Nio (NIO) released its Q2 earnings Wednesday morning as the Chinese EV maker enters a critical stage of development. With competition rising and the auto supply chain still in shambles, Nio’s losses are widening as it introduces several new EVs to the market.

Since its foundation in 2014, Nio has been a pioneer in the Chinese EV industry. The automaker was deemed the “Tesla of China” after an explosive entrance, and then, after going public in September 2018, Nio became a favorite among investors and EV enthusiasts alike.

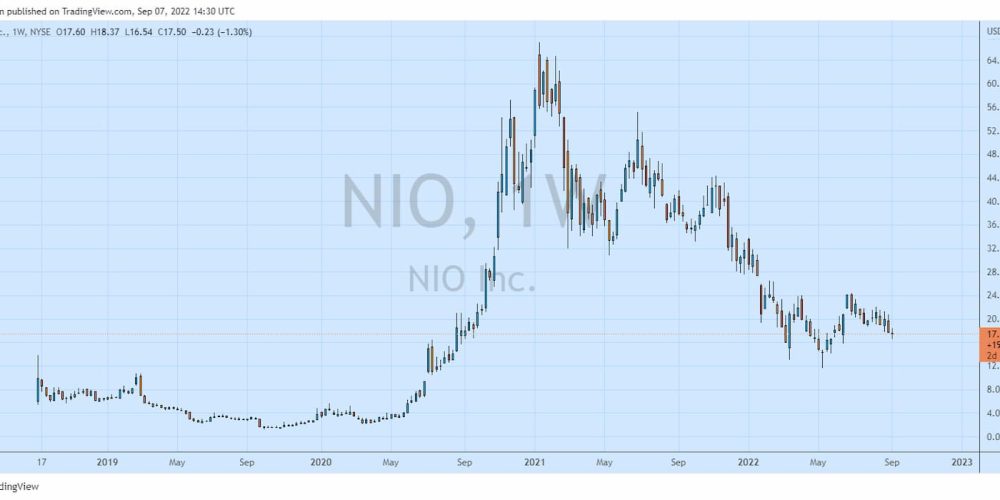

Between 2018 and 2021, Nio’s revenue grew by over 630%. And after seeing Tesla stock explode in 2020, investors were not going to give up the chance to miss the next Tesla. As a result, Nio stock raced from under $5 a share in June 2020 to nearly $67 on January 11, 2021, gaining 1,240%.

However, since then, new competition has entered the market in China and across the globe. Several EV makers and legacy automakers in China, like Xpeng, Li Auto, and BYD, are introducing new EV models gaining market share.

Nio shares have come down significantly since then, settling at around $18 per share. Supply chain challenges this year and lockdown in China over resurging Covid are cutting into profits and slowing vehicle deliveries as Nio’s losses widen.

Meanwhile, Nio introduced its flagship ET7 electric sedan in March and began deliveries of its new ES7 EV SUV on August 28. The EV maker plans to further its EV lineup with the ET5 mid-sized sedan.

Not only is Nio expanding its lineup, but it’s also broadening its market by introducing new models, such as the ES7, to Europe and other parts of the globe (maybe the US?). Yet, Nio’s Q2 earnings suggest the company has hit a critical threshold.

What Nio’s Q2 2022 earnings report is telling us

Nio delivered 25,059 EVs according to its Q2 earnings. Although deliveries were still up 14% YOY, the pace has slowed significantly and is down 2.8% from Q1.

Here’s the delivery breakdown by model:

- ES8 – 3,681

- ES6 – 9,914

- EC6 – 4,715

- ET7 – 6,749

Vehicle sales rose 21% YOY and 3.5% from Q1, reaching $1.4 billion, but vehicle margins slipped from 20.3% in 2021 to 16.7% as costs of materials rose.

Overall, Nio’s revenue of $1.5 billion represents growth of 21.8% YOY and 3.8% from the first quarter.

Even though Nio is making more money, the cost to produce EVs is more expensive. As a result, Nio’s loss widened to $411.7 million, over 369% from 2021 and a 54% increase from Q1.

Nio’s founder and CEO, William Bin Li, commented on its Q2 earnings and remainder of 2022, saying:

The second half of 2022 is a critical period for NIO to scale up the production and delivery of multiple new products. The ES7, our first mid-large five-seater smart electric SUV based on NIO Technology 2.0 (NT2.0), has become a new favorite of the market with its superior performance, comfort and digital experience.

He adds:

With the ET7 setting sail to Europe in August, users in more countries will experience our new products and services later this year. To meet the growing EV demand of the global market, we have been working closely with our partners to ramp up the production and deliveries of our new products. We also expect to further expand our market share in the global premium smart electric vehicle market with high operating efficiency

Despite the positive comments, Nio is conservative with its guidance for Q3.

- Vehicle deliveries – between 31,000 and 33,000

- Revenue – between $1.9 billion and $2.03 billion

Electrek’s Take

Although Nio’s pace is slowing, the EV giant is investing in future growth. With new models being introduced and an overseas expansion taking place, Nio is setting itself up for continued success.

At the same time, new competition in China and abroad may present a challenge as Nio sets its sights on gaining market share.

The widening loss and slowing deliveries are concerning, yet the EV market in China is taking off. If Nio can overcome the recent supply chain challenges, I don’t doubt its ability to spark growth again.

The rest of 2022 will be crucial for Nio and its success. We should gain a clearer picture of how the company is fairing in the third quarter.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Peter Johnson

Source: Electrek