In recent years, automakers have announced new EV investments totaling $154 billion and creating 188,000 jobs, largely catalyzed by President Biden’s EV policies. A new map shows where it’s all happening in the US.

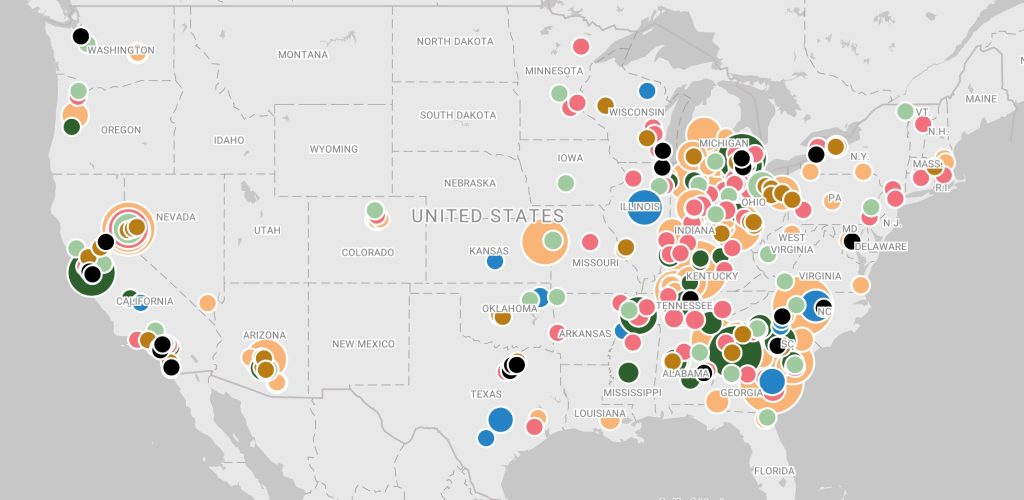

The new interactive mapping tool was created by BlueGreen Alliance and Atlas Public Policy. It aggregates all the investment in EV-related facilities – battery, automotive and parts manufacturing – throughout the US.

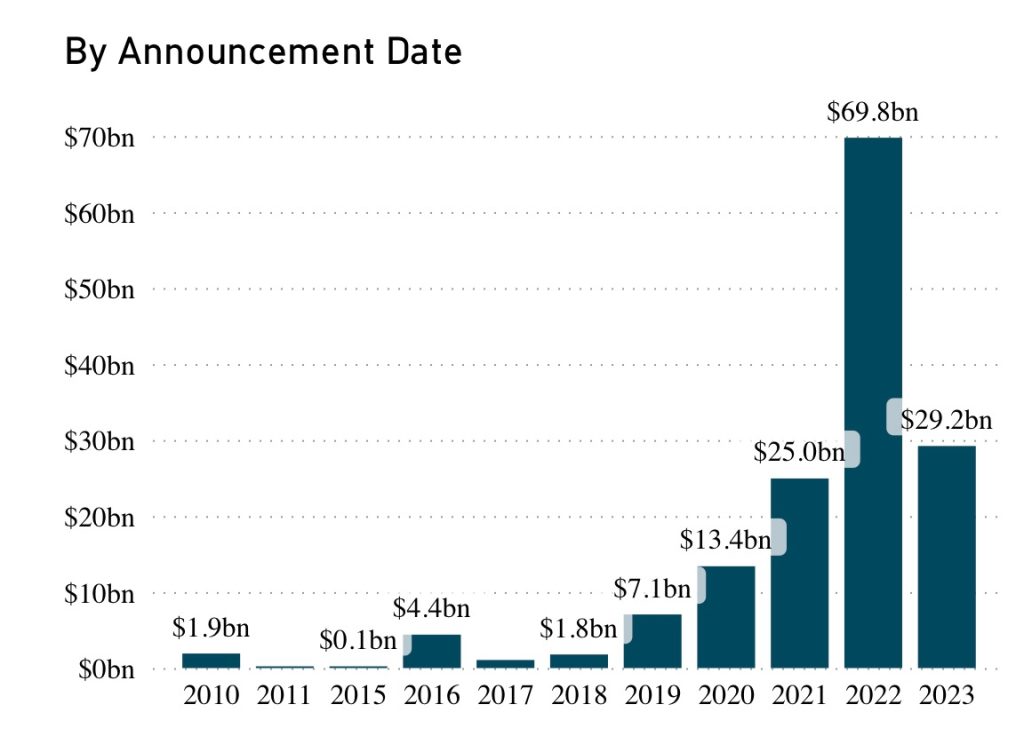

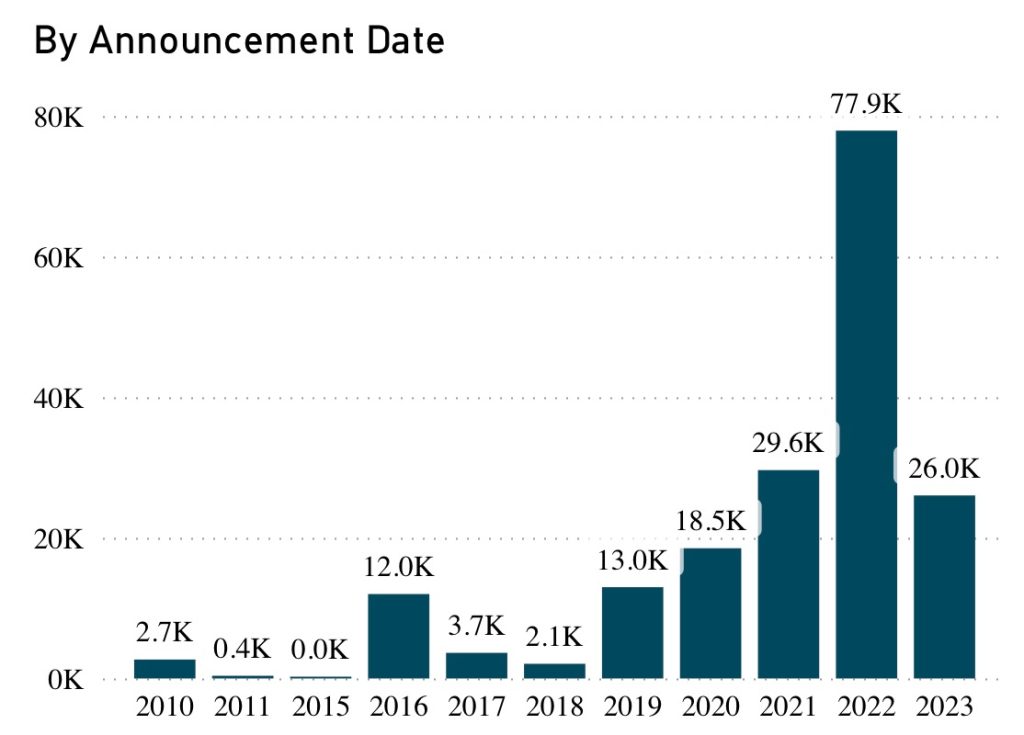

Investments in EV facilities have increased rapidly in recent years, peaking in 2022, the year the Inflation Reduction Act (IRA) was passed.

The IRA extended the US federal EV tax credit for the next decade, but also limited it by requiring that electric vehicles and their components be manufactured in the US in order to qualify (though there are some loopholes, like leasing, that allow you to still take the credit on foreign cars).

In addition, the Bipartisan Infrastructure Law (BIL) included similar rules for EV chargers, and billions in funding for EV infrastructure development and battery materials supply.

The laws have had the intended effect. Manufacturers rushed to announce huge EV investments as the laws were being negotiated and passed, as you can see in one of the charts in the tool (the spikes in 2016 and 2019 are Tesla’s factories in California and Nevada):

EV investments were already increasing due to the obvious direction the industry is going, so not everything here can be credited directly to IRA and BIL. But the large spikes in investment and job creation in the US can reasonably be correlated to Biden’s government policies directly encouraging domestic manufacturing in the EV space.

Many of these investments have happened in the burgeoning “battery belt,” which is developing in the midwest and south, and some on the west coast due to the influence of Tesla and Silicon Valley.

The interactive map can also sort locations by many other qualifications, like by company, source and amounts of government funding, plant unionization, party of the congressperson representing the district the plants are in, and so on.

According to the tool, 32% of the facilities have been sited in disadvantaged communities, which could help to revitalize those local economies (and provides companies access to cheaper labor). And 25% of the facilities seem likely to be unionized, which is high compared to the US average of 10% or US auto industry average of 16%.

Unionization has been in focus in recent times with union approval at its highest point in over half a century in the US. Biden’s EV proposals originally included union-made provisions, but those were struck down by opposition from republicans and Joe Manchin. But we’ve seen some union movement in battery manufacturing regardless, with GM’s Ultium plant voting overwhelmingly to unionize and then winning a 25% pay increase soon after.

If you’d like to have a look at the interactive map yourself, head on over to BlueGreen Alliance’s EV Jobs Hub and have a look around.

Author: Jameson Dow

Source: Electrek