Tesla’s stock (TSLA) tumbled today on price cuts across its lineup and the dream sold by Elon Musk that Tesla vehicles will become an “appreciating asset” is going away.

The automaker did a bit of a news dump late last night with the release of the updated Model 3 in Europe and Asia.

While the launch of the new version was bad for the company, the other two changes to Tesla’s lineup were not a good look.

Tesla updated Model S/X configurations and slashed the price of the FSD package.

With the Model S and Model X, Tesla killed each vehicle’s software-locked Standard Range versions despite launching them just a few weeks ago.

On top of getting rid of the Standard Range versions, Tesla slashed the price of the Long Range versions by $15,000.

Those kinds of price cuts show that Tesla is having some demand issues for its top-of-the-line vehicles.

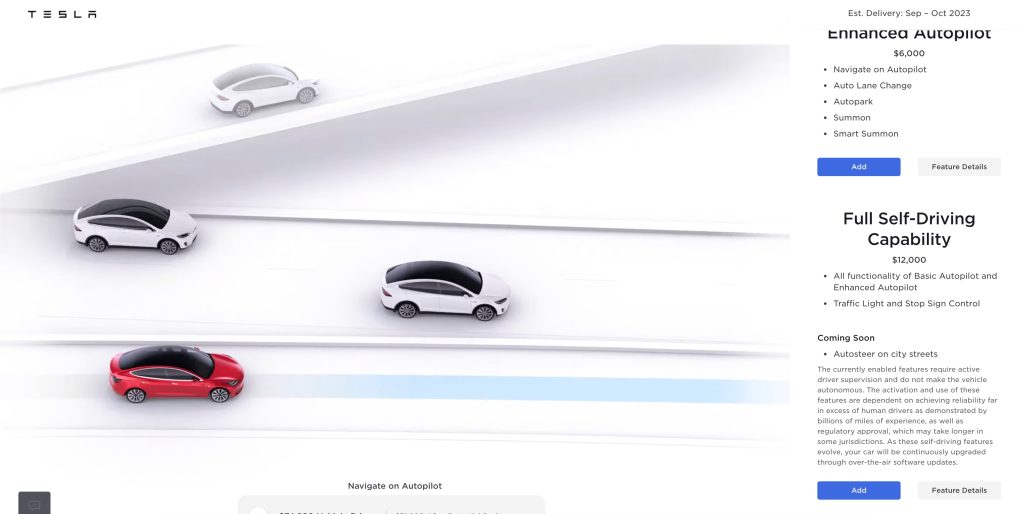

As for the FSD package price cut, it was slashed from $15,000 to $12,000, and that presents a whole other set of issues.

It opens up a weird can of worms.

Tesla CEO Elon Musk famously said that Tesla vehicles have become “appreciating assets” due to the Self-Driving (FSD) package.

The logic behind the claim is that he believes as Tesla improves its FSD package through software updates, it would increase the value of Tesla vehicles. To reflect that, he said that Tesla would incrementally increase the price of the FSD package.

Musk suggested that the value of FSD could end up closer to $100,000 to $200,000 once fully autonomous, but those claims have yet to materialize, and Tesla has missed several of Musk’s public timelines to achieve self-driving.

At least, Tesla has been gradually increasing the price of the package, which has created a sense that people who bought FSD early were getting a deal compared to those buying it now.

But now, Tesla is going back by reducing the price of the FSD package by $3,000.

Considering the fact that Tesla has yet to deliver on its promise under the package, those who bought it for $15,000 believing that it would keep going up if they wait have an argument to be reimbursed the difference.

The good news for Tesla is that it shouldn’t be a massive bill for the automaker as the FSD take-rate is estimated to be under 8% globally and under 15% in the US, where the price cut was implemented.

The Model S/X demand problem and the FSD pricing fiasco might explain why Tesla’s stock is down almost 6% today despite the market being flat.

Electrek’s Take

I think it’s clear that Tesla is having some issues with Model S and Model X demand and those price cuts will hurt margins.

However, a big reason that those models are having demand issues in the US is the fact that people feel like they are leaving money on the table because they were not eligible for the federal tax credit.

Now that the Model X starts under $80,000, it will help greatly on that front.

As for the FSD pricing, that’s quite a mess. I think Tesla should offer a $3,000 rebate for anyone who paid $15,000 – if anyone actually paid $15,000 for FSD.

I know it’s not the case, but it would be funny if Tesla reduced the price because FSD Beta is getting worse. I’ve had a horrible experience with the latest update.

If the plan is to increase the price as FSD beta gets better, it would make sense to reduce the price when they have a bad update.

Author: Fred Lambert

Source: Electrek