After posting strong Q2 earnings, EV maker Rivian (RIVN) is raising guidance numbers for the year. Rivian continues ramping production while gross margins improved by 50%. Overall, it was a solid improvement quarter-over-quarter.

Rivian Q2 2023 earnings preview

Yesterday, we posted a preview of what you can expect from Rivian’s Q2 earnings report, indicating investors will be watching pricing, margins, and guidance after a mixed quarter from EV makers.

Rivian crushed expectations, delivering 12,640 EVs in the second quarter, up 50% from Q1. Analysts were looking for around 11,000. After a slow start to the year, Rivian’s production is picking up after retooling its EDV line to accommodate for its new Enduro drive units and LFP battery packs.

After initially introducing the new in-house components into its EDVs, Rivian says it has helped reduce input costs by around 25%.

The Enduro drive units began making their way into R1 models in the second quarter, with its cheaper “Dual Motor” and “Performance Dual Motor” appearing in the R1 shop last month.

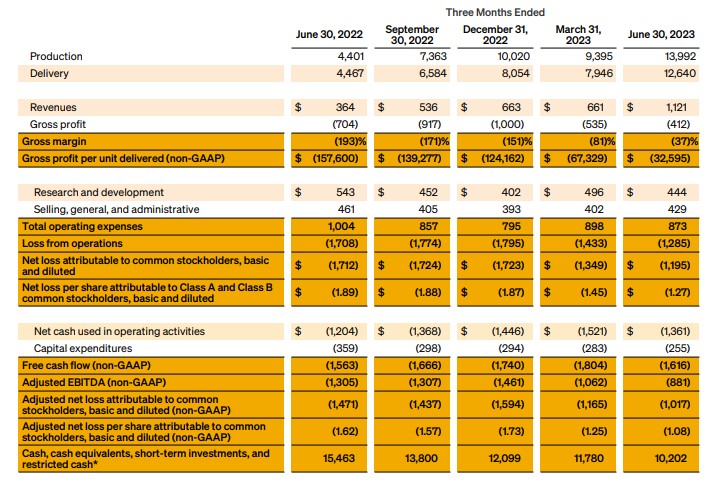

Rivian posted a net loss of $1.4 billion in the first quarter, down from $1.7 billion in Q4, as the EV maker cuts costs. Here’s a look at Rivian’s Q2 2023 earnings highlights.

Rivian Q2 earnings results and highlights

In the second quarter, Rivian generated $1.12 billion in revenue, up from $661,000 in Q1, primarily from the 12,640 vehicle deliveries ($34 million from regulatory credits).

The biggest takeaway is Rivian’s improvement quarter over quarter. Rivian’s production and deliveries grew by 50% and 60%, respectively.

Perhaps most importantly, Rivian’s gross profit per vehicle delivered improved by $35,000. Rivian says its company-wide cost transformation program is having a maximum impact with meaningful reductions in both R1 and EDV vehicle costs.

Gross margins improved by 50% in Q2, with ($32,595) gross profit per unit delivered, compared to ($67,329) in the first quarter and ($124,162) in Q4. Rivian commented on the improvement, saying:

We remain confident in our ability to continue to drive our cost per vehicle lower by ramping production and leveraging our fixed costs, as well as our commercial, engineering design changes, and operational cost reduction efforts

This includes introducing its new in-house Enduro drive units, LFP battery packs, and negotiated supplier price reductions. As Rivian produces more vehicles, it’s helping the company better leverage the plant overhead and manufacturing operations.

Rivian says about 70% of total R1 production was the R1S in Q2, in the electric SUV’s first quarter overtaking the R1T to meet the growing backorders.

Overall, Rivian posted a net loss of $1.12 billion, compared to a net loss of $1.7 billion last year and $1.4 billion last quarter.

After the progress made in the second quarter, Rivian is raising its 2023 production guidance to 52,000 units, up 2,000 from its previous target. Rivian is also improving its adjusted EBITDA guidance to ($4.2 billion) while lowering capital expenditure to $1.7 billion following the improvements in production, in-house components, and supply chain outlook.

Rivian CEO RJ Scaringe commented on the company’s Q2 earnings progress, saying:

Our second quarter results reflect our continued focus on cost efficiency as we accelerate the drive towards profitability. On a quarter-over-quarter basis, delivered vehicles grew around 60% while gross profit per vehicle improved by about $35,000. We have achieved meaningful reductions in both R1 and EDV vehicle unit cost across the key components, including material costs, overhead and logistics. It was a strong quarter, and we remain focused on ramping production, driving cost efficiencies, developing future technologies, and enhancing the customer experience.

Meanwhile, Rivian ended the quarter with $9.2 billion in cash and equivalents ($10.2 billion, including short-term investments and accounts receivable), down from $11.78 billion in the previous quarter.

Author: Peter Johnson

Source: Electrek