A study by Henley & Partners, an investment migration consultancy in London, reveals an interesting insight: of the world’s 56.1 million millionaires, a notable 88,200 have earned their fortunes in cryptocurrency.

Crypto’s Elite: How Bitcoin and Cryptocurrency Carved Out a New Generation of Millionaires and Billionaires

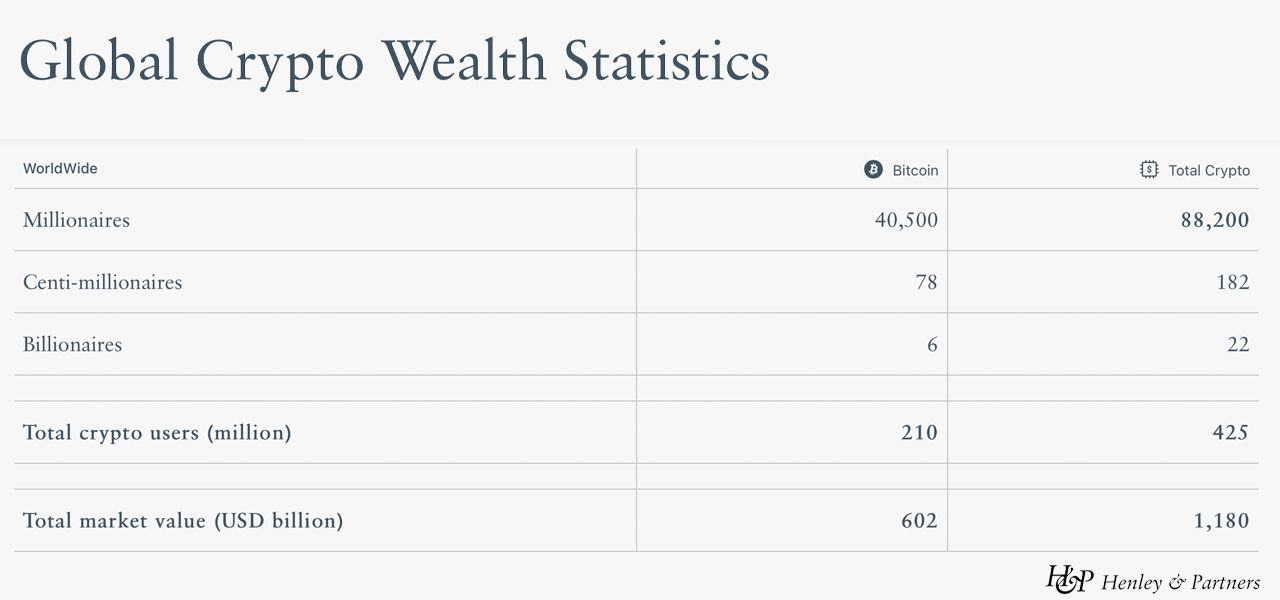

At the time of writing, the crypto economy boasts a valuation slightly above $1 trillion. This vast sum has birthed a new generation of crypto millionaires and billionaires over time. Henley & Partners, a prominent investment consultancy, reports that out of today’s 88,200 crypto millionaires, 40,500 owe their affluence exclusively to bitcoin (BTC). This means that crypto millionaires represent a mere 0.157% of the total 56.1 million millionaires globally.

Diving deeper into Henley & Partners’ data, 182 individuals have reached the status of centi-millionaires through crypto investments. For clarity, a centi-millionaire is someone with investable assets surpassing $100 million. Remarkably, 78 of these centi-millionaires owe their fortunes to BTC alone. Moreover, about six individuals have become billionaires through BTC, while approximately 22 billionaires have amassed their wealth from the broader crypto realm.

The elite group of crypto centi-millionaires and billionaires in 2023 includes Binance’s CEO Changpeng Zhao (CZ), Ripple’s Chris Larsen, the Winklevoss twins from Gemini, venture capitalist Tim Draper, Galaxy’s Michael Novogratz, Coinbase’s Brian Armstrong, Block.one’s Dan Larimer, Ethereum’s Anthony Di Iorio, Digital Currency Group’s Barry Silbert, Ripple’s Brad Garlinghouse, Bitcoin.com’s founder Roger Ver, ex-Bitmain CEO Jihan Wu, and venture capitalist Matthew Roszak.

Dr. Juerg Steffen, the CEO of Henley & Partners, highlighted in the report that as governments draft crypto regulations, crypto enthusiasts and investors are actively seeking investment migration avenues to safeguard their assets. “We have seen a significant spike in inquiries from crypto millionaires over the past six months, who are all looking to build a viable ‘Plan B’ to protect themselves against any potential future bans on the trading or use of cryptocurrencies in their countries and to allay the risks of aggressive fiscal policies that tax digital assets at source,” Steffen remarked.

On the other hand, the two dominant digital currencies, bitcoin and ethereum (ETH), have seen a decline of over 10% in the past month. Bitcoin’s value is 62% below its peak of $69K in November 2021, while ethereum has plummeted 66% from its high of $4,878 during the same period. Jeff D. Opdyke, a personal finance and investment guru, cited in the Henley & Partners Crypto Wealth Report, suggests that such a downturn is a typical phase in BTC’s financial trajectory.

Opdyke opined, “From the moment bitcoin was born in 2009, crypto was always going to become the most inevitable trade in 30 years.” He drew parallels with the initial internet buzz, emphasizing the inevitable boom and bust cycles. “Crypto today, in the wake of a bear market, is a replay of 1999 to 2001 — in other words, a fantastic opportunity to buy when blood stains the streets because we’re not likely to ever see these prices again.”

You can check out Henley & Partners’ Crypto Wealth statistics and the report’s methodology in its entirety here.

What do you think about the Crypto Wealth Report published by Henley & Partners? Share your thoughts and opinions about this subject in the comments section below.

Source: Bitcoin