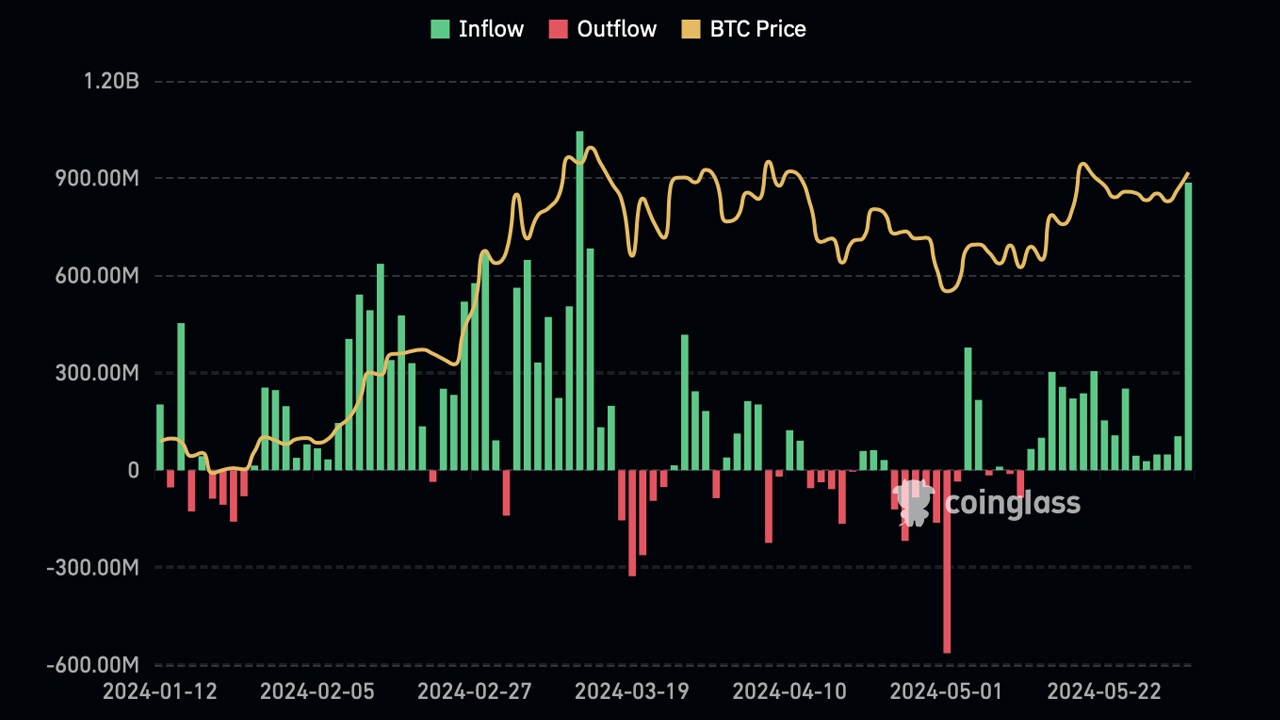

On June 4, 2024, U.S. spot bitcoin exchange-traded funds (ETFs) saw their second-largest day of inflows since their launch in January. The inflows totaled approximately $886.6 million, with Fidelity’s FBTC leading, capturing $379 million on Tuesday.

U.S. Spot Bitcoin ETFs Secure Over $61 Billion in BTC Holdings

Spot bitcoin ETFs have been experiencing daily inflows consistently, and Tuesday’s trading session marked the 16th consecutive day of inflows. On Tuesday, these ETFs amassed $886.6 million in inflows, marking the second-highest day since March 12, 2024. On March 12, the ETFs achieved $1.04 billion in positive inflows. The June 4 inflows represented 85.25% of the March 12 peak in terms of positive gains.

Fidelity’s FBTC led the inflows on Tuesday, accumulating $379 million, while Blackrock’s IBIT followed with $274 million. Grayscale’s GBTC also secured $28 million in inflows during the trading session. Other ETFs saw inflows as well, contributing to a total trade volume of $2.49 billion on Tuesday.

Currently, Blackrock’s IBIT holds the largest amount of BTC reserves, with 295,457.46 BTC valued at $20.96 billion. Grayscale’s GBTC follows with 285,069.81 BTC worth $20.22 billion. Fidelity’s FBTC, after Tuesday’s significant inflows, now possesses 165,232.89 BTC valued at approximately $11.72 billion based on current exchange rates.

Ark Invest’s and 21shares’ ETF ARKB now holds 49,298 BTC valued at $3.49 billion, while Bitwise’s BITB fund manages 37,844.39 BTC worth around $2.68 billion at current rates. Together, these five spot bitcoin funds hold 832,902.55 BTC valued at $59.10 billion. The remaining funds (BTCO, BTCW, HODL, BRRR, and DEFI) command 33,532.64 BTC worth approximately $2.3 billion. Altogether, all 11 spot bitcoin ETFs in the United States hold 866,435.19 BTC, valued at over $61 billion.

What do you think about the action U.S. spot bitcoin ETFs witnessed on Tuesday? Share your thoughts and opinions about this subject in the comments section below.

Source: Bitcoin