Lucid Motors (LCID) topped Wall Street’s Q2 revenue estimates Monday after announcing another $1.5 billion investment from Saudi Arabia’s Public Investment Fund (PIF).

Lucid reports Q2 2024 earnings results

Lucid delivered a record 2,394 vehicles in the second quarter, up 22% from the previous record in Q1 2024 (1,967).

Production at its AMP-1 manufacturing plant also picked up, with 2,110 models built in Q2. Although it needs to build another 5,163 EVs in 2024 to meet its target, Lucid said it remains on track to produce 9,000 EVs this year.

With output and deliveries picking back up, Lucid reported Q2 revenue of $200.6 million, topping Wall St estimates of around $192 million.

Despite this, Lucid missed Wall St EPS estimates reporting a loss of 29 cents per share in Q2 vs 26 cents per share expected.

- Lucid Q2 2024 Revenue: $200.6 million vs $192 million expected.

- Lucid Q2 2024 EPS: (-$0.29) vs (-$0.26) expected.

Lucid ended the quarter with $4.28 billion in liquidity. With another $1.5 billion commitment from Ayar Third Investment Co, an affiliate of Saudi’s PIF, Lucid said it has enough liquidity runway until at least Q4 2025.

CEO Peter Rawlinson said he’s “very encouraged” by the momentum Lucid is building. Lucid is gearing up to launch its first electric SUV, the Gravity, later this year.

New EV models and tech launches are coming soon

Lucid plans to start Gravity production in late 2024. It will be available starting at under $80,000 as Lucid expands its market.

The first Gravity electric SUV prototype rolled off the assembly line at its Casa Grande factory last month. Rawlinson shared a video, saying the “Gravity SUV represents a significant leap forward for Lucid’s world leading tech and design.”

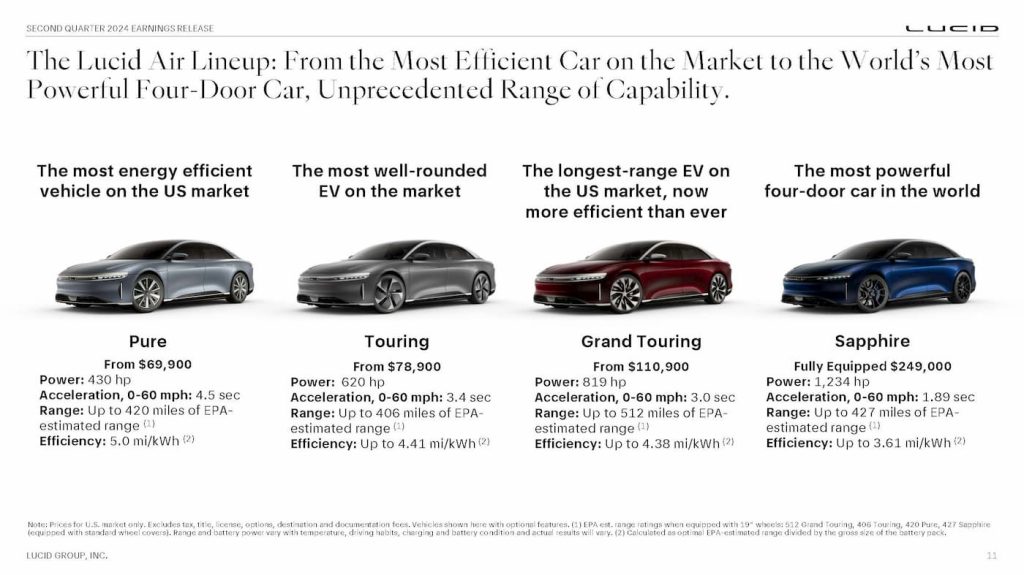

Lucid confirmed last month that the 2025 Air Pure is the “most energy-efficient mass production car ever,” with 5 miles per kWh and a record 146 MPGe EPA estimated range rating.

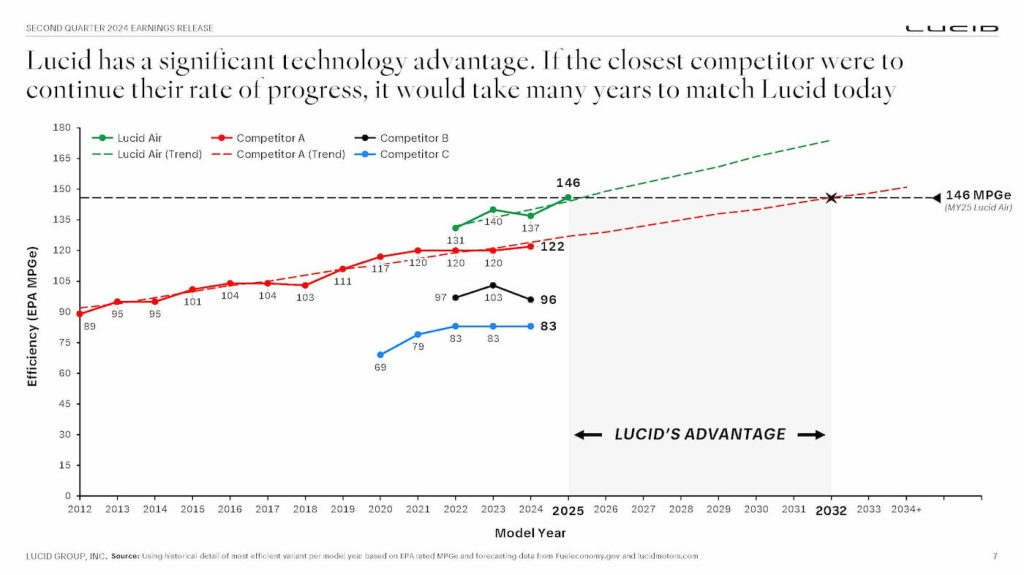

The EV maker claims its superior tech gives it a significant advantage. Lucid said it would take the closest competitor years to match Lucid’s current rate of progress.

With ultra-efficient vehicles, Lucid said it’s lowering the cost of making an EV vs the competition. The Lucid Air Pure starts at $69,900, down from around $90,000 when it launched.

Lucid is seeing continued interest in its tech, the EV maker revealed Monday. With a lower-priced midsize SUV slated to enter production in late 2026, Lucid (like Rivian) aims to expand the brand into the mass market.

Lucid’s stock is up nearly 10% in Monday’s after hours trading following the release. However, Lucid shares are still down 50% over the past 12 months slipping below $5 per share.

Check back for more info after Lucid’s Q2 earnings call with investors at 5:30 pm EST.

Author: Peter Johnson

Source: Electrek