Electric vehicles are taking over the streets, and that means drivers are looking for more places to charge. The rapid rise in EVs is creating an opportunity for those willing to learn the tricks of the trade. See how you can invest in EV charging stations and play a role in the future of transportation.

Why Invest in EV charging stations

If you are noticing more electric vehicles on your daily commute, it’s not just you. Battery electric vehicle sales hit another record in the second quarter of 2022, rising to 196,788 as overall new vehicle sales slumped 20%.

The electric vehicle share in the US rose to 5.6% compared to 2.7% in the second quarter of 2021. Automakers are introducing new EVs to the market with more range, superior technology, and zero emissions giving drivers a reason to make the switch.

According to information from the PEW Research Center, 42% of Americans say they would consider purchasing an electric vehicle. The survey was taken before the historic climate bill passed, giving new incentives to buy an EV. What’s more interesting is the breakdown by age group.

- 18-29: 55%

- 30-49: 47%

- 50-64: 34%

- 65+: 31%

Moreover, over half of them live in urban areas. Although it is true most EV owners charge at night, a growing number of people living in cities rent. A new study from Harvard shows overall rental vacancy is at its lowest since the mid-1980s.

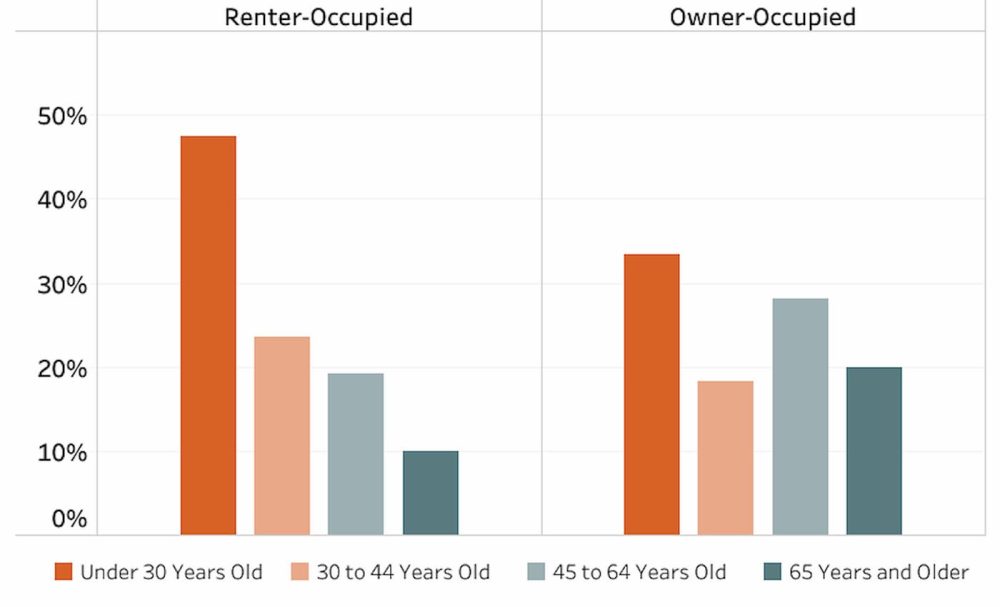

Younger generations are those more likely to be renters, and many apartment complexes don’t have EV charging stations installed yet. Nearly 50% of people under the age of 30 rent, while 10% of those ages 65+ do.

Where EV charging stations are located now

Electric vehicles are expected to account for the majority of vehicles on the road by 2030. However, the most common reason Americans (58%) say they would not purchase an EV is because they fear it will not give them enough range.

Although much is being done to alleviate this fear, there is an opportunity for businesses to participate while contributing to the future of transportation (and earning an extra profit).

The Biden Administration has rolled $5 billion in funding over the next five years through the NEVI program to build a national network of EV charging stations.

Electrify America, a subsidiary of Volkswagen, is working to build a fast charging network across North America.

Automakers like Tesla are also building their own Supercharging network to enable their drivers the freedom to go anywhere. Meanwhile, many of the people in the category above (younger drivers looking to purchase EVs) are looking for more convenient options on their daily routes.

For business owners, this presents an opportunity. And for those that don’t own a business but still want to get involved, there are ways for you to invest in EV charging stations.

How to invest in EV charging stations

To give EV drivers more options, you can install chargers at your business. In particular, if customers stay for more extended periods of time, it may be worth considering. For example, a quick stop (under five minutes) may not be worth it, but it’s a different story for restaurants, entertainment venues, bars, clubs, malls, small businesses, and even workplaces.

Installing EV charging stations is an investment in your business. As electric vehicles continue gaining market share, having convenient charging options can help drive traffic with increased visibility.

Many popular digital map services (like Google Maps) now offer solutions to find charging stations, while others like Plugshare are specifically designed to locate them.

That being said, having electric vehicle charging options available can drive business. There are over $2 billion in utility-provided rebates and $60 million in government grants to help you get started (see what incentives are in your state here). Companies like ChargePoint make it easy with different charging options and valuable tools to help you manage data.

What about those that don’t own a business

If you don’t own a business and still want to invest in EV charging stations, you can always opt to own a piece of one of the companies listed above. For example, buying stock in companies like Tesla (TSLA) or ChargePoint (CHPT) can give you exposure to the expected massive growth in electric vehicles and its supporting factors over the next several years.

To gain exposure to the entire electric vehicle market, an ETF like KraneShares Electric Vehicles & Future Mobility ETF (KARS) has holdings in companies like Tesla, ChargePoint, Nio (NIO), Albemarle (ALB), BYD, Rivian (RIVN), Lucid (LCID), Aptiv (APTV) and more.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Peter Johnson

Source: Electrek