Lucid Group (LCID) announced the pricing of a new $875 million offering of senior notes in a private sale to institutional investors. The funds will help Lucid pay down debt as it prepares for its next growth stage.

Lucid Group stock falls after $875 debt offer

After delivering just over 4,000 vehicles in Q3, Lucid marked its seventh straight quarter with record deliveries. Through September, the EV maker delivered nearly 10,500 vehicles, already topping the roughly 10,200 it handed over in 2024.

Lucid ended the third quarter $1.6 billion in cash and equivalents, which it said is enough to fund it through the first half of 2027. However, it also reported debt of just over $2 billion.

The EV maker also announced an agreement with Saudi Arabia’s Public Investment Fund (PIF), Lucid’s largest shareholder, to increase the delayed draw term loan credit facility (DDTL) from $750 million to around $2 billion.

Including the undrawn credit line, Lucid’s total liquidity was about $5.5 billion, up from the actual $4.2 billion it reported in Q3.

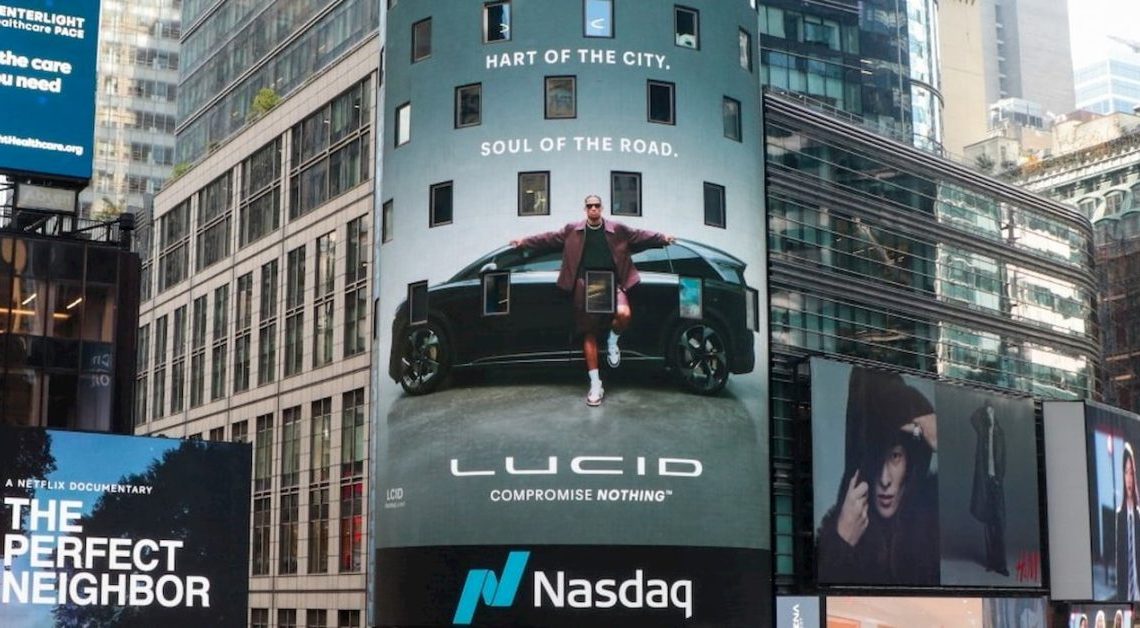

Lucid said it was looking outside of PIF for funding as it ramped up production of the Gravity SUV and prepared to launch its midsize platform in late 2026.

The EV maker launched a $875 million convertible senior note offering due in 2031 in a private offering to “persons reasonably believed to be qualified institutional investors.” Lucid gave the investors the option to purchase an additional $100 million in debt within 13 days.

Lucid will use about $752.2 million of the proceeds to repurchase some of its outstanding 1.25% convertible senior notes due in 2026. It will use the remaining proceeds “for general corporate purposes.”

In relation to the offering, Ayar Third Investment Company, a subsidiary of the PIF, is expected to purchase around $636.7 million of Lucid’s common stock. The transaction is expected to occur around the notes’ maturity date.

Lucid confirmed it was still on track to launch its midsize platform in late 2026, which will wear at least three “top hats.” The first will be a midsize electric crossover, starting at around $50,000.

Lucid’s stock is down over 6% on Wednesday following the convertible note offering. Share prices have slipped 48% this year and are approaching an all-time low at around $15.85 per share.

Author: Peter Johnson

Source: Electrek

Reviewed By: Editorial Team