EV maker Rivian (RIVN) is set to release its second-quarter 2023 earnings after the bell on Tuesday, August 8. Amid of wave of EV price cuts and lowered guidance, investors will be watching production and pricing closely in Rivian’s Q2 earnings report.

Rivian Q2 2023 earnings preview

Rivian shattered analyst expectations after delivering 12,640 models in the second quarter. Analysts were looking for the EV maker to deliver around 11,000.

After a slow start to the year, production is also picking up. Rivian made nearly 14,000 EVs during the period, an increase of 48% from around 9,400 in Q1.

Rivian warned it would start slowly as it retooled its electric delivery vehicle (EDV) assembly line to add its in-house Enduro drive units and LFP battery packs. The new drive units and batteries will help streamline production while cutting costs.

According to Rivian, the new in-house components have helped reduce input costs on its EDVs by roughly 25%.

The new drive units have begun making their way into the R1 models, with the cheaper “Dual Motor” and “Dual Motor Performance” versions appearing in the R1T and R1S configurator last month.

Production and pricing

Rivian was among the few EV makers to stick to its annual production guidance so far this year of building 50,000 EVs, which would more than double last year’s figures (24,337 EVs produced in 2022). This will be a number to watch closely if Rivian maintains or not.

Several Rivian executives, including CEO RJ Scaringe and CFO Claire McDonough, claimed the EV maker hit a turning point in Q2 regarding supply chain hurdles. Scaringe said in an interview in early July:

What we saw in Q2 was the beginnings of the supply chain really running in a healthy way.

Meanwhile, Rivian will face rising competition, with Ford slashing prices on its F-150 Lightning electric truck and R1T competitor by up to $10K last month. Rivian will get a new competitor with Tesla’s Cybertruck, which is expected to begin delivering by the end of next month.

Will Rivian follow the trend and adjust prices? The R1T starts at around $73K, and the R1S begins at around $78K. Ford’s Lightning now starts under $50K. Given they are two different vehicles, they both compete in the electric pickup market. Lucid was the latest to cut prices, announcing up to $12K off its Air luxury electric sedans.

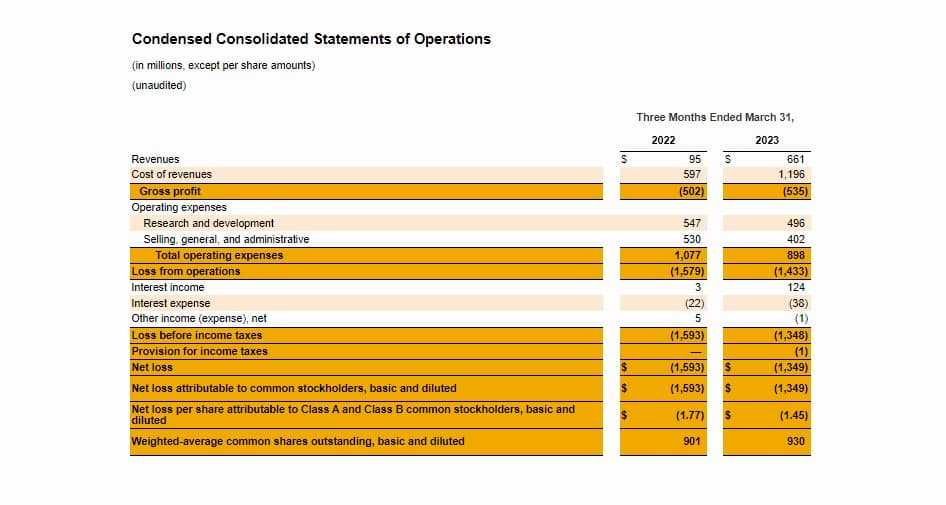

At the same time, Rivian is facing financial pressures of its own. Although gross margins improved in the first quarter amid cost-cutting measures, the EV maker is still losing about twice as much as it takes to make the vehicles.

Rivian posted a net loss of $1.4 billion in the first quarter, down from $1.7 billion in Q4. The EV maker ended the quarter with $11.78 billion in cash, equivalents, and restricted cash.

Despite cooling off into earnings, Rivian’s stock is up over 80% since late June. However, share prices are still down over 80% from their highs set shortly after going public in November 2021.

Author: Peter Johnson

Source: Electrek