This content is provided by a sponsor.

As of April 2025, Solana’s decentralized application (dApp) ecosystem has seen significant swings in revenue and activity. Here’s a look at the latest trends—and the emerging opportunities they reveal:

Recent Revenue Trends

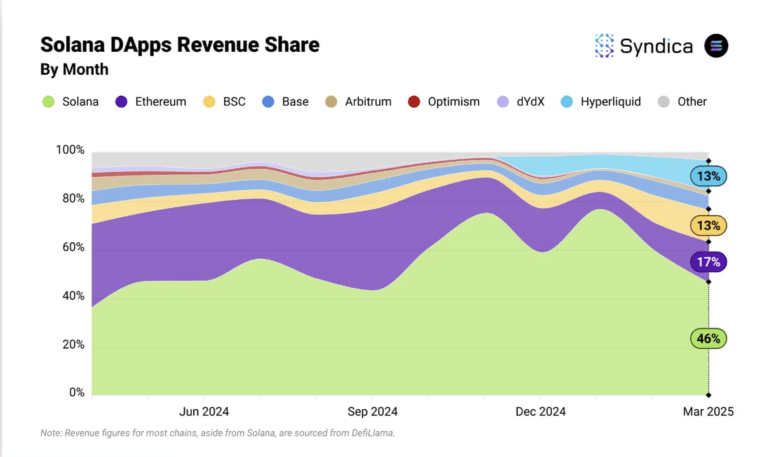

In March 2025, Solana’s dApp ecosystem generated $146 million in total revenue, capturing 46% of all Web3 dApp revenue. This represents a decline from $300 million in February and a peak of $650 million in January. While the drop reflects a short-term cooldown in user activity, especially in speculative sectors like memecoins and decentralized exchanges (DEXs), it also signals a maturing market.

Q1 2025 Performance: A Record-Breaking Quarter

Despite March’s pullback, Solana achieved a record-breaking quarter. Solana-based dApps generated $1.16 billion in revenue during Q1 2025—the highest quarterly total on record. The strong performance in January and early February, particularly across memecoin platforms and DEXs, underscores Solana’s position as a leading high-performance platform for Web3 applications.

Must Know: Solana DEXs Overtake Ethereum in Weekly Trading Volume

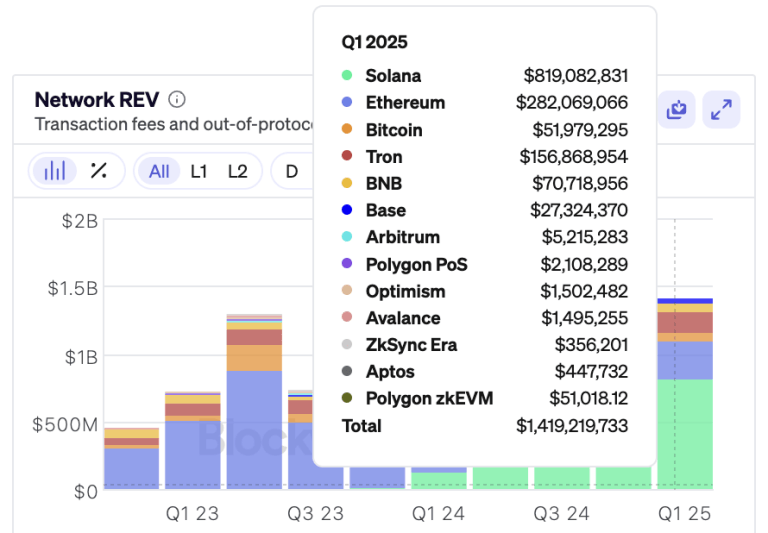

Solana also led all Layer 1 and Layer 2 blockchains in network-level revenue, posting $819 million in transaction fees and out-of-protocol earnings. This figure surpassed the combined revenue of Ethereum, Tron, and Bitcoin, further establishing Solana’s dominance in both activity and protocol-level economics.

Key Drivers of Activity

Innovation in Action: Solana’s Emerging dApp Frontiers

If revenue charts tell the story of market momentum, then individual dApps reveal the creative engine behind Solana’s ecosystem. In Q1 2025, several breakout projects pushed the boundaries of what’s possible on-chain—spanning creator monetization, real-world assets, gamified behavior, and social tokenization. These aren’t just applications; they’re early signals of how Web3 might permeate everyday life.

Redefining Everyday Value: Time, Steps, and Participation

Projects like Time.fun(https://x.com/timedotfun) and Moonwalk Fitness(https://x.com/moonwalkfitness) show how Solana is powering a new era of behavior-linked finance.

Blending Reality and the Blockchain: RWA & Viral Game Mechanics

Web3’s promise of programmable ownership finds fresh ground in real-world and immersive use cases.

From Ideas to Tokens: Social Virality Meets Real Utility

Solana’s low fees and high speed enable new kinds of expression.

These projects, though varied in style and scope, all point to a single truth: Solana is no longer just a trading chain—it’s becoming a playground for experimental utility. Whether tokenizing time, reshaping social content, or redefining how we buy, move, or play, the ecosystem’s creative frontier is wide open.

Why It Matters: Strength Beyond the Metrics

Solana’s Q1 revenue performance is a headline achievement—but it’s the underlying developer activity, category diversity, and consumer experimentation that point to long-term health. The March cooldown should be read in context: speculative froth may fade, but innovative applications—from tokenized time to decentralized fitness—are gaining real traction.

Solana continues to lead the blockchain application space not just in numbers, but in real product innovation. As high-impact projects push into new verticals and Solana maintains its technical edge, the ecosystem is well-positioned for its next wave of growth.

Bitcoin.com accepts no responsibility or liability, and is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the article.

Source: Bitcoin