Swedish performance EV maker Polestar (PSNY) reported its Q2 2023 earnings on Thursday, showing widening losses as production scales. Polestar is entering an “exciting” growth phase with two highly anticipated EVs scheduled for production.

Polestar hits record deliveries, but losses widen in Q2

Polestar delivered 15,765 EVs in the second quarter of the year, up 36% YOY. The EV maker has delivered a record 27,841 vehicles through the first half of the year as it ramps manufacturing capabilities.

After lowering its annual production guidance from 80K to between 60K and 70K in Q1, Polestar is sticking to its forecast for the year.

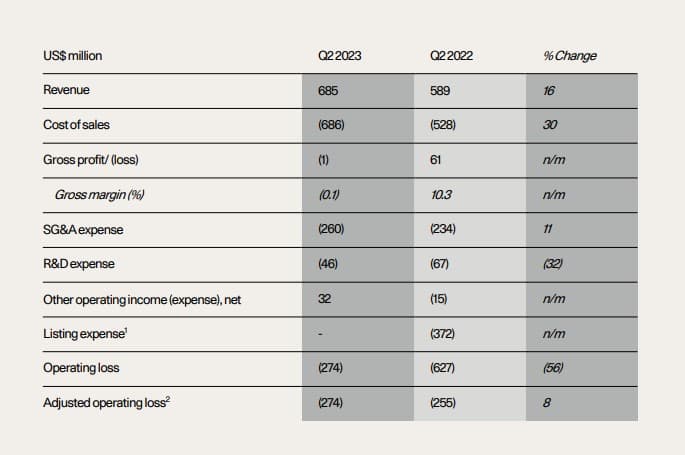

The EV maker posted revenue of $685 million, up from $589 million last year. Through the first six months of the year, revenue reached $1.2 billion, driven mainly by higher Polestar 2 sales.

Meanwhile, higher contract manufacturing costs and supplier chargers for semiconductors and batteries drove Polestar’s cost of sales 30% higher than last year, reaching $686 million, for a gross loss of (-$1 million).

As a result, Polestar’s net loss grew to $304 million, up from a loss of $228 million last year and $9 million in Q1.

The EV maker ended the quarter with $1.06 billion in cash and equivalents, up from $974 million last year and $884 million in Q1.

Thomas Ingenlath, Polestar’s CEO, commented on the growth, saying, “We achieved record volume growth during the second quarter. Deliveries of our significantly upgraded Polestar 2 are now ramping up.”

New EVs coming

The company launched the 2024 Polestar 2 in June, with upgrades including more range, RWD options, enhanced electric motors, and Polestar SmartZone.

Polestar is entering an “exciting” growth phase with two new EV models scheduled for production. Ingenlath said:

With Polestar 4 expected to start production in November and Polestar 3 in the first quarter of next year, we are entering an exciting phase of higher volumes and value from our expanded model range.

The Polestar 3 was initially slated to enter production this quarter but was pushed back until Q1 2024.

Polestar said the delay was due to more time needed “for final software development of the new all-electric platform shared by Volvo Cars.”

The Polestar 3 is the company’s first electric SUV. It will launch in two versions – a long-range dual motor and a performance pack model. Both will have 111 kWh battery capacity.

Polestar’s standard version will feature an expected up to 300 miles range, starting at $82,900. Meanwhile, with 517 hp and 671 lb-ft of torque, the performance model will start at $89,900 with an expected 270-mile range.

The Polestar 4 is an SUV coupe that combines “The aerodynamics of a coupe. The space of an SUV” with “The technology for the electric age.”

Polestar unveiled its SUV coupe at the Shanghai Auto Show in April. The model is scheduled to start production in November with a starting price of around $60,000. Deliveries in China are expected by the end of the year, with overseas markets planned for 2024.

Author: Peter Johnson

Source: Electrek