As sales of electric vehicles continue to surge, many new and prospective customers have questions about qualifying for federal tax credit on electric vehicles.

Whether you qualify is not a simple yes or no question… well, actually it sort of is, but the amount you may qualify for varies by household due to a number of different factors. Furthermore, there are other potential savings available to you that you might not even know about yet.

Truthfully, this information is out there in the internet ether, but only available by piecemeal and thorough searching. Luckily, we have compiled everything you need to know about tax credits for your new or current electric vehicle into one place.

The goal is to help ensure you are receiving the maximum value on your carbon-conscious investment because, let’s face it, you’ve gone green and you deserve it.

Table of contents

How does a federal tax credit work for my EV?

The idea in theory is quite simple — “All electric and plug-in hybrid vehicles that were purchased new in or after 2010 may be eligible for a federal income tax credit of up to $7,500,” according to the US Department of Energy.

With that said, you cannot simply go out and buy an electric vehicle and expect Uncle Sam to cut $7,500 off your taxes in April. In reality, the amount you qualify for is based on both your income tax as well as the size of the electric battery in the vehicle you own. Here’s how it works.

How much is the federal tax credit?

First and foremost, it’s important to understand three little words the government slips in front of the $7,500 credit – “may” and “up to.” As in, you may qualify for up to $7,500 in federal tax credit for your electric vehicle. At first glance, this credit may sound like a simple flat rate, but that is unfortunately not the case.

While the credit amount is based on battery size, the amount of that credit you can receive is based entirely on your federal income tax and is implemented as such.

For example, if you owned a Nissan LEAF and owed say, $3,500 in income tax this year, then that is the federal tax credit you would receive. If you owed $10,000 in federal income tax, then you would qualify for the full $7,500 credit.

It’s important to note that any unused portion of the $7,500 is not available as a refund, nor as a credit for next year’s taxes. Bummer.

Other federal tax credit rules to note as an electric vehicle owner

Hopefully you now understand how the government determines its tax credits for individuals based on your federal income tax and vehicle, but it’s important to stay aware of additional fine print. This is the US government, after all.

First, understand that these federal tax credits will not last forever, and they may have already expired for your vehicle. As the demand for electric vehicles increases, sales push certain manufacturers over the predetermined threshold of qualified sales.

For example, US automaker Tesla topped over 200,000 qualified plug-in electrics sold a few years ago, and as a result no longer qualifies for any federal tax credit… at least for now. Fear not, Tesla owners, there are still ways to save money on your EV purchase! See the “tax incentives for Tesla buyers” section below.

Another important rule to keep in mind is that the federal tax credit cannot be passed on. This credit applies to the original registered owner only. That means any used EVs you already have or are going to purchase are already disqualified.

Same rules apply to any lease on an electric vehicle as well. In this case, the tax credit goes to the manufacturer that’s offering the lease to you. However, an automaker might be willing to apply the tax credit into the cost of your lease to help lower your payments, but that’s not guaranteed. It’s definitely worth an ask!

Can a household receive multiple Federal tax credits?

Several readers have reached out and asked if they qualify for multiple tax breaks if they purchase more than one EV in a calendar year. Well, the short answer is yes.

However, we must preface this by relaying that the IRS is the official source for all Federal tax information and responsible for administering the Federal plug-in vehicle tax credits. It is best to consult with a qualified tax professional to make sure you do in fact qualify before purchasing multiple electric vehicles.

That being said, the fueleconomy.gov team was not aware of any limitations on the number of vehicles you may claim tax credits for provided that you have enough Federal tax burden for that purchase year.

So, if two people in your household each purchase an eligible vehicle and both have $7,500 in Federal tax burden, then each should be able to claim the tax credit.

If a single person purchases two eligible plug-in electric vehicles with tax credits up to $7,500 for each vehicle, they should be able to claim $15,000 in tax credits if their Federal tax burden is $15,000 or more for calendar year in which they purchased those vehicles.

Again, speak with a tax professional or the IRS to be extra sure this is possible.

The Biden administration looks to expand electric vehicles

President Biden has been busy during his short tenure at President of the United States. First he vowed to make the nation’s entire federal fleet all electric. Well that hasn’t quite gone to plan yet. However, the White House has already introduced two bills to reform the federal tax credit for EVs.

This will expand thresholds on the number of EVs manufacturers like Tesla and GM have surpassed, to once again qualify for federal tax credits. This also includes plans to heavily expand EV charging infrastructure.

Previously, there were rumors that this federal tax credit will be increased to $10,000. In President Biden’s recent $174 billion investment plan for electrification, the tax credit was quickly mentioned a reform. The summary remained vague about the reform – only confirming that it will not only take the form of tax rebates but also “point of sale rebates” and it will now be for “American-made EVs.”

Most recently, the US Senate Finance Committee passed a reform bill that would increase the tax incentive to $10,000 for EVs produced in the US, and to $12,500 for EVs produced in the US by union workers.

This bill appears to specifically target Tesla as it is one of the only US automakers whose staff is not controlled by the United Auto Worker (UAW) union.

We do not yet have a timeline on when these tax credits will in fact be expanded. The reform bill will first need to pass through all of Congress which includes the House of Representatives as well as a full vote from the Senate. We will update this list (as always) to coincide with such credits.

What’s the latest update on federal tax credits for Electric vehicles?

Earlier this year, bipartisan members of the US Senate agreed upon a $1 trillion infrastructure bill covering everything from chargers, to grid improvements, to electric bus implementation.

Unfortunately, this bill had zero language regarding an expansion of federal tax credits for EV consumers. The Biden Administration was expected to tackle tax credits in a separate funding bill at a later date.

Democrats in Congress have now proposed an updated electric car incentive program at the federal level, which would go through their $3.5 trillion social spending bill. The proposal must still go through the formal US legislative process, but it currently removes the limit on the number of vehicles and replaces it with a timeline.

Additionally, it introduces a higher payout up to $12,500 as a point-of-sale benefit, rather than a federal credit based on equivalent tax burden as is the current mode of operation. Here are additional changes in the proposed incentive program:

- Remove the 200,000 vehicle limit per manufacturer

- Keep the $7,500 incentive for new electric cars for five years

- Make the $7,500 incentive a point-of-sale discount instead of tax credit

- EVs with battery pack smaller than 40 kWh are limited to a $4,000 incentive

- Add an additional $4,500 for EV assembled at union factories

- Add another $500 for EVs using battery packs with 50% of components (including cells) made in the US

- After the first 5 years, the $7,500 applies only to US-made electric vehicles and it applies for another 5 years.

- Introduces price limits on the EVs eligible for the incentives:

- Sedans under $55,000

- SUVs under $69,000

- Pickup trucks under $74,000

- Vans under $54,000

- The proposal also introduces caps on income to get access to the incentives, but they are fairly high at an adjusted gross income of up to $400,000 for individuals, and up to $800,000 for joint filers.

Again, this new incentive program is merely a proposal from House Democrats and could still change quite a bit as it is sure face opposition in the divided Senate.

We will continue to follow its progress and update this page with the latest as it hopefully moves forward.

Does your electric vehicle qualify for tax credit?

Now that you understand what hurdles you may have to overcome to qualify for the federal tax credit, let’s see how much that EV in your driveway might be able to save you this year.

Please note that these qualifying vehicles are relevant at the time this post has been published. We will update this page as the vehicles and their designated credits change.

All-electric vehicles

| Make and Model | Full Tax Credit |

| AUDI | |

| e-tron Sportback (2020-2022) | $7,500 |

| e-tron SUV (2019, 2021-2022) | $7,500 |

| BMW | |

| i3 Sedan (2014-2021) | $7,500 |

| i3s (2018-2021) | $7,500 |

| BYD | |

| e6 (2012-2017) | $7,500 |

| FIAT | |

| 500e (2013-2019) | $7,500 |

| FORD | |

| Focus EV (2012-2018) | $7,500 |

| Mustang Mach-E (all trims) (2021) | $7,500 |

| HYUNDAI | |

| Ioniq Electric (2017-2021) | $7,500 |

| Kona Electric (2019-2022) | $7,500 |

| JAGUAR | |

| I-Pace (2019-2021) | $7,500 |

| KANDI | |

| EX3 (2019-2021) | $7,500 |

| K22 (2019-2020) | $7,500 |

| K23 (2020-2021) | $7,500 |

| K27 (2020-2021) | $7,500 |

| KIA | |

| Niro EV (2019-2021) | $7,500 |

| Soul Electric (2015-2020) | $7,500 |

| MERCEDES-BENZ | |

| B-Class EV (2014-2017) | $7,500 |

| MINI | |

| Cooper S E Hardtop 2 & 4 Door (2020-2022) | $7,500 |

| MITSUBISHI | |

| i-MiEV (2012, 2014, 2016, 2017) | $7,500 |

| NISSAN | |

| LEAF (2011-2022) | $7,500 |

| POLESTAR | |

| Polestar 2 (2021) | $7,500 |

| Polestar 2 Long Range – Single & Dual Motor (2022) | $7,500 |

| PORSCHE | |

| Taycan (2020-2021) | $7,500 |

| SMART USA | |

| EQ fortwo Coupe (2019) | $7,500 |

| EQ fortwo Cabrio (2019) | $7,500 |

| TOYOTA | |

| RAV4 EV (2012-2014) | $7,500 |

| VOLKSWAGEN | |

| e-Golf (2015-2019) | $7,500 |

| ID.4 EV (First/Pro/Pro S) (2021) | $7,500 |

| VOLVO | |

| XC40 Recharge Pure Electric (2021-2022) | $7,500 |

Plug-in hybrid electric vehicles

Note: Here are some of the more popular models. The US Department of Energy offers the full detailed list on its website.

| Make and Model | Full Tax Credit |

| AUDI | |

| A3 e-tron / e-tron ultra (2016-2018) | $4,502 |

| A7 55 TFSI e Quattro (2021) | $6,712 |

| A7 TFSI e Quattro (2022) | $7,500 |

| A8L PHEV (2020) | $6,712 |

| A8L 60 TFSI e Quattro (2021) | $6,712 |

| Q5 PHEV (2020) | $6,712 |

| Q5 55 TFSI e Quattro (2021) | $6,712 |

| Q5 TFSI e Quattro (2022) | $7,500 |

| BENTLEY | |

| Bentayga Hybrid (2020-2021) | $7,500 |

| BMW | |

| i3 Sedan w/ Range Extender (2014-2021) | $7,500 |

| i3s w/ Range Extender (2018-2021) | $7,500 |

| BMW i8 (2014-2017) | $3,793 |

| i8 Coupe/Roadster (2018-2020) | $5,669 |

| X3 xDrive30e (2020-2021) | $5,836 |

| X5 xDrive40e (2016-2018) | $4,668 |

| X5 xDrive45e (2021-2022) | $7,500 |

| 330e (2016-2018) | $4,001 |

| 330e/330e xDrive (2021-2022) | $5,836 |

| 530e/530e xDrive (2018-2019) | $4,668 |

| 530e/530e xDrive (2020-2022) | $5,836 |

| 740e (2017) | $4,668 |

| 740e xDrive (2018-2019) | $4,668 |

| 745e xDrive (2020-2022) | $5,836 |

| CHRYSLER | |

| Pacifica Plug-In Hybrid (2017-2022) | $7,500 |

| FERRARI | |

| SF90 Stradale (2020-2021) | $3,501 |

| FORD | |

| C-Max Energi (2013-2017) | $4,007 |

| Fusion Energi (2013-2018) | $4,007 |

| Fusion Energi (2019-2020) | $4,609 |

| Escape Plug-in Hybrid (2020-2021) | $6,843 |

| FISKER AUTOMOTIVE | |

| Karma Sedan (2012) | $7,500 |

| HONDA | |

| Accord Plug-in Hybrid (2014) | $3,626 |

| Clarity Plug-in Hybrid (2018-2021) | $7,500 |

| HYUNDAI | |

| Ioniq Plug-in Hybrid (2018-2021) | $4,543 |

| Sonata Plug-in Hybrid (2016-2019) | $4,919 |

| JEEP | |

| Wrangler Unlimited PHEV (2021-2022) | $7,500 |

| KARMA | |

| Revero (2018-2020) | $7,500 |

| KIA | |

| Niro Plug-in Hybrid (2018-2021) | $4,543 |

| Optima Plug-in Hybrid (2017-2020) | $4,919 |

| LAND ROVER | |

| Range Rover/Sport PHEV (2019) | $7,087 |

| Range Rover/Sport PHEV (2020-2021) | $6,295 |

| LINCOLN | |

| Aviator Grand Touring (2020-2022) | $6,534 |

| Corsair Reserve Grand Touring PHEV (2021) | $6,843 |

| McLAREN | |

| Artura (2022) | $4,585 |

| MERCEDES-BENZ | |

| S550e Plug-in Hybrid (2015-2017) | $4,460 |

| GLE550e 4matic (2016-2018) | $4,460 |

| GLC350e 4matic (2018-2019) | $4,460 |

| GLC350e 4M EQ (2020) | $6,462 |

| S560e EQ PHEV (2020) | $6,462 |

| C350e (2016-2018) | $3,501 |

| MINI | |

| Cooper S E Countryman ALL4 (2018-2019) | $4,001 |

| Cooper S E Countryman ALL4 (2020-2022) | $5,002 |

| MITSUBISHI | |

| Mitsubishi Outlander Plug-in (2018-2020) | $5,836 |

| Mitsubishi Outlander Plug-in (2021) | $6,587 |

| POLESTAR | |

| Polestar 1 (2020-2021) | $7,500 |

| PORSCHE | |

| Cayenne S E-Hybrid (2015-2018) | $5,336 |

| Cayenne E-Hybrid / Coupe (2019-2020) | $6,712 |

| Cayenne Turbo S E-Hybrid / Coupe (2021) | $7,500 |

| Cayenne E-Hybrid / Coupe (2021) | $7,500 |

| Panamera S E-Hybrid (2014-2016) | $4,752 |

| Panamera 4 E-Hybrid (2018) | $6,670 |

| Panamera 4 E-Hybrid (2019-2020) | $6,712 |

| Panamera 4 E-Hybrid (2021) | $7,500 |

| SUBARU | |

| Crosstrek Hybrid (2019-2021) | $4,502 |

| TOYOTA | |

| Prius Plug-in Hybrid (2012-2015) | $2,500 |

| Prius Prime Plug-in Hybrid (2017-2021) | $4,502 |

| RAV4 Prime Plug-in Hybrid (2021) | $7,500 |

| VOLVO | |

| S60 (2019) | $5,002 |

| S60 (2020-2022) | $5,419 |

| S90 (2018-2019) | $5,002 |

| S90 (2020-2022) | $5,419 |

| V60 (2020-2022) | $5,419 |

| XC60 (2018-2019) | $5,002 |

| XC60 (2020-2022) | $5,419 |

| XC90 (2016-2017) | $4,585 |

| XC90 / XC90 Excellence (2018-2019) | $5,002 |

| XC90 (2020-2022) | $5,419 |

Other tax credits available for electric vehicle owners

So now you should know if your vehicle does in fact qualify for a federal tax credit, and how much you might be able to save.

Perhaps, however, you plan to buy the newly refreshed Tesla Model S or you already drive a 2017 Chevy Bolt and no longer qualify for any tax credit… at least not quite yet. Don’t worry! Before giving up hope on your tax break quest for the year, keep in mind the other incentives offered in each state.

State tax incentives

In additional to any federal credit you may or may not qualify for, there are a number of clean transportation laws, regulations, and funding opportunities available at the state level.

For example, in the state of California, drivers can qualify for a $2,000-$4,500 rebate or a $5,000 grant (based on income) on top of any federal credit received. Furthermore, states like California offer priority driving lanes and parking spots for EV drivers who qualify.

In New York, residents can receive either a $500 or $2,000 rebate depending on the base price of the EV purchased. Again, these incentives vary by state, and much like the federal tax credit, are contingent on multiple factors.

To check what incentives you may qualify for, the Alternative Fuels Data Center is a great resource from the US Department of Energy. This page allows you to tap or click your respective state and research what options might be available to you and your electric vehicle.

Tax incentives for Tesla buyers

If you’re a current or prospective Tesla owner and have read this far, you’re probably not super psyched right now. Tesla’s record number of sales is great for the automaker, but not for your tax return, right?

Although Tesla’s federal tax credit has driven off toward the sunset like its first-generation Roadster, drivers still have potential incentives at their disposal.

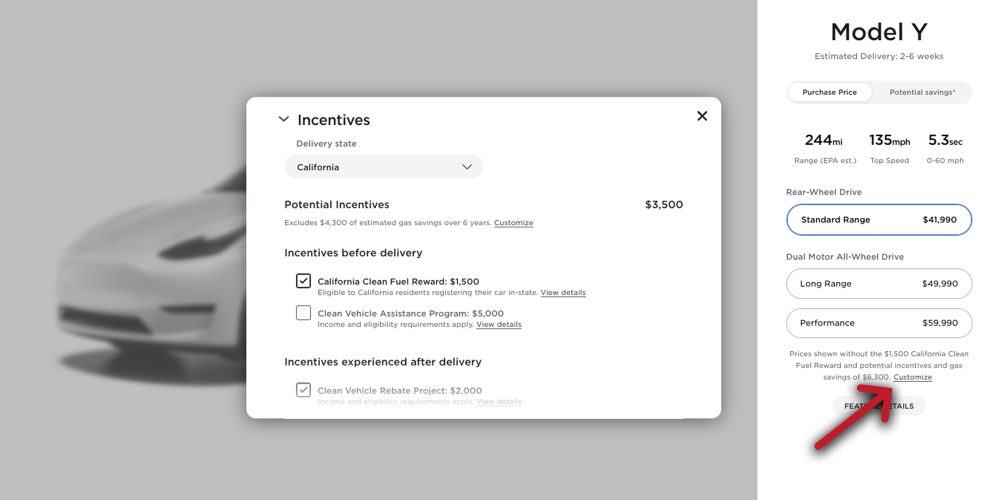

In fact, Tesla has compiled its own database of resources by state to help its customers calculate their potential savings before they even commit to buy.

Additionally, you can tap or click the “customize” link on any Tesla model purchase page. In addition to the “gas savings” tab, you can view “incentives” to check what tax credits may be available to you.

It’s also important to note that all incentives mostly apply to purchases by cash or loan only. Incentives for customers leasing a Tesla are currently only available in California, Colorado, Massachusetts, New York, and Tennessee.

Tax incentives on electric vehicles are worth the research

Hopefully this post has helped to incentivize you to use the resources above to your advantage.

Whether it’s calculating potential savings or rebates before making a new EV purchase or determining what tax credits might already be available to you for your current electric vehicle, there is much to discover.

Ditching fossil fuels for greener roadways should already feel rewarding, but right now the government is willing to reward you further for your environmental efforts.

Use it to your full capability while you can, because as more and more people start going electric, the less the government will need to reward drivers.

Subscribe to Electrek on YouTube for exclusive videos and subscribe to the podcast.

Author: Scooter Doll

Source: Electrek