Rivian (RIVN) released its third-quarter earnings after market close Tuesday, showing strong results as production and deliveries picked up. Meanwhile, losses are shrinking…

Earnings preview

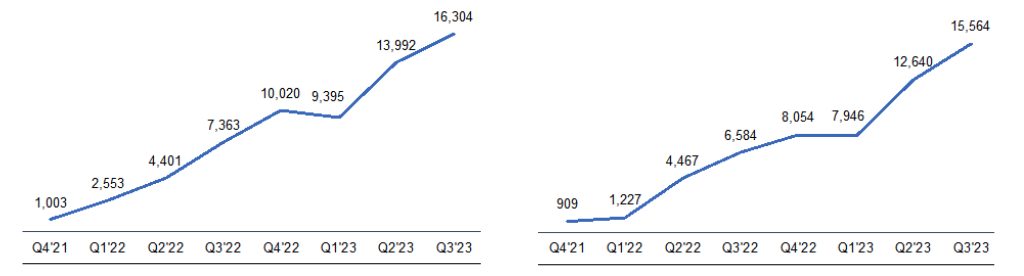

The EV maker continued progressing in the third quarter, easily surpassing expectations with 15,564 vehicles delivered.

Rivian’s deliveries were up 24% from Q2 and more than double last year’s figures. The company built 16,304 EVs during the quarter, representing 17% growth from Q2.

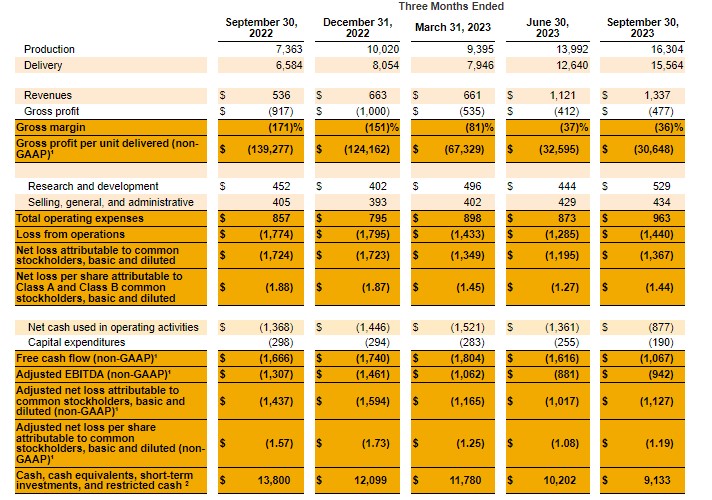

As Rivian better leverages its manufacturing facility, the cost of building each vehicle is decreasing. Rivian lost $32,595 on each vehicle it made in the second quarter. Although still a high number, it’s down over 50% from the first quarter’s loss per vehicle of $67,329. Also, it should be noted it is still working through its backlog of early orders, many of which were priced ~$20K below current prices.

CEO RJ Scaringe previously said the automaker will see a “very clear staircase” toward profitability. Rivian has been one of the few automakers to avoid cutting prices this year.

Rivian’s Q3 preliminary results indicate between $1.29 billion and $1.33 billion in revenue, in line with Wall St estimates of $1.3 billion.

Investors will watch Rivian’s loss per vehicle and margins closely as the EV maker accelerates production which is now over double YoY.

Rivian Q3 earnings results

Rivian generated $1.34 billion in revenue in Q3, up from $1.12 billion in Q2, beating estimates as deliveries continued progressing.

Gross profits improved in the third quarter. Rivian posted a negative gross profit of $477 million in Q3 compared to $917 million last year.

Rivian’s gross profit per vehicle delivered improved by about $2,000 during the quarter, with a loss of around $30,500 per vehicle.

The company said the gross profit improvement was due to scaling production and cost-reduction efforts in the quarter.

Rivian’s operating expenses grew to $693 million compared to $857 last year as the EV maker increased output.

The EV maker’s net loss reached $1.3 billion in Q3, up from $1.12 billion in Q2. However, the number is still down from $1.7 billion last year and $1.4 billion in Q1.

In light of the progress, Rivian is increasing its production target for 2023 to 54,000, up 2,000 from its previous goal.

The company also raised adj. EBITDA guidance to ($4 billion) from ($4.2 billion) and lowered CapEx to $1.1 billion.

Rivian ended the third quarter with 9.13 billion in cash and equivalents, down slightly from $9.2 billion at the end of June. With its revolving credit facility, the company had $10.25 billion in liquidity.

In another significant milestone,

Author: Peter Johnson

Source: Electrek