Tesla CEO Elon Musk and President Trump are in the middle of a nasty break-up and it didn’t take long for Musk’s companies, including Tesla, to be thrown in the middle of it like kids in a divorce.

We will focus on the real impact on Tesla’s business here, rather than its stock price, which is largely driven by sentiment, similar to a meme stock.

As Jamie pointed out in his post yesterday, Tesla’s stock surged following Trump’s election, mostly on anticipated corruption between Musk, who invested nearly $300 million to get Trump elected, and the federal government.

Now, Tesla’s stock crashed 14% yesterday following Musk turning on Trump in a very public way.

During the post-election rise and now this drop, Tesla’s core business has remained unchanged. Its automotive business is in evident decline, while its energy business is growing, but not enough to compensate for the decrease in EV deliveries.

Investors are clinging to the hope that this time Musk is finally right about Tesla solving self-driving, even though he has been consistently wrong about it for years, and now has initiated a pivot to Tesla operating an internal ride-hailing fleet in a geo-fenced area of Austin, Texas, and helped by “heavy teleoperation.”

In this context, at Tesla, and with its CEO now embroiled in a feud with the head of the US federal government and his loyalists in Congress and the Senate, how might this impact Tesla?

Branding issues

Tesla has been experiencing major brand issues over the last few years, as its CEO has become increasingly political, and this trend has intensified since he became directly involved with Trump.

It led to the “Tesla Takedown” protests all around the world, and Musk alienated a large part of Tesla’s customer base, who tend to lean to the left. Some argued that Tesla might manage to grab new customers to the right of the political spectrum, and Trump tried to help with that by holding what amounted to a Tesla infomercial on the White House lawn.

However, we have previously highlighted that Tesla has limited opportunities to bring in customers from red states and rural areas.

Now that Musk has called Trump an ingrate, insinuated that he was a pedophile, and called his flagship legislation an “abomination”, all in the span of a few hours, it’s likely going to result in MAGA supporters turning away from Tesla.

Musk’s impact on the brand has had the most significant adverse effect on Tesla in North America and Europe.

Tesla’s sales are on track to be down roughly 50% in Europe this year, and Tesla’s market has been wiped out in Canada.

While the impact on the brand in the US is undeniable, it hasn’t been intensely felt in deliveries yet for several reasons.

Firstly, Tesla has maintained record discounts and incentives to purchase its vehicles in the US.

Secondly, the US market is the least competitive for electric vehicles among all global markets. Tesla’s main competition is from other US automakers, while many foreign automakers don’t bring their entire EV lineups into the US, and Chinese EVs are virtually banned in the country.

Lastly, the US still has a $7,500 incentive on the purchase of new electric vehicles, which is expected to go away next year – creating some urgency to buy now.

Incentives

Trump campaigned on removing the $7,500 incentive at the purchase of electric vehicles – a campaign that Musk backed with almost $300 million.

The President also attacked electric vehicles in general during the campaign with clear misinformation. Shortly after, Musk said that “Trump was right about everything.”

The plan was always to remove the EV tax credit and any incentives for renewable energy. Musk actually publicly agreed with this ,though he added that he thinks that subsidies for fossil fuels, which greatly outpace those for renewable energy, should also be removed.

Trump never showed any intention to do that and campaigned on the US drilling for more oil and restarting unprofitable coal power plants.

The ‘Big Beautiful Bill’ that was approved by Congress and is now being discussed in Senate is officially killing the EV tax credit, the 30% tax credit for solar, wind, and energy storage (ITC), the incentives to produce batteries in the US, and it tries to kill CARB’s ZEV credits.

Some have attributed this as the real reason why Musk turned on Trump and attacked the bill, but the truth is that Trump and the GOP had signaled all this prior, including during the campaign that Musk backed.

However, Musk has been mostly absent at Tesla for the last year, but he recently returned at Tesla and received several briefings. There’s a possibility that Musk has now grasped the full impact of the removal of all EV, battery, and solar incentives.

Without ZEV credits, the EV tax credit, the ITC, and battery manufacturing credits, Tesla would have lost money in Q1 2025.

Investigations, penalties, and bans

Many argued that the real reason Musk backed Trump was to get federal agencies investigating him and his companies off his back.

Musk and his companies have been under SEC, DOJ, NTHSA, US Labor Board, and FTC investigations.

Some of those investigations were ramping up, and once Musk entered the government, he pushed for new leaders of those agencies and depleted their resources through DOGE.

Now that he has turned on Trump, there’s a possibility that those investigations ramp back up again.

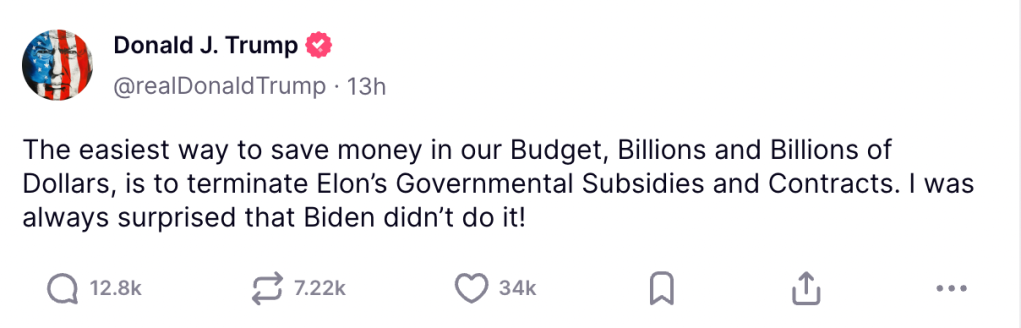

Trump has already made it clear that he plans to retaliate against Musk’s companies in a series of posts on Truth Social:

In particular, the SEC could take action against Musk and Tesla due to recent allegations of misstatements about Tesla’s demand.

NHTSA has been conducting a long-running investigation into Tesla’s Full Self-Driving program, and Trump could pressure the agency to shut down its upcoming pilot program in Austin or even recall FSD features.

Electrek’s Take

I think things will cool down. The way I see it, Musk was pushed out; he realized he didn’t have that much control over Trump and tested the waters to activate his Plan B, which is to get Trump impeached and have him replaced by JD Vance.

He quickly realized that he didn’t have the political weight to make that happen and backed off.

The situation is still not ideal, and I can certainly see it escalating again. Especially since Musk signaled that he is willing to throw his weight at the political class to get what he wants:

Trump could be worried about that and decide to reduce Musk’s power, which relies significantly on Tesla’s inflated stock price.

However, even if nothing happens and Musk and Trump resolve their differences, the truth is that Tesla will suffer significantly from this bill.

The entire EV market is going to suffer. If the bill passes, EV are going to have a great second half of the year as buyers try to take advantage of the tax credit, but things are going to get rough in 2026.

For Tesla, I think it starts losing money in 2026. Competition is beginning to crush the company in Europe and China. The US is its only market where sales are not crashing, but that’s because Tesla is willing to reduce its gross margins with discounts.

Tesla will have to dig deeper on that front without the tax credit. You remove the billions of dollars that Tesla has been getting for ZEV and battery manufacturing credits from Biden’s IRA, and it turns negative.

Ultimately, it will cripple the entire US automotive market as the rest of the world moves to electric vehicles, and American automakers are left with a weaker auto market that still indirectly incentivizes fossil fuel-powered vehicles.

Author: Fred Lambert

Source: Electrek

It’s mind-boggling. Two years ago Tesla was a highly-respected tech brand that enjoyed phenomenal margins on auto sales and impressive growth.