Tesla today announced that it had purchased $1.5B in bitcoin, pushing the cryptocurrency to an all-time high, currently approaching $44,000. The company announced the move in an SEC filing today and says it plans to accept the currency as payment for its products and services.

Tesla noted in its 10-K this morning:

In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.

Tesla CEO Elon Musk has been hinting at his admiration for the cryptocurrency, which many are taking as a hedge against inflation and possible volatility of the dollar and other state currencies.

Last week on his Clubouse chat, Musk said he was a supporter of the cryptocurrency, pushing it higher at the time. Musk attached the #bitcoin hashtag to his Twitter bio for a few weeks in January sparking speculation that he was getting involved in the crypto.

Musk has spent most of the last few weeks tongue-in-cheek pumping the “not to be taken seriously” Dogecoin as well causing fluctuations in its own market value.

Tesla Bitcoin Payments

Tesla plans to accept bitcoin as payment for its products and services as well.

In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, we may invest a portion of such cash in certain specified alternative reserve assets. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.

Digital assets are considered indefinite-lived intangible assets under applicable accounting rules. Accordingly, any decrease in their fair values below our carrying values for such assets at any time subsequent to their acquisition will require us to recognize impairment charges, whereas we may make no upward revisions for any market price increases until a sale. As we currently intend to hold these assets long-term, these charges may negatively impact our profitability in the periods in which such impairments occur even if the overall market values of these assets increase.

Tesla notes that the move could introduce significant volatility into its liquidity and financials but add “more flexibility to further diversify and maximize returns on our cash”

Bitcoin price has rocketed on the news, approaching the all time high of $44,000, up over $2000 since I started writing this post.

Electrek’s Take

We’ve been tracking Tesla CEO Elon Musk’s affinity for the Cryptocurrency for quite some time expecting an announcement like this. (Check out our sister site BlockTalk.co for more on Block/Crypto). Tesla has also used Blockchain, the technology behind Bitcoin, in its Shanghai plant logistics.

The move is likely going to be seen as a pioneering one for large companies and will put Tesla in a great position to be at the top of the list of companies taking advantage of the cryptocurrency.

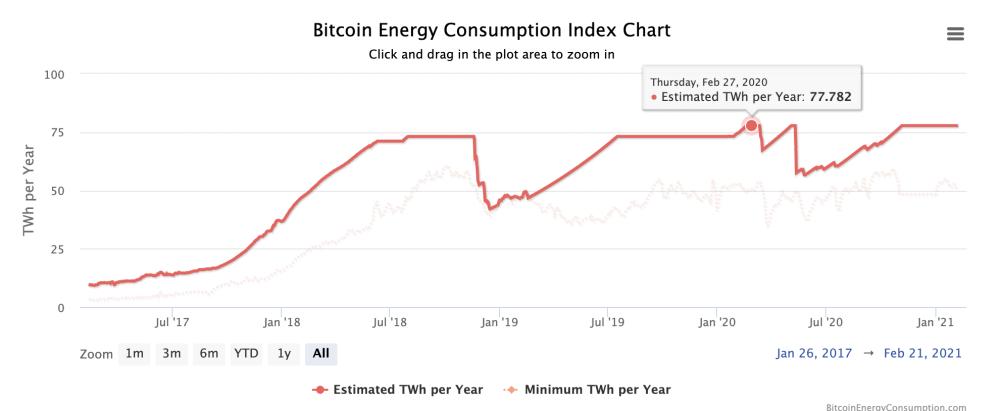

Bitcoin is not without its flaws however, the most relevant being its intense use of energy to “mine” the coins. Mining “rigs” often use energy that isn’t properly accounted for and overall, Bitcoin mining is estimated to pull many TWh of energy off the grid. Tesla’s mission is “to accelerate the world’s transition to sustainable energy” by focusing on renewable energy but this would seem to counter that in a big way.

This morning alone, TSLA has made 15% on its $1.5B investment and with other companies likely to follow, legitimizing Bitcoin, the currency will likely continue to rise and become more stable.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Seth Weintraub

Source: Electrek