Tesla (TSLA) will release its Q1 2025 financial results today, Tuesday, April. 22, after the markets close. As usual, a conference call and Q&A with Tesla’s management are scheduled after the results.

Here, we’ll look at what the street and retail investors expect for the quarterly results.

Tesla Q1 2025 deliveries and energy deployment

CEO Elon Musk and his loyal shareholders often claim that Tesla is now an AI/Robotics company, but the truth is that the company’s automotive business still drives the vast majority of its financial performance.

Tesla’s revenue remains tied mainly to the number of vehicles it delivers.

Earlier this month, Tesla disclosed its Q1 2025 vehicle production and deliveries:

| Production | Deliveries | Subject to operating lease accounting | |

| Model 3/Y | 345,454 | 323,800 | 4% |

| Other Models | 17,161 | 12,881 | 7% |

| Total | 362,615 | 336,681 | 4% |

It was significantly below expectations and approximately 50,000 units short of what Tesla delivered in Q1 2024.

Analysts have been adjusting their revenue and earnings expectations accordingly since the disclosure a few weeks ago.

Now, Tesla’s energy storage business is also starting to make a meaningful contribution to its financial performance. The company disclosed having deployed 10.4 GWh of energy storage products during Q1 2025.

Tesla no longer discloses solar deployment information.

Tesla Q1 2025 revenue

For revenue, analysts generally have a pretty good idea of what to expect, thanks to the delivery numbers and now the energy storage deployment data.

However, many were taken by surprise by how low Tesla’s deliveries were this quarter and the automaker offered a lot of discounts, which will affect the average sale price that analysts are now trying to figure out.

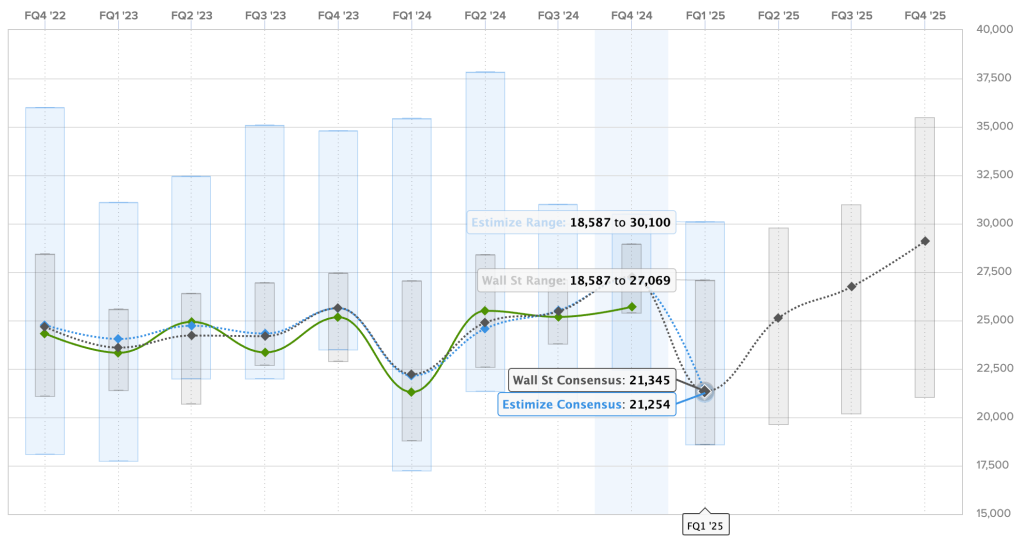

The Wall Street consensus for this quarter is $21.345 billion, and Estimize, the financial estimate crowdsourcing website, predicts a slightly lower revenue of $21.254 billion.

Here are the predictions for Tesla’s revenue over the past two years, with Estimize predictions in blue, Wall Street consensus in gray, and actual results are in green:

This would be about a $1 billion lower than the same period last year – meaning that analysts don’t expect Tesla’s increased energy storage deployment to compensate for the lower vehicle deliveries.

Tesla Q1 2025 earnings

Tesla claims to consistently strive for marginal profitability every quarter, as it invests the majority of its funds in growth, but its growth has disappeared from its automotive business over the last year, and its gross margin is going in the same direction.

Analysts are trying to estimate Tesla’s gross margin with the lower deliveries to figure out its actual earnings per share.

For Q1 2025, the Wall Street consensus is a gain of $0.41 per share and Estimize’s crowdsourced prediction is a little lower at $0.40.

Here are the earnings per share over the last two years, where Estimize predictions are in blue, Wall Street consensus is in gray, and actual results are in green:

If the estimates are accurate, Tesla’s earnings per share would be down from $0.45 during the same period last year.

There are several things that Tesla could do here that could surprise investors with a significant earnings beat. Tesla could have recognized revenue from the launch of FSD in China, even though the launch was brief and 95% of the value of the FSD package is unsupervised self-driving, which Tesla has yet to deliver.

Tesla could have also sold more emission credits. As of the end of last quarter, Tesla was still sitting on a good amount, and while it claims to sell them when the price makes the most sense, it is quite an opaque market and Tesla could at any time decide to sell them just to save itself from a bad quarter.

Other expectations for the TSLA shareholder’s letter, analyst call, and special ‘company update’

As we reported yesterday, this is likely going to be a messy earnings report. Musk has been on a propaganda spree lately after Tesla suffered immense brand damage and declining stock price due to his involvement in politics.

Now, he has called for a “live company update” at the same time as the release of Tesla’s financial results, which appears to be a desperate move at damage control amid a tough quarter for the company.

Also Read: Tesla Hits Record Deliveries as Quarterly Forecasts Rise

I expect that he will try to paint a rosy picture of Tesla’s self-driving and robot efforts to come save the company amid declining EV sales.

As I previously reported, I wouldn’t be surprised if he also pushes for Tesla to invest in his xAI startup or proposes a merger between the companies.

Tesla will also take questions from retail shareholders based on the most popular ones on Say. Here are the top 5 questions and my thoughts on them:

- Is Tesla still on track for releasing “more affordable models” this year? Or will you be focusing on simplified versions to enhance affordability, similar to the RWD Cybertruck?

- We have had the answer to that question for about a year now, but Tesla shareholders don’t believe it because Elon claimed that Reuters’ original report that Tesla canceled its more affordable EV was “wrong” when it fact it wasn’t. As we recently reported, Musk killed the “$25,000 Tesla” in favor of the Robotaxi and building new stripped-down versions of Model Y and Model 3.

- When will FSD unsupervised be available for personal use on personally-owned cars?

- Lol – we are just going to get Elon’s “best guess”, which has been wrong every time for the last decade.

- How is Tesla positioning itself to flexibly adapt to global economic risks in the form of tariffs, political biases, etc.?

- Musk is going to say “you go woke, you go broke” and that his pathetic quest to “kill the woke mind virus” will ultimately be good for Tesla because the world will be rid of this destructive virus. As for the global economic risks, I wouldn’t be surprised if Tesla announces more layoffs soon.

- Robotaxi still on track for this year?

- It could very well be. We have already reported in detail about how Tesla’s “robotaxi” launch in Austin, planned for June, is actually a “moving of the goal” and it has very little to do with Tesla’s long-stated promise of delivering unsupervised self-driving in a consumer vehicle, as asked in the second question.

- Did Tesla experience any meaningful changes in order inflow rate in Q1 relating to all of the rumors of “brand damage”?

- If they say no here, don’t believe them. Tesla is down 50,000 units in Q1, and yes, the Model Y changeover has something to do with it, but you can clearly see now, based on new Model Y delivery timelines, that Tesla has no order backlog for the vehicle. It will likely launch incentives to sell the brand-new vehicle that was supposed to save Tesla’s auto business in the coming weeks.

Tune in with Electrek after market close today to get all the latest news from Tesla’s earnings, conference call, and now also an apparent “company update.”

Author: Fred Lambert

Source: Electrek

The Q2 figures will reveal the true disaster. Then it will no longer be possible to claim that the slump in deliveries is due to 3 weeks of production changeover to Model Y Juniper.

But the Q2 figures will only be released after the AGM. And that will save Elon and the board once again at the AGM this year. Elon will once again paint some “visions” that will never come true. But that will be one last time enough for shareholder approval at the AGM. With the Q2 figures I expect TSLA shares to fall below 150. And maybe Trump will do the rest, to bring the shares below 100.