Tesla has filed a proxy with shareholders to ask them to vote for the company to move its state of incorporation to Texas and re-pass Elon Musk’s 2018 CEO massive compensation plan that was rescinded by a Delaware judge earlier this year.

In January, a judge sided with lawyers representing a Tesla shareholder alleging that Tesla’s board misrepresented Elon Musk’s CEO compensation package worth $55 billion when presenting to shareholders.

It’s a complicated issue, but in short, the judge found that Tesla’s board and Musk didn’t play by the rules of a public company when it presented the plan to shareholders.

The judge found that Tesla had governance issues when coming up with compensation plan and those issues were not communicated to shareholders before voting on the plan.

The Delaware court found that this invalidated the vote, and therefore, Tesla had to rescind the compensation plan worth roughly $55 billion in stock options to Musk.

The company signaled that it would appeal, but Musk also highlighted another strategy. The CEO blamed the ruling on a “politically motivated judge” in Delaware and suggested that Tesla could move its state of incorporation to Texas and have shareholders vote on the package again.

That’s exactly what Tesla is doing right now.

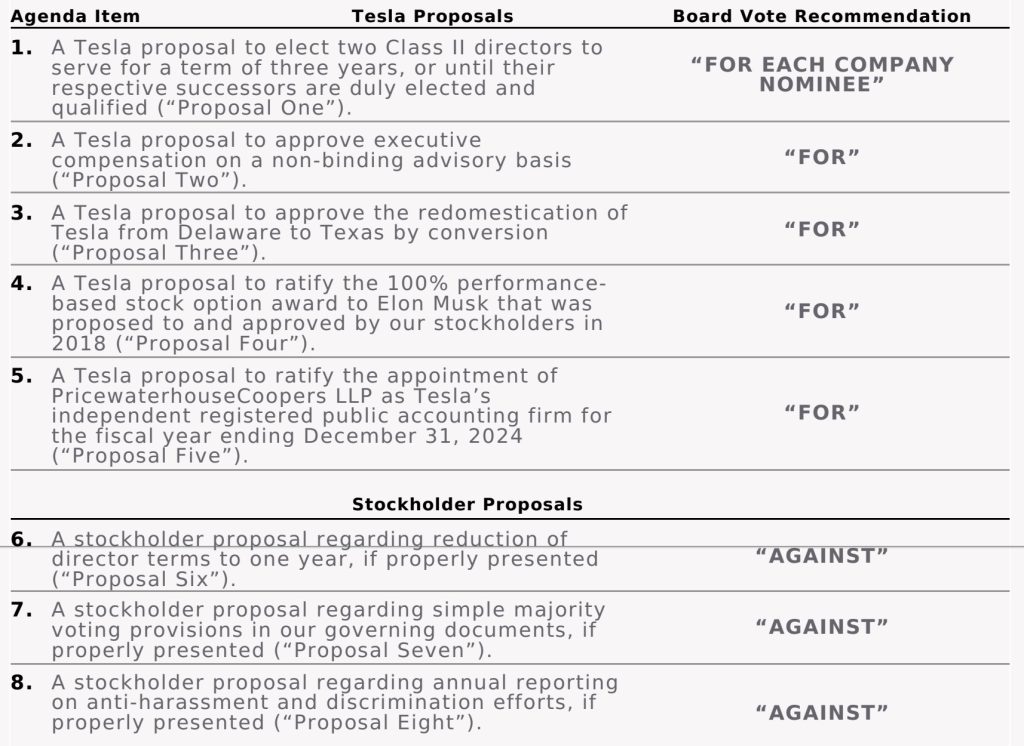

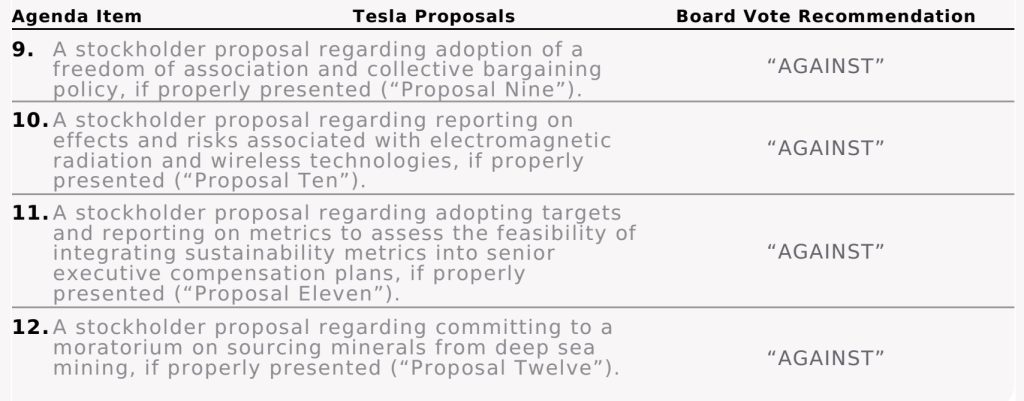

The automaker released a proxy statement to shareholders in preparation for its upcoming 2024 shareholders meeting in June, and the two main items on the agenda are moving Tesla to Texas and re-passing Musk’s compensation plan.

Tesla’s Chairwoman, Robin Denholm, wrote the opening to the proxy and said about the case that had Musk’s compensation package rescinded:

The Tornetta Court decided, years later, that the CEO pay package was not “entirely fair” to the very same stockholders who voted to approve it — even though approximately 73% of all votes cast by our disinterested stockholders voted to approve it in 2018. Because the Delaware Court second-guessed your decision, Elon has not been paid for any of his work for Tesla for the past six years that has helped to generate significant growth and stockholder value. That strikes us — and the many stockholders from whom we already have heard — as fundamentally unfair, and inconsistent with the will of the stockholders who voted for it.

Denholm, who was on the compensation committee that approved the package, didn’t address the actual concerns in the judge’s finding about Tesla’s governance issues that led to the judgment.

At the meeting, shareholders will also vote on the re-election of Kimbal Musk, Elon’s brother, and James Murdoch, former 21st Century Fox CEO, to Tesla’s board.

Tesla’s board recommend to vote for all those items and against all the shareholders proposals:

Here’s the proxy statement in full:

Electrek’s Take

As I have previously stated, you can be for Elon getting his compensation for his work from 2018 to 2022 in the compensation plan and still agree with the judge’s finding that Tesla misrepresented it to shareholders – highlighting serious governance issues at Tesla.

As a shareholder, I’d be tempted to vote for the compensation again, but not if Tesla didn’t get the message about governance, which it clearly didn’t based on Denholm’s presentation of the issue.

She only states that the court found that the package “was no entirely fair”, which is a gross misrepresentation of the court’s findings.

The court found that Tesla’s board misrepresented the package to shareholders in the original proxy presenting the compensation package, and now she does it again in this one. Musk and his lawyer, who was also Telsa’s own general counsel at the time, were behind the compensation package, which Tesla didn’t seem to negotiate in any significant way.

Read More: Electrek Podcast: Tesla record numbers, prices, shareholders

It was approved by people who weren’t just friends of Elon but also people who had personal financial dealings with him outside of Tesla – clearly making them not independent despite their description as such by the board.

Ironically, Denholm was probably the only board member at the time that could have been described as independent, but she was also getting a juicy new compensation plan at the time – incentivizing her to approve Elon’s.

Also, Tesla’s own board agreed to settle a lawsuit and return over $700 million in compensation over claims of overcompensation.

If there’s one thing that is clear, Tesla has a serious governance problem.

Author: Fred Lambert

Source: Electrek

Well since the Delaware incorporation actually protected shareholders I’d be inclined to deny the movement to Texas. Based on Musk not pushing forward with the NV9 (and expanding to that huge potential market), making the truck much more expensive than initially proposed (drastically reducing potential sales) and his personal negative affects on Tesla sales in general I don’t think I’d vote to give him $55 billion either. With the board being essentially in the pocket of the CEO over this time period when they’re not supposed to be, I’d be inclined to boot the members up for re-election. Year to date Tesla stock is down ~35% based on performance and news (such as the canceling of the NV9 project).