Tesla’s move to stop Bitcoin payments over energy use concerns has wiped out hundreds of billions of dollars worth of market value in the cryptocurrency market.

Yesterday, we reported that Tesla stopped accepting payment in Bitcoin for its vehicles.

Shortly after, Elon Musk announced that Tesla is suspending the payment option over concern about the use of fossil fuel to power Bitcoin mining:

“Tesla has suspended vehicle purchases using Bitcoin. We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.”

The CEO shared a trend of energy consumption from Bitcoin and examples of fossil fuel-powered plants reopening to power Bitcoin mining:

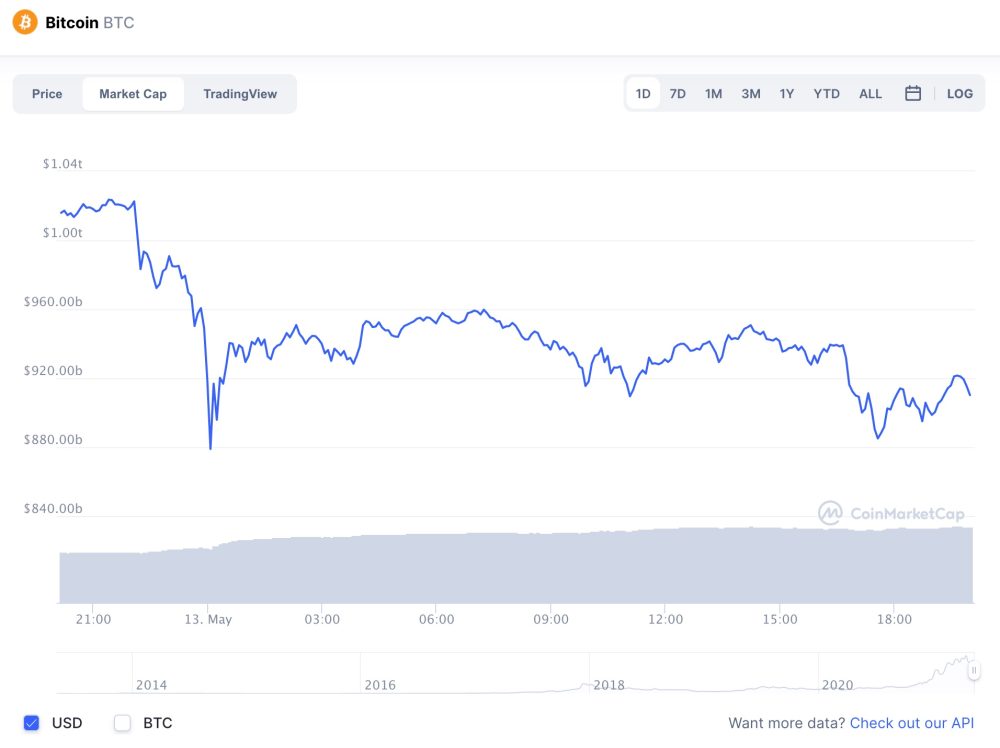

The announcement resulted in a massive crash in value for Bitcoin, which shed about $100 billion in market capitalization in just hours after the announcement:

But the crash extended to more than just Bitcoin with several other big cryptocurrencies losing value.

Overall, it is estimated that crypto market value retreated by over $300 billion following Tesla’s announcement with some estimates as high as $365B.

This affects Tesla itself since while the company is not accepting Bitcoin as payment, the automaker is still holding over $1 billion in Bitcoins.

Electrek’s Take

When Tesla first started to get involved in Bitcoin back in January, the energy use concerns has been brought up by many people.

It’s strange that Tesla wasn’t aware of it or did the due diligence beforehand.

The company is being roasted for it, which is fine, but I also see a lot of people having this take on it:

I don’t think that’s exactly fair since if you forget about the energy source, electric vehicles are more efficient than gasoline-powered vehicles.

That’s not exactly the case for Bitcoin versus regular bank transactions.

You could make the argument that if the blockchain was to replace the entire banking industry, the energy use would be more comparable, but we are quite far from that happening.

There’s no doubt both crypto and electric vehicles would benefit from a cleaner grid, but it is far from a perfect comparison.

Ultimately, I think Tesla’s move was the right thing to do since it is putting pressure on the crypto community to turn to renewable energy to power the technology.

To be fair, many of them have already been doing that, but there is also some strong evidence of the crypto gold rush helping some fossil fuel plants:

I am myself a big fan of crypto and I do mine ETH using miners powered by hydro-electricity, but I don’t mind the market taking a hit if it means more people are thinking about making mining cleaner.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Fred Lambert

Source: Electrek