Can you imagine a future where your daily commute is filled with electric vehicles zooming past you with fresh, crisp air coming through the windows? For now, we are sitting at stop lights, rolling the windows up because it’s better to breathe the AC than the toxic fumes from the vehicles around us. But what if I told you that a future with electric vehicles could also do the unthinkable: slow a recession?

We have already seen it several times in our lifetime – oil and gas prices spiking so high that even essentials like toilet paper and food seem out of reach.

It happened after 2000, then again in 2008, and we caught of glimpse of it earlier this year as gas prices set a new national record at over $5 a gallon on June 14, 2022, according to AAA.

Meanwhile, consumers and businesses are feeling the pinch. For the first time in years, many tech giants (Apple, Google, Facebook, etc.) paused hiring or even started laying off due to slowing demand and rising costs.

Companies that ship goods often feel the impacts the most as air, ocean, and freight expenses all rise. This is why you saw the price of food, technology, and essentially every other good skyrocket as gas prices climbed.

For example, on Amazon’s Q1 2022 earnings call (in April), CFO Brian Olavsky said:

The cost of fuel is approximately 1.5 times higher than it was even a year ago. Combined with the year-over-year increases in wage inflation, these inflationary pressures have added approximately $2 billion of incremental costs when compared to last year.

Those costs then get passed on to the consumer, leaving them with two choices: either pay more and spend less elsewhere, or cut it out of the budget.

If you decide not to buy it, you are contributing less to the economy. Now imagine this on a larger scale. Many consumers feel the same way, and when overall economic growth falls for more than two quarters, it’s commonly believed to be in a recession (though not official until the NBER declares so).

An economic crisis in the making

We are seeing an example of how rising gas and oil prices are destroying the European economy. The EU relies heavily on Russia for its energy imports, and sanctions are driving up energy prices as the group of nations looks elsewhere to fill the supply gap.

According to a recent update, the EU imports almost half (43%) of its natural gas imports from Russia. Natural gas prices almost doubled in July alone in the UK and are sitting on record highs across Europe.

Germany, the largest importer of Russian energy and Europe’s largest economy, is especially feeling the pinch. In July, the country declared it was entering the second phase of its three-stage emergency plan signaling an economic crisis was on the horizon.

Meanwhile, Russia is threatening to reduce energy deliveries further as the war in Ukraine continues. The German economy and energy minister, Robert Hasbeck, claimed:

Even if we can’t feel it yet — we are in a gas crisis.

Other European countries are signaling similar warnings as they cut back on energy use. The entire situation shows how energy can be used as a weapon, and if not prepared, it can destroy an economy without one soldier stepping foot in the country.

How electric vehicles can slow a recession in its tracks

What if we didn’t have to worry about a spike in gas prices? Instead, what if the US could set its own rates?

Oil is a market-driven commodity, meaning its price is set on supply and demand. Furthermore, oil is refined into gasoline, so gasoline prices are also determined by supply and demand. So, when oil prices are elevated, many times, the US has its hands tied behind its back.

For one thing, increasing supply can take years (especially with little funding as the US transitions to EVs), and the other largest oil-producing nations include Russia and Saudi Arabia, so it’s not as easy as a phone call.

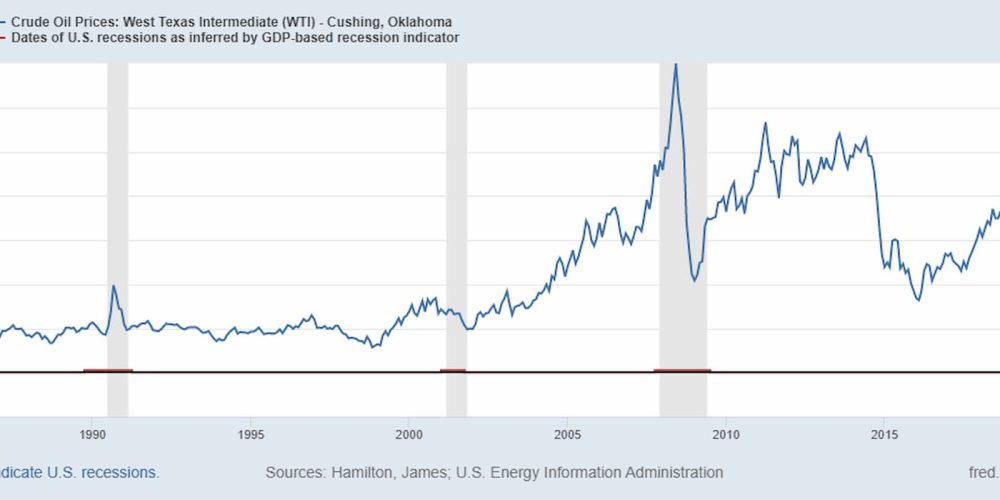

Take a look at the chart below; the blue line shows crude oil prices, and the shaded portions indicate a GDP-based recession.

Do you notice anything? A recession is almost always following or during rising oil prices. It makes complete sense: If more money is spent on a fixed cost (gas), then less is available to be spent on other areas of the economy, resulting in a contraction.

On top of this, gas prices generally fall much slower than they rise, which continues putting pressure on the economy.

Energy rates, on the other hand, can be regulated. For a utility company to raise its rates, it must submit an official request. It can’t just decide it wants to charge more one day (like oil companies).

I know what you are thinking: But what about people who are being asked to conserve energy right now? And this is an issue. It will take some investments to strengthen the energy grid and supporting infrastructure to make this a reality, precisely what the Inflation Reduction Act (IRA) aims to do.

How the Inflation Reduction Act can help

A major goal of the new climate bill is to build a clean energy economy. The bill aims to reduce greenhouse gases by 40% from a 2005 benchmark by 2030.

What does a clean energy economy look like?

For one thing, it means powering homes, businesses, and vehicles with sustainable energy. The IRA provides funding for:

- 950 million solar panels

- 120,000 wind turbines

- 2,300 grid-scale battery plants

On top of this, the bill provides tax rebates and incentives to make clean energy options more affordable for everyday consumers. For example, consumers that install electric appliances can get up to $14,000 for home energy rebates while saving money on energy bills.

More importantly, buyers looking to purchase electric vehicles are eligible for a tax incentive of $7,500 for new EVs and $4,000 for used ones if it meets the criteria. (You can find a list of qualifying EVs here).

The more electric vehicles and clean energy projects being deployed, the less vulnerable the US is to a recession. But, for this theory to stand true, it needs the critical infrastructure to be able to handle mass adoption.

For this reason, the US is investing $369 billion to kick-start the movement with the IRA bill. The US is building a clean, self-sustaining energy ecosystem as a result.

With an adequate energy grid, electric vehicle adoption, and supporting infrastructure, instead of falling victim to gas prices, the US may be able to regulate energy rates and slow a recession before it gets out of control.

Electrek’s Take

Right now, the Federal Reserve is raising interest rates at a record pace to slow runaway inflation and prevent a recession from triggering. But, the biggest factor driving inflation up is energy (gas and oil) prices. Consumers are paying almost a third (32.9%) more for energy than they were a year ago. As a result, the economy has now contracted for two consecutive quarters, which many see as a recession.

Instead of relying on a market-driven commodity (gas and oil) to power the economy, clean energy can provide a sustainable solution. That’s why the US is investing billions into these projects. Once completed, clean energy, like electric vehicles, wind, and solar power, can help the US become self-sustaining and limit the impacts of a recession.

For example, electric vehicles and charging companies are using vehicle-to-grid (V2G) technology, allowing energy from the vehicle’s battery to be transferred back to the home and vice versa. By doing so, you can dictate the flow of energy and save it for when you need it most. For instance, Ford just partnered with Duke Energy to allow Ford F-150 Lightning owners to utilize the technology and, in return, save money on utility costs.

On top of this, solar energy users in certain states can sell energy back to the grid, called net metering. All of this combined can help the US create a clean, self-sustaining energy network.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Peter Johnson

Source: Electrek