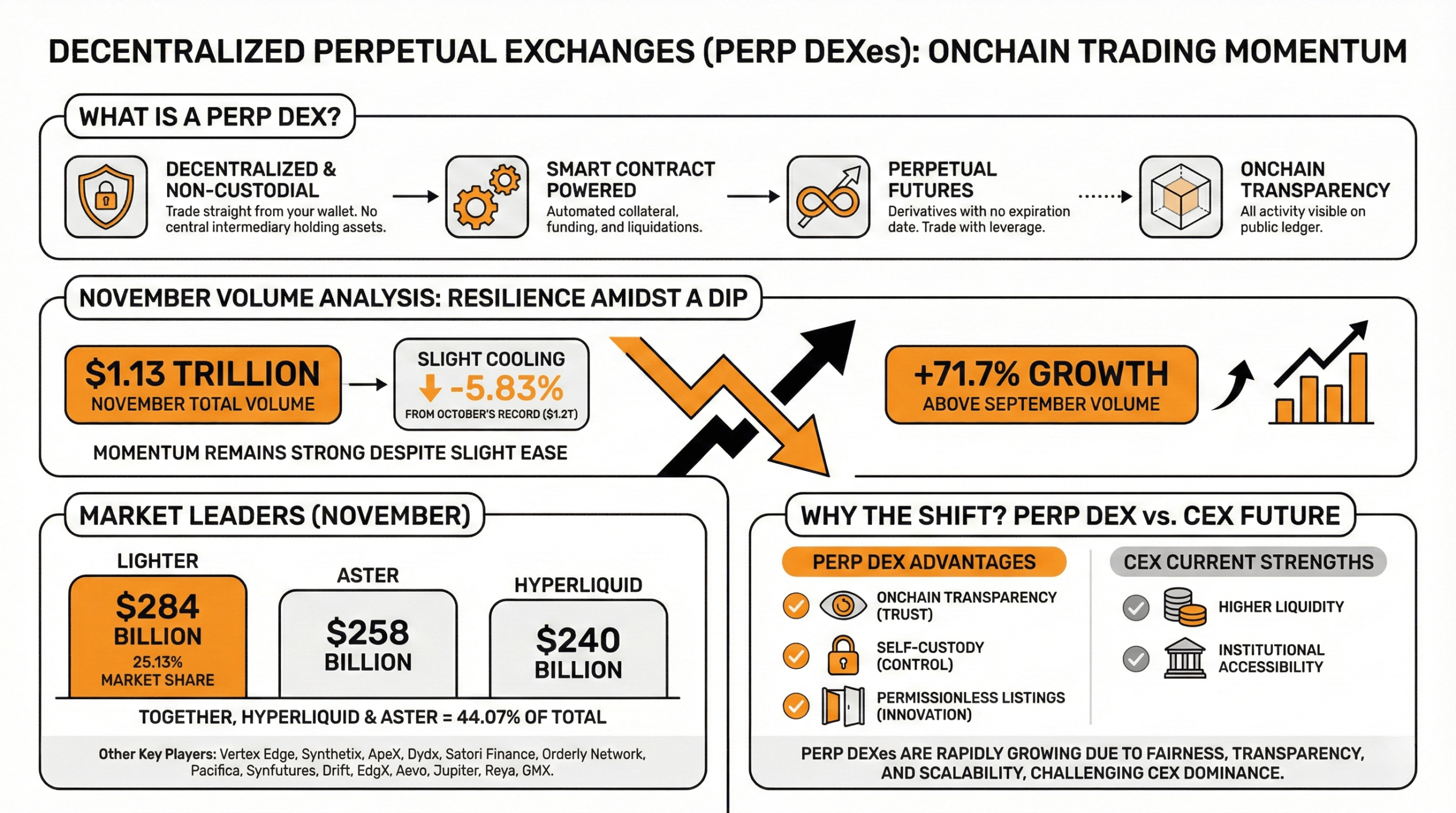

While decentralized perpetual exchanges, or perp DEXes, clocked an eye-popping $1.2 trillion in volume in October, the data reveals their November tally eased slightly, trading a bit softer than the prior month’s fireworks. While the dip clocked in at just $70 billion, November’s perp DEX haul still loomed 71.7% above September, making it clear the momentum didn’t exactly curl up for a long winter nap.

Perp DEX Momentum Holds Strong With Another Heavyweight Month in November

At its core, a in DeFi operates as a DEX where traders lean on smart contracts to trade perpetual futures contracts — derivatives with no expiration date — straight from their own wallets, often with a pinch of leverage.

Everything remains onchain and non-custodial, letting collateral, funding payments, and liquidations play out in full view without a centralized hall monitor meddling in the process. Last month, data from shows perp protocols pulled in $1.2 trillion in volume, marking their highest tally to date.

November’s perp DEX volume cooled a bit, slipping just 5.83% after stacking up $1.13 trillion over the 30-day stretch. Defillama.com figures show more than $240 billion flowed through , while Aster chimed in with $258 billion during the same period. Together, Hyperliquid and Aster logged 44.07% of the total volume. grabbed the bigger slice, racking up $284 billion — a full 25.13% of the total.

Read more:

The remaining share flowed to perp protocols such as Vertex Edge, Synthetix, ApeX, Dydx, Satori Finance, Orderly Network, Pacifica, Synfutures, Drift, EdgX, Aevo, , Reya, and GMX — with EdgX and ApeX both putting up notably competitive volume tallies for November.

Over the long run, people believe perp DEXes will outpace centralized exchanges (CEXes) mainly because perp DEXes offer onchain transparency, self-custody of assets, and permissionless listings, which build trust and foster innovation in derivatives trading.

Although CEXs currently lead in liquidity and institutional accessibility, perp DEXs are rapidly growing in volume due to their fairness, transparency, and evolving scalability. As November wrapped, the takeaway was clear — even with a slight cooldown, perp DEXes kept the tempo high enough to remind everyone they’re not fading from the main stage anytime soon.

FAQ ❓

- What is a perp DEX? A perp DEX is a decentralized exchange that lets traders swap perpetual futures contracts onchain without relying on a centralized intermediary.

- How much volume did perp DEXes handle in November? Perp DEXes recorded $1.13 trillion in November, slipping just 5.83% from October’s all-time high.

- Which platforms led November’s perp DEX activity? Hyperliquid, Aster, and Lighter dominated the month, collectively handling a large share of total onchain derivatives volume.

- Why are traders shifting toward perp DEXes? Traders favor perp DEXes for transparency, self-custody, and permissionless access, which continue to draw volume from centralized exchanges.

Author: Jamie Redman

Source: Bitcoin

Reviewed By: Editorial Team