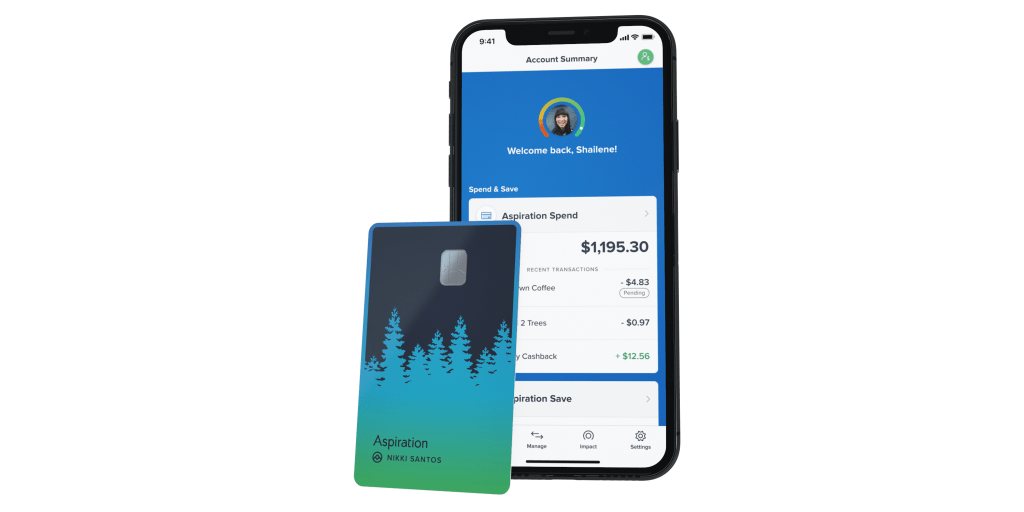

We put a big focus on pushing news with clean cars, but what about financial institutions that are investing in the fossil fuels that we try to avoid? With all of the convenience of standard banking, is one way to ensure that your hard-earned and hard-saved money isn’t going to be invested in fossil fuel companies, but rather will be helping to plant trees all around the world and offset carbon emissions. 100% committed to clean finance, Aspiration is one way to make saving and spending money a little more eco-friendly. Head below to check out the video.

Clean up your financial portfolio

When trying to make choices that help lower your carbon footprint or just supporting eco-friendly initiatives, considering where we put our money can have a massive impact. Large banks that hold money can also invest that money in companies that maybe you would rather they didn’t.

According to the report, ”” the largest banks in the US are investing hundreds of billions of dollars in fossil fuels. That’s where Aspiration comes in as an alternative to big banks.

Offering a different want to spend, save, and invest money, Aspiration is committed to clean finance by offering socially-conscious and sustainable ways to spend, save and even invest.

Aspiration: Video

One way to make a difference is by enabling Plant Your Change with Aspiration. With this program, Aspiration will round up transactions and put all of the extra change from purchases towards their reforestation partners. With in-app metrics, it’s easy to see what kind of an impact your spending is having on making the world more green.

With an Aspiration Plus account, you can even help to offset the carbon dioxide from every gallon of gas you purchase.

Banking Experience

Not quite like a normal bank, Aspiration is a fintech financial services provider. They offer accounts to both save and spend and investment options to help hit your financial goals while ensuring that your dollars aren’t supporting companies that you don’t want to support. But, Aspiration has plenty of tools built in to make spending and saving feel the same as with bigger, more well-known banks.

Right away, when opening your account, you can earn $100 when you spend $1,000 in the first 60 days. Of course, this requires some spending right away but is a great incentive to get started with Aspiration.

Two different account modes let you either pay or what you feel is fair, even if it is $0, or opt into the Plus account for added features like gas purchasing carbon offset, up to 1.00% APY on savings, and one out-of-network ATM reimbursement monthly.

Deposits are FDIC insured and the Aspiration card can be used at over 55,000 ATMs for fee-free transactions.

With Aspiration, you also earn up to 5% cashback for shopping at Conscience Coalition merchants like Toms and Warby Parker.

If supporting companies that focus on eco-friendly and socially-conscious initiatives is on your priority list, using Aspiration to save, spend, and invest is one way to ensure that your money is being used to support companies you believe in. From avoiding fossil fuels to helping to put extra change towards reforestation, you can rest assured that your money is helping out causes that you support. To get started hit the link below and open an Aspiration or Aspiration Plus account.

Earn $100 when you and spend $1,000 in the first 60 days of account opening.

The Aspiration Spend & Save Accounts are cash management accounts offered through Aspiration Financial, LLC, a registered broker-dealer, Member FINRA/SIPC, a subsidiary of Aspiration Partners, Inc. (“Aspiration”). Paid experience may not be representative of others and is no guarantee of future success. aspiration.com/disclaimers. Aspiration is under separate ownership from any other named entity. Aspiration is not a bank.

The Aspiration Plus Debit Card is issued by Coastal Community Bank, Member FDIC, pursuant to a license by Mastercard International Incorporated. The Aspiration Save Account’s up to 1.00% Annual Percentage Yield (“APY”) is variable, subject to change, and only available to customers enrolled in Aspiration Plus after conditions are met. Visit aspiration.com/atms for Aspiration’s ATM network. Deposits in your Aspiration account are FDIC-insured up to $2.46 million per depositor by being swept to FDIC Member institutions. For details, vist aspiration.com/program-banks and fdic.gov

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Sponsored Post

Source: Electrek