Lucid Motors shared its financial report for Q2 2023 this afternoon, ahead of its call with investors later today. The financial details follow a production report made public last month that shows a decrease in deliveries for a second straight quarter. Still, Lucid’s revenue has held steady and its liquidity is strong, providing optimism the young American automaker can reach its annual production guidance… at least the low end of it.

It’s been a busy three months since we covered Lucid Group’s ($LCID) Q1 2023 results – leaving a Sapphire colored trail of both excitement market wariness. Less than a month after its Q1 results went public, the automaker announced a $3 billion raise through a public stock sale and investment from Saudi Arabia’s Public Investment Fund (PIF).

That same week, Lucid announced the hiring of Zhu Jiang – a former executive at Ford and NIO – to help the American automaker enter the ultra-competitive EV market in China. Lucid sure kept us busy in June as it also shared details of a new strategic tech partnership with Aston Martin to supply the latter with its proprietary EV powertrain components.

Ahead of today’s full Q2 2023 report, Lucid Group shared its production and delivery numbers, which once again left something to be desired, leading to a downward trend in the automaker’s shares. The market will most likely not be blown away by today’s results, but should at the very least be pleased at Lucid’s ability to maintain revenues. Here’s the latest:

Lucid holds in Q2, aims for low end of production guidance

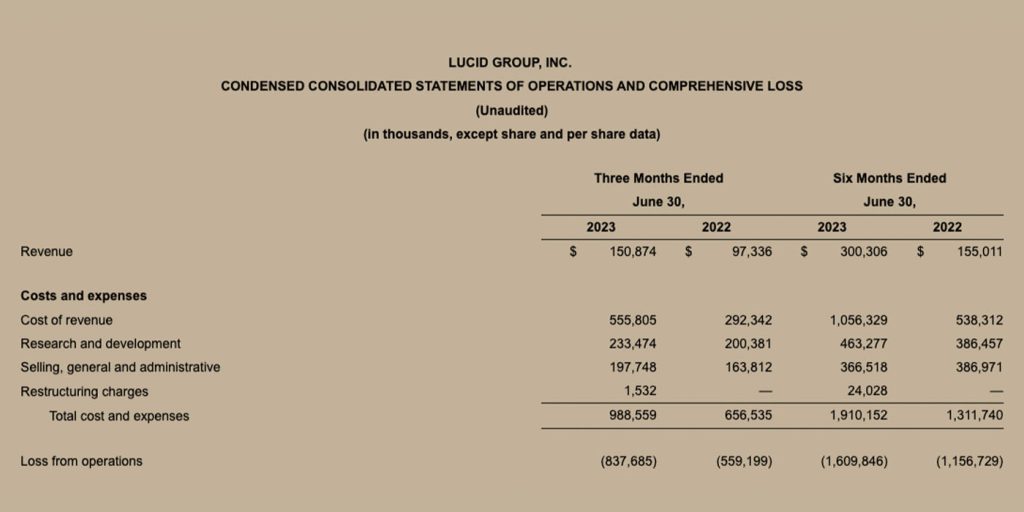

As previously reported last month, Lucid Motors produced 2,173 EVs between April 1 and June 30, 2023 – 1,404 of which saw deliveries to customers. These sales led the American automaker to a Q2 revenue of $150.9 million, up slightly from the $149.4 million achieved a quarter prior.

Compared to Q4 2022, Lucid’s Air production slipped 33% to 2,314 units in Q1 2023 and have now dropped another 6% in Q2. Still, the automaker believes it’s on track to achieve its production guidance of at least 10,000 annual units. Per Lucid Group CEO and CTO Peter Rawlinson:

We’re on track toward achieving our 2023 production target of more than 10,000 vehicles, but we recognize we still have work to do to grow our customer base. During our second quarter, we achieved several major milestones, including signing agreements to enter into a long-term strategic partnership with Aston Martin. Following a competitive process, their investment validates our award-winning technology and marks the first partnership for Lucid Group’s technology arm. We look forward to exciting new products in the second half of this year, including the planned start of production of the Lucid Air Sapphire and the Lucid Air Pure Rear Wheel Drive, plus the highly anticipated unveiling of our new SUV, Lucid Gravity, forthcoming in November.

Those milestones laid out by Rawlinson are significant, but it may be an understatement when he says that Lucid needs to grow its customer base. Building 10,000 EVs this year loses a bit of its zeal if only 6,000 or 7,000 are purchased and delivered to consumers. That’s some expensive inventory to sit on.

Over the weekend, Lucid shared that it is slashing prices of its Air models back to the originally promised MSRPs – some seeing cuts as large as $12,000. That should help sway some consumers on the fence about purchasing a new Air sedan, but even at its lowest Pure trim – it’s still an $82,400 EV.

The RWD Pure alongside the long-anticipated tri-motor Sapphire Air are expected to hit the assembly lines in September and could do wonders for Lucid’s revenue before the end of the fiscal year. Lackluster deliveries aside, there’s a lot to recognize from Lucid in Q2, and the company looks flush with cash to get it well into 2025 – that’s past the arrival and SOP of the long-teased Gravity SUV, another potential factor in increased sales and deliveries. Per Lucid CFO Sherry House:

In the second quarter, we raised $3.0 billion in capital, including $1.8 billion from the PIF, and I’m pleased to say that our current liquidity of $6.25 billion is expected to take us through the start of production for the Lucid Gravity, and into 2025. In addition, the targeted actions underway to invigorate our marketing programs in the luxury and premium segment have resulted in greater brand awareness, which we aim to capitalize on through the launch of our latest pricing program.

Lucid’s call with investors will take place at 5:30PM EST today alongside a webcast you can access here.

Author: Scooter Doll

Source: Electrek