.45% have failed, while 34.56% are dead. Just over a third (33.41%) earn less than $1,000 per month.

As a top-tier VC firm, Polychain Capital not only had the highest rate of failed or dead projects, but over three-quarters (76%) of the projects it backed failed to generate meaningful revenue. Yzi Labs (formerly Binance Labs) saw 72% of the crypto projects it backed fail, which again shows that even most VC firms face high risks.

Other top VC firms who saw a significant proportion of projects they were backing cease operations include Circle (38%), Delphi Ventures (33%), Consensys (30%) and Andreessen Horowitz (24%). Like Polychain Capital, many of these VC firms also saw more than two-thirds of the projects they backed fail.

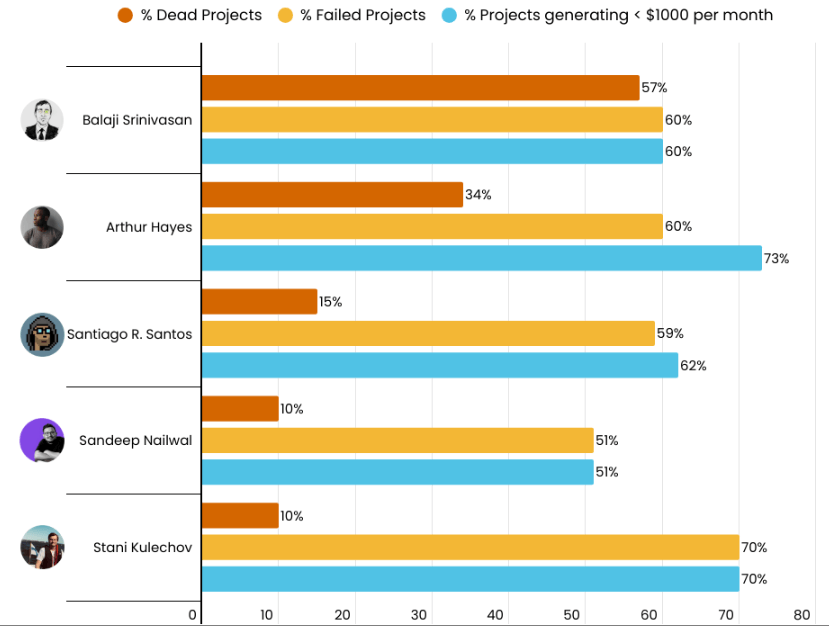

Meanwhile, the study found the former Coinbase CTO Balaji Srinivasan had a 57% dead-project share, the highest among so-called angel investors. Arthur Hayes had the next highest with 34%, followed by Santiago Santos with 15%. Sandeep Nailwal and Stani Kulechov both saw 10% of the crypto projects they were backing cease operations.

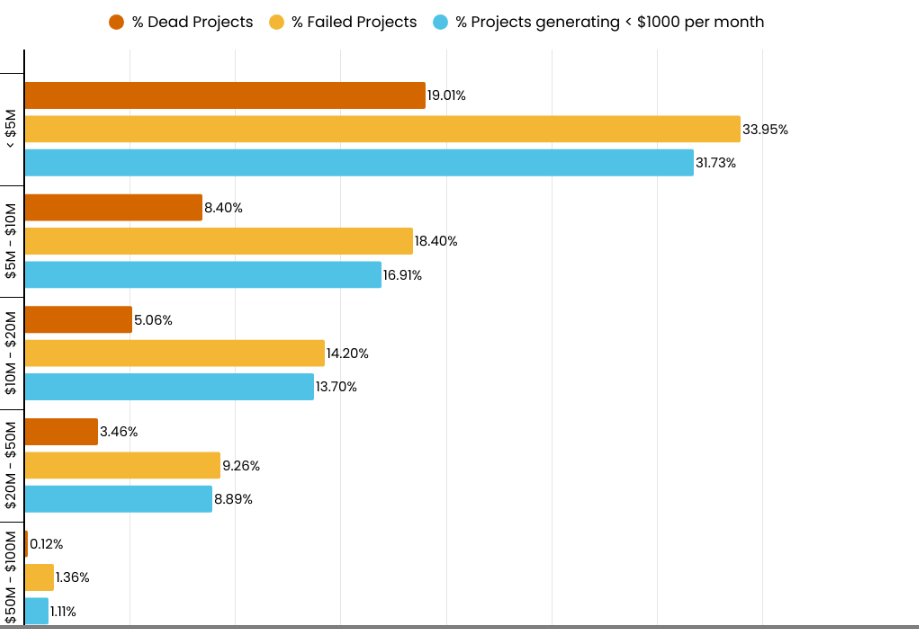

The study findings nevertheless suggest that the amount raised during fundraising rounds “strongly correlates with project success.” According to the study report, $50 million is seen as a figure high enough to increase a project’s success prospects.

“Projects raising over $50 million exhibit significantly lower failure rates, implying substantial capital as a crucial factor in crypto success,” the study report asserts. “On the other end of the spectrum, projects that raised less than $5 million saw failure rates above 33% and nearly one in five ended up dead, underlining how limited funding severely impacts a project’s ability to survive.”

Source: Bitcoin