Rivian (RIVN) released its first-quarter earnings Tuesday as the EV maker looks to build upon its momentum from last year. Despite a slow start to 2023, Rivian says it still expects to produce 50,000 vehicles this year.

Rivian Q1 2023 earnings preview

After producing 9,395 vehicles and delivering 7,946 total units in the first three months of the year, Rivian says it remains on track to hit its 50,000 production goal by the end of the year.

Rivian warned of lower production and deliveries as it retools its EDV assembly line to add its new in-house “Enduro” drive units.

Despite the slow start, the EV maker says the new drive units will help streamline production and bring down costs. The company says it’s preparing to ramp output later in the year.

Wall Street is expecting Rivian to post a slightly smaller loss than the $1.7 billion recorded in the fourth quarter as it works to reduce operating costs and enhance efficiency.

With production falling, Wall Street is looking for slight revenue growth in Q1 2023 ($686 million) compared to $660 million in its fourth-quarter earnings.

More importantly, with other EV startups including, Fisker and Nikola, cutting production guidance this week after Q1 earnings, Rivian’s guidance and expectations going forward will be something to watch closely.

Rivian first quarter financial results and highlights

After market close, Rivian posted its Q1 earnings results showing narrowing losses but also lower revenue.

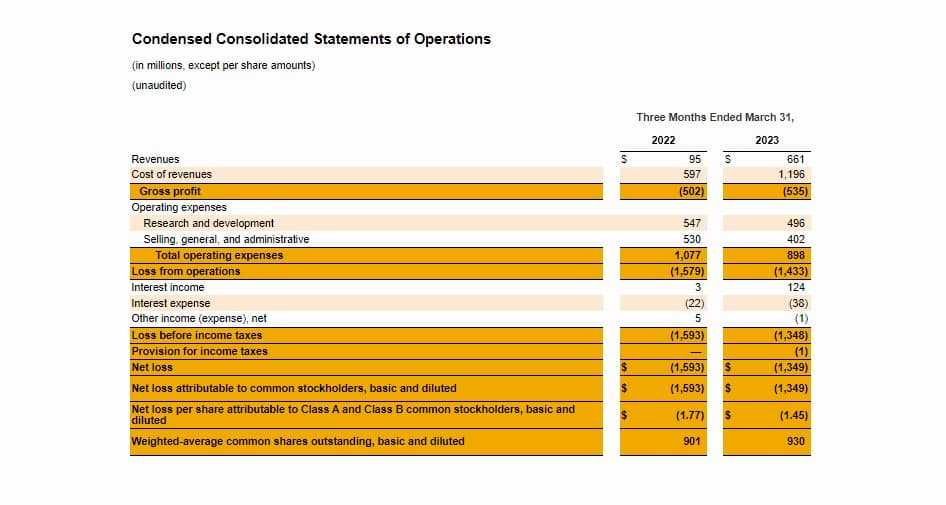

Rivian posted revenue of $661 million in the quarter from the 7,946 vehicle deliveries, slightly beating expectations and falling from Q4. Gross profits fell to negative $535 million in Q1, compared to negative $502 million last year.

With cost-cutting measures in place, Rivian’s operating expenses fell to $898 million, compared to over $1 billion during the same period last year.

Rivian says the scheduled commercial van line down time impacted cost of good sold.

Although gross margins did improve, it’s still costing Rivian roughly twice as much to make it than what they are selling for. Rivian did note it expects to reach positive gross profit by the end of 2024.

Overall Rivian posted a net loss of $1.4 billion, down when compared to $1.6 billion in Q1 2022 and over $1.7 billion from last quarter. Rivian burned through $1.5 billion in cash in the quarter, leaving the EV maker with $11.78 billion in cash and equivalents.

Looking ahead, Rivian is maintaining its 50,000 EV production goal for 2023. The EV maker says it remains focused on ramping production and implementing new technology to drive down costs throughout the year.

The team believes supply chain issues will continue to be the limiting factor so it’s working to introduce new engineering design changes and key technologies, which will be implemented in the second half of the year.

We’ll update you with the latest from Rivian’s Q1 earnings call that follows. You can refresh for the latest news.

Author: Peter Johnson

Source: Electrek