Tesla’s (TSLA) stock is falling by as much as 5% in pre-market trading – seemingly putting a bookend on an incredible rally. This is against the backdrop of the US passing the landmark infrastructure package which includes big outlays for EV ecosystem.

One of the main catalysts appears to be Elon Musk confirming plans to sell 10% of his stake in the company over growing pressure over the idea that “the rich don’t pay taxes”.

But is he being genuine?

Tesla’s stock has been on an historic run over the last few weeks, adding hundreds of billions in market capitalizing to surpass $1 trillion.

This weekend, CEO Elon Musk floated an idea that is likely at least partly responsible for putting a stop to the rally.

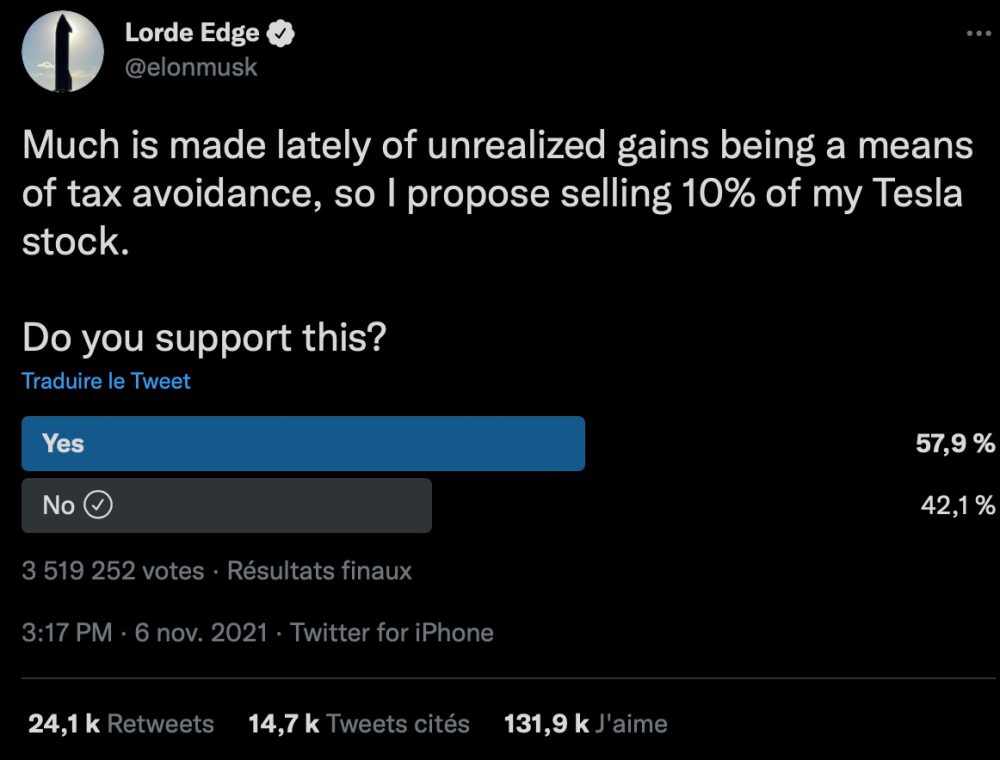

He said that he would sell 10% of his stake in Tesla if a Twitter poll would agree, which it unsurprisingly did. His brother and Tesla board member Kimbal Musk on Friday sold 88,500 TSLA shares valued at over $100M.

Over 3.5 million Twitter users voted on the poll and almost 58% of them voted to sell:

Musk said that if Twitter votes for it, he will follow through – meaning he will start selling millions of Tesla stocks.

Today, Tesla’s stock opened down 5%, which would result in tens of billions in market capitalization going away and roughly the amount of the stake Musk is now apparently planning to sell.

The CEO framed the idea as a way to pay taxes amid pressure to find ways to tax the super-rich who often live off of loans backed by the rising value of their stock holding in companies.

However, there are also other reasons why the CEO would want to sell some Tesla stocks right now.

Electrek‘s take

Normally, I’m quick to defend Musk when he is accused of having ulterior motives, but I think it’s fair this time to dig deeper.

During this whole conversation about unrealized gains and paying taxes, he never advertised the fact that he has a ton of stock options from his previous CEO grant that are about to expire if he doesn’t exercise them.

Unlike unrealized gains on stocks you are holding, exercising new stock options is taxable.

With the massive increase in Tesla’s stock price, some tax experts estimate his tax burden on exercising his stock options at over $10 billion regardless of this new stock sale.

This means that he was going to have to pay taxes regardless of this Twitter stunt.

But now, he is making it look like he is willingly making a move that will result in him paying taxes and leaving it “in the hands of the people” with this Twitter poll.

At the end of the day, he can sell or not sell stocks however he wants, he is within his rights, but it’s a little disingenuous to frame it as he did.

He found a way to cover his massive tax burden from receiving a ton of new Tesla stocks by making it look like he is setting himself off on purpose to pay more taxes amid social pressure over the super-rich not paying many taxes.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Fred Lambert

Source: Electrek