Back in March, a longtime Google vice president in charge of Google Pay and Next Billion Users left the company. That team was merged with Google’s shopping/commerce efforts, but a new report today points to the new Google Pay seeing slow growth and progress.

According to Business Insider, the departure of Caesar Sengupta in April was followed by a dozen vice presidents, directors, and employees leaving the team responsible for the Google Pay app and overall payments infrastructure.

At issue, according to two former employees, was how “the product wasn’t growing at the rate we wanted it to.” Today’s report goes on to talk about how Sengupta’s tenure focused on bringing the Tez payments app originally built for India to the US. The new Google Pay launched in the US last November and was a two-year effort.

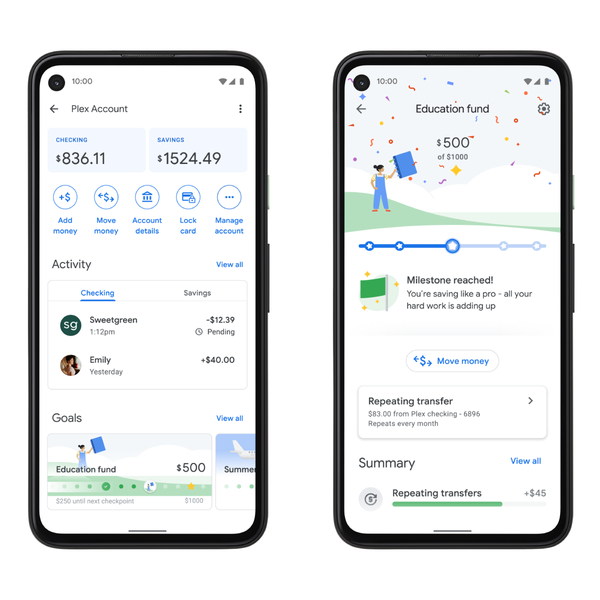

The revamped effort focused on budgeting, finance tracking, and deals launched just over nine months ago, but is still only available in the US, India, and Singapore. It’s a much more ambitious app, but it’s not clear how people have taken to Google Pay being more than just a smartphone wallet.

One particular slowdown is the Plex digital bank accounts announced with the revamped Google Pay last fall. The company is working with banks and credit unions on co-branded checking and saving accounts that will be managed via the mobile app. Besides progress being slower than expected, further delays could be coming following executive departures.

In a statement to Business Insider, Google said it “finished a limited pilot of Plex and are actively applying learnings from early testing to bring this to market soon,” but would not commit to the original 2021 launch timeline. The company also disputed there being an uptick in employee departures, rather pointing to the usual attrition that occurs after a reorganization.

There are rumors of another reorg following the initial one that combined shopping and payments, though people generally agree that combining and having one executive — tasked with taking on Amazon — was the right move.

Author: Abner Li

Source: 9TO5Google