Lucid Motors (LCID) is cutting its 2023 production goal following widening losses in Q3. The EV maker is facing stiff competition in the premium electric vehicle market.

Despite initial plans to build between 10,000 and 14,000 cars this year, Lucid is revising its plans as EV sales fail to gain traction.

Lucid delivered 1,456 EVs in Q3, up slightly from 1,404 in the second quarter. Deliveries have fallen from a peak of 1,932 in the fourth quarter of 2022.

Production is also down, slipping over 50% from a peak of 3,493 during the fourth quarter of 2022 to just 1,550 in Q3.

Lucid said earlier this year it would likely hit the lower end of its production goal. However, the EV maker adjusted its outlook lower following its Q3 earnings results.

The company now expects to build between 8,000 and 8,500 vehicles this year. That’s over 40% lower than its higher-end target from the fourth quarter.

Lucid cuts EV production goal amid widening losses

“We recognize we still have work to do on our customer journey and deliveries,” explained Lucid CEO Peter Rawlinson.

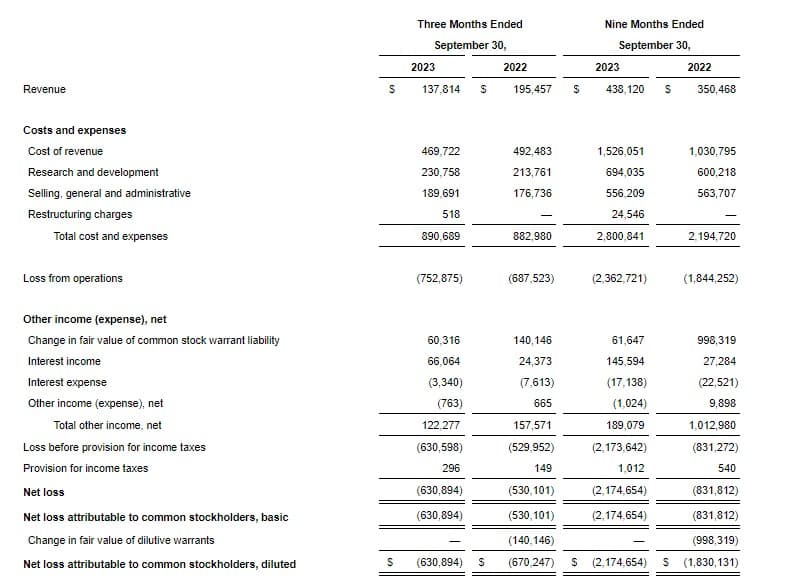

Lucid reported Q3 revenue of $137.8 million, down from $195.5 million last year. As a result of the lower output, Lucid’s operating losses widened to $752.9 million, up from $687.5 million last year.

The EV makers’ net loss grew to $630.9 million in Q3. Lucid’s losses reached $2.17 billion through the first nine months of the year.

Lucid lost around $433,000 on every electric vehicle it delivered in the third quarter.

Lucid’s CFO, Sherry House, explained, “We’ve also made progress with the cost control program we implemented in the first half of the year and have identified further opportunities for 2024.”

The company ended the quarter with $5.45 billion in liquidity, which “we expect to lead us to our next major milestone, Gravity production, and beyond, into 2025,” according to House.

To boost demand, Lucid slashed prices on its Air electric sedans by up to $12,000 earlier this year.

Lucid is bolstering its lineup to expand its market. The EV maker began delivering its Tesla Model S Plaid rival Lucid Air Sapphire during the quarter.

Its first electric SUV, the Lucid Gravity, will be revealed at the LA Auto Show next week. Rawlinson said the Gravity will “redefine the electric SUV,” adding that production remains on track to begin in late 2024.

Lucid stock is down around 5% following its Q3 earnings and production announcement. Share prices are down roughly 69% over the past 12 months.

Author: Peter Johnson

Source: Electrek