![]()

If you pay any attention to the photography industry, it’s hard to ignore the news of the financial struggle that Nikon has been dealing with since late last year. What were once rumors are now confirmed: the company isn’t in a good place. But that said, Nikon is going to be fine… probably.

I cannot predict the future, of course, so I cannot say with absolute certainty that Nikon is going to emerge from these financial woes but what I can do is look at the past, at similar situations, to make educated guesses. And to do so, the most obvious company to compare Nikon to is Olympus.

Comparing Two Camera Companies

Olympus dug themselves a particularly deep hole in the years leading up to 2012 when the former executive team compounded losses with annual risky investments. Those executives were eventually removed and arrested for those deeds, but the company still kept moving along.

As a result, Olympus was absolutely not healthy financially. So not healthy that in order to stay afloat, Sony (the company’s competitor) invested $650 million to keep the company going. We’ll revisit this situation in a bit.

![]()

Because I don’t particularly trust the financial statements put out by the leadership team prior to 2012, I took a look at all the financials from the Olympus Imaging Division starting that year all the way up until it was sold off to Japan Industrial Partners at the beginning of 2021.

From 2012 through 2021, Olympus Imaging’s worst year was 2013 which saw the division lose 23 billion yen, or approximately $223 million. While the company reported losses in 2012 through 2017, it did post a meager profit in 2017 before dipping into the red again the next year and even further after paying Sony back its $650 million investment and eventually divesting entirely from the camera business. You can peruse all the company’s historical financial documents here.

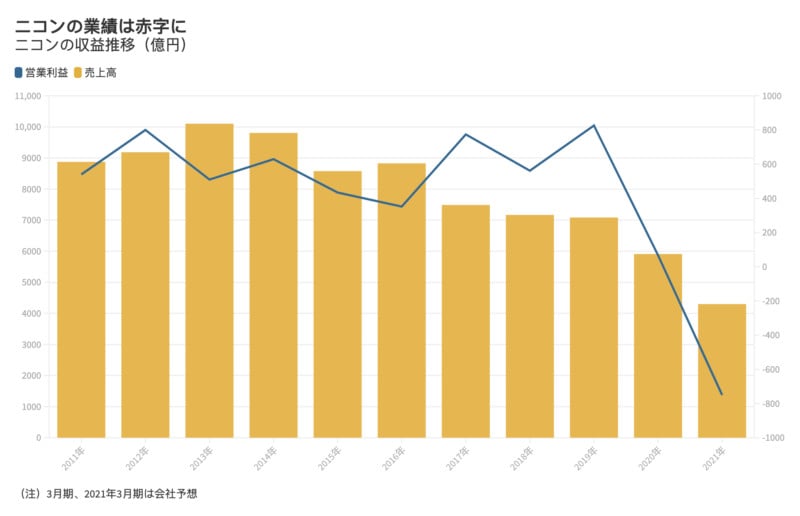

But looking specifically at Olympus’s terrible 2013, let’s compare that to Nikon’s anticipated loss for the 2021 fiscal year of 75 billion yen, or $720 million. Factoring inflation, Olympus’ 2013 losses translate to about $250 million in 2021. Even if we add up the eight straight years of losses since 2012 for Olympus and factor inflation into the mix, those losses still do not equal Nikon’s single year anticipated loss for 2021.

I know I’m not painting a great picture yet, but bear with me.

Nikon’s expected loss is monumental. It’s the biggest loss in a single year for the company and the biggest loss I can recall for any business in the imaging segment. This loss is larger than the value of the bailout that Sony provided Olympus, and is a greater loss than Canon is anticipated to make as profit in the same period (as reported, Canon anticipates approximately a $616 million profit for the fiscal year ending 2021).

The blue line shows operating income, the yellow bars show sales numbers.

It gets even worse if you consider that Nikon is a much smaller company than Olympus.

Olympus’s current market cap is $26.34 billion, and was about 8 billion in 2013. Nikon’s current market cap is about $2.9 billion. While this comparison isn’t entirely fair as it compares Nikon’s rather lean, focused business to Olympus’s much larger and more diversified business, it is worth noting that Sony did not just bail out Olympus Imaging with that $650 million: it bailed out the entire company.

I am clearly not trying to downplay this: this is really, really bad. But still, I don’t think Nikon is going to die off, and I also don’t believe that the company is even going to attempt to sell itself as Olympus did with its Imaging Division quite yet.

Japanese Business Strategy

Japanese businesses work differently than Western businesses. In addition to being a member of Mitsubishi’s keiretsu, Nikon is unlikely to be ignored by Canon, Sony, or Panasonic who I believe will not let Nikon fail. Let’s start with that first bit.

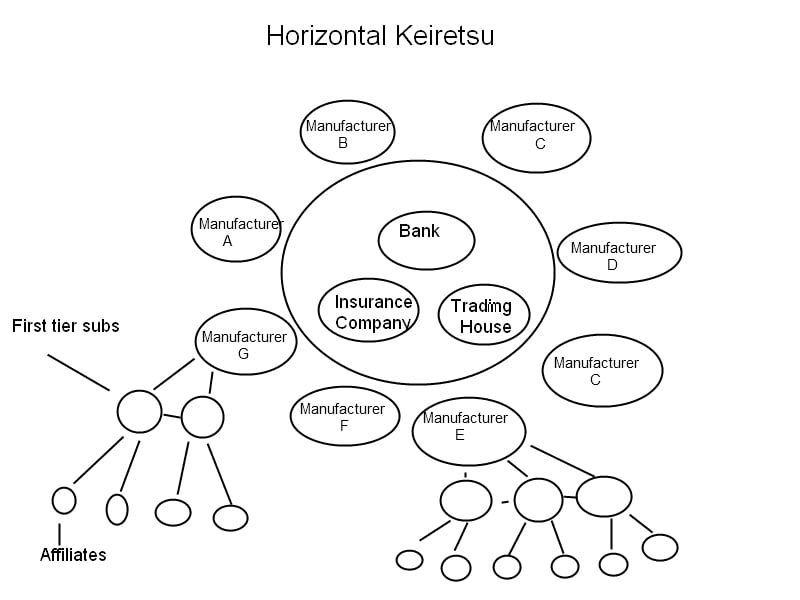

What is a keiretsu? It’s a Japanese style of business investment group. There are two types: Vertical and Horizontal. In this particular case, is a Horizontal keiretsu which means that it is managed by a bank; in this specific case that would be The Bank of Tokyo-Mitsubishi. Does this mean Mitsubishi owns Nikon? Not exactly. As explained by Investopedia:

Their purpose is strictly distribution of goods around the world. They may seek new markets for keiretsu companies, help incorporate keiretsu companies in other nations, and sign contracts with other companies around the world to supply commodities used in Japanese industry.

Still confused? This section from a Smithsonian article goes a bit deeper:

Horizontal keiretsu revolve around the bank. Rather than a parent company cross-shareholding with the other companies, it’s mostly the bank that owns pieces of the companies and the companies that hold pieces of it. These are the keiretsu where it’s typical to have a huge spread of companies across many industries that have little or nothing to do with each other, such as the Fuyo Group and Sanwa Group… Horizontal keiretsu also share employees, like vertical keiretsu. Hitachi may transfer an engineer temporarily to another company who’s building components Hitachi will use in an upcoming product, or it may transfer the employee there permanently. Executives also often transfer between groups, so Nissan’s board may consist of former Yamaha, Sapporo and Canon executives, in addition to others, and former Nissan executives would sit on the boards of those companies as well. It could be the only career change for an employee; Japanese employees often work at one company for life.

Nikon’s leadership works with the leadership of multiple businesses in this keiretsu to determine investment strategy and distribution, but it’s not the same as a company like Google owning FitBit.

So while I am uncertain that the keiretsu would pump money into Nikon to keep it going, Nikon is at least well connected to navigate business strategy and future investment because of this relationship.

So what was that about competitors bailing each other out?

Looking back at Sony’s giant investment in Olympus in 2012, if you’re a member of Western society, you probably asked yourself: why? Would it not have benefitted Sony to let its competitor flounder and die? Why would a company save a business rival?

The answer: Japanese companies in specific segments actually want the competition to thrive because they recognize that if a competitor collapses, it brings into question the viability of the entire market segment. These companies want imaging to be blossoming, not dying. To see a competitor completely flame out makes the industry look unstable, and instability is very much not something Japanese investors want to see. That’s why Sony gave Olympus that huge financial infusion, and it’s why I do not think Nikon will go anywhere without it and its competitors first exhausting all avenues.

I believe that Nikon won’t just implode. I believe first that it, should it determine it needs it, will seek a bailout from competitors. If that does not work, then it will not simply go out of business, but transition ownership. There is no reason for anyone to doubt the efficacy of Nikon product for at least 10 years, because as far as consumers go the cameras will continue to be supported for at least that long.

Nikon Will Be Fine

Despite the fact that Nikon’s financial hole is multiple times worse than what Olympus faced, I actually think Nikon is in a better position to recover. When Olympus was floundering, it wasn’t producing anything close to a “world-beater” of a camera. It made ok product, but it was not a globally recognized and beloved brand like Nikon is. While Olympus did well in Japan, Western countries were all-in on Canon and Nikon.

![]()

Today, while Canon and Sony are the two heavy hitters, Nikon still has a very strong brand. On top of that, it’s making excellent products. The Z6 II and Z7 II are really great and the lenses being manufactured are also fantastic. Nikon’s product and brand are strong, and the company’s finances are due to a couple of bad decisions in the past compounded by the COVID-19 pandemic.

Nikon should not have tried the KeyMission line of products: those were an abysmal failure that really hurt the company. It can actually be argued that the failure of KeyMission is more to blame for Nikon’s current financial woes than its slow entry into mirrorless. Speaking of which, Nikon should have invested in mirrorless sooner, as clearly stated by its own leadership. Those are past mistakes, and those can’t be fixed. But Nikon is doing the right thing, the only thing, it can: continue to make really great products and weather the storm.

Heck, Nikon was only able to sell the Z7 II in Japan for half the month of December, and still flew up to #2 sales overall for that month. That’s a good sign that there is significant value in Nikon product.

…Probably

I believe in Nikon despite never being a Nikon shooter myself. So while I think it is going to ultimately get out of this hole, I think in order to do so it also needs to answer a really important question about its camera business going forward: what do you want to be best at, Nikon?

![]()

Canon is the best at a simple interface and truly solid hybrid performance (you could also argue that Canon has great investments in patents and technology, finally, too). Sony is outstanding at camera IQ: no one beats Sony when it comes to autofocus technologies and AI advancements. Panasonic is the hands-down best choice for serious video shooters.

So what is Nikon best at? Right now, I honestly cannot answer that question. I think when Nikon can show me that answer, it will be well on the way to vying for the top spot in the industry again.

Image Credits: Background of header photo by Marc-Olivier Jodoin.

Author: Jaron Schneider

Source: Petapixel