Tesla (TSLA) is set to announce its third-quarter 2021 financial results tomorrow, October 20, after the markets close. As usual, a conference call and Q&A with Tesla’s management is scheduled after the results.

We’ll take a look below at what both the street and retail investors are expecting for the quarterly results.

Tesla Q3 2021 deliveries

As usual, Tesla already disclosed its Q3 vehicle delivery and production numbers, which drives the vast majority of the company’s revenue.

Earlier this month, Tesla confirmed that it delivered 241,300 electric vehicles during the last quarter.

That’s a new record.

Tesla has been beating new delivery records every quarter lately, but this one is up 20% quarter-over-quarter.

Delivery and production numbers are always slightly adjusted during earning results.

Tesla Q3 2021 revenue

For revenue, analysts generally have a pretty good idea of what to expect thanks to the delivery numbers.

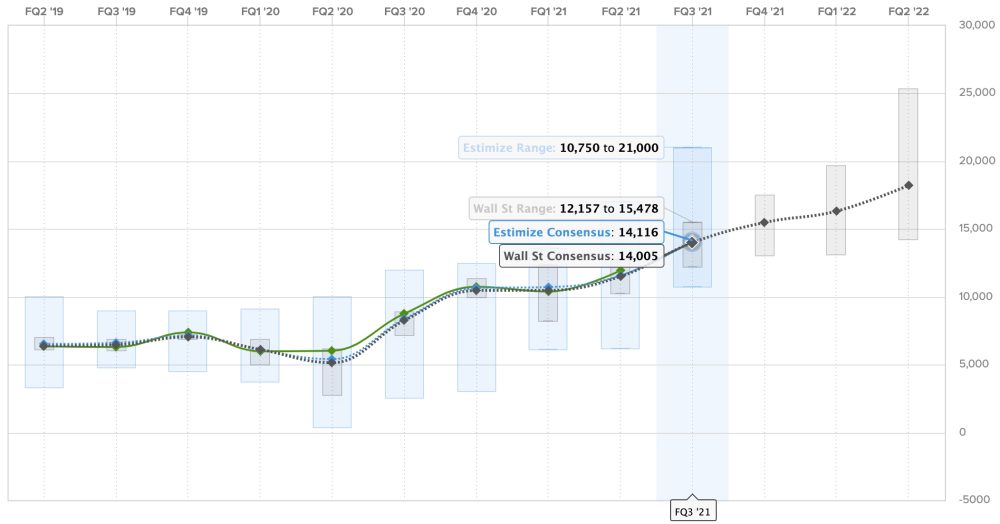

The Wall Street consensus for this quarter is $14.005 billion, and Estimize, the financial estimate crowdsourcing website, predicts a slightly higher revenue of $14.116 billion.

Unsurprisingly, the market is expecting one of the biggest quarter-over-quarter increases due to the rise in deliveries.

The predictions for Tesla’s revenue over the past two years: Estimize predictions are in blue, Wall Street consensus are in gray, actual results are in green:

Tesla Q3 2021 earnings

Tesla always attempts to be marginally profitable every quarter as it invests most of its money into growth, and it has been successful doing so over the last two years now.

For Q3 2021, the Wall Street consensus is a gain of $1.59 per share, while Estimize’s prediction is significantly higher with a profit of $1.82 per share.

Tesla had a big earnings beat last quarter, and with the important ramp-up in deliveries, it looks like the market is setting expectations higher this quarter.

Earnings per share over the last two years: Estimize predictions in blue, Wall Street consensus in gray, actual results in green:

Other expectations for the TSLA shareholder’s letter and analyst call

This quarter’s management call should be interesting since it is just a few weeks after Tesla’s annual shareholder’s meeting when investors were also able to ask questions.

As usual, the focus is on growth, which is mostly going to come from Tesla’s two new factories, Gigafactory Berlin and Gigafactory Texas.

Both factories are supposed to be producing vehicles by the end of the year, and a status update would be appreciated even though Tesla recently provided those at its shareholder’s meeting and Giga Fest in Germany.

Full Self-Driving Beta is also one of the biggest stories at Tesla right now, and financially, it is an interesting one.

The automaker has already been selling the package for years, but it hasn’t been recognizing all the revenue from it since it has yet to deliver the full features.

The company has been gradually recognizing more revenue from it as it pushes new features and with the wider release of FSD Beta that started last week, investors might be looking to know how to factor that in over the next quarter.

As usual, Tesla Energy is a much smaller part of the company’s business in terms of actual revenue, but investors would like to see Tesla sustain its growth on that front.

What else are you looking for during Tesla’s earnings? Let us know in the comments section below, and join us tomorrow for an extensive coverage of the earnings.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Fred Lambert

Source: Electrek