Ledn has funded over $10 billion in bitcoin-backed loans across more than 100 countries since the company was founded in 2018.

Need Liquidity? Borrow Against Your Bitcoin and Keep Your Holdings

“Never sell your .” Those are Donald Trump’s words from July 2024 when he gave his keynote in front of an 8,000-person crowd at the Conference in Nashville, Tennessee. It’s a well-worn mantra in the community and it’s the main reason loans exist.

The cryptocurrency has enjoyed a compounded return of roughly 80% annually between 2015 and 2024, assuming a price of $430 for 2015 and $87,300 for 2024. Few, if any, assets can match that performance over an extended time horizon.

And that’s exactly why shrewd investors never sell. They buy the dip and hold on to their ( ). But often, a dilemma arises; what if that investor needs cash for a purchase but doesn’t have the money on hand? This is where loans come in.

Companies like offer loans that use as collateral. Essentially, borrowers can access cash without liquidating their . The entire process can be completed in a few hours, and no credit check is required. Here is a step-by-step overview of what that process looks like.

Step 1: Interest rates, KYC, and submitting a bitcoin loan application

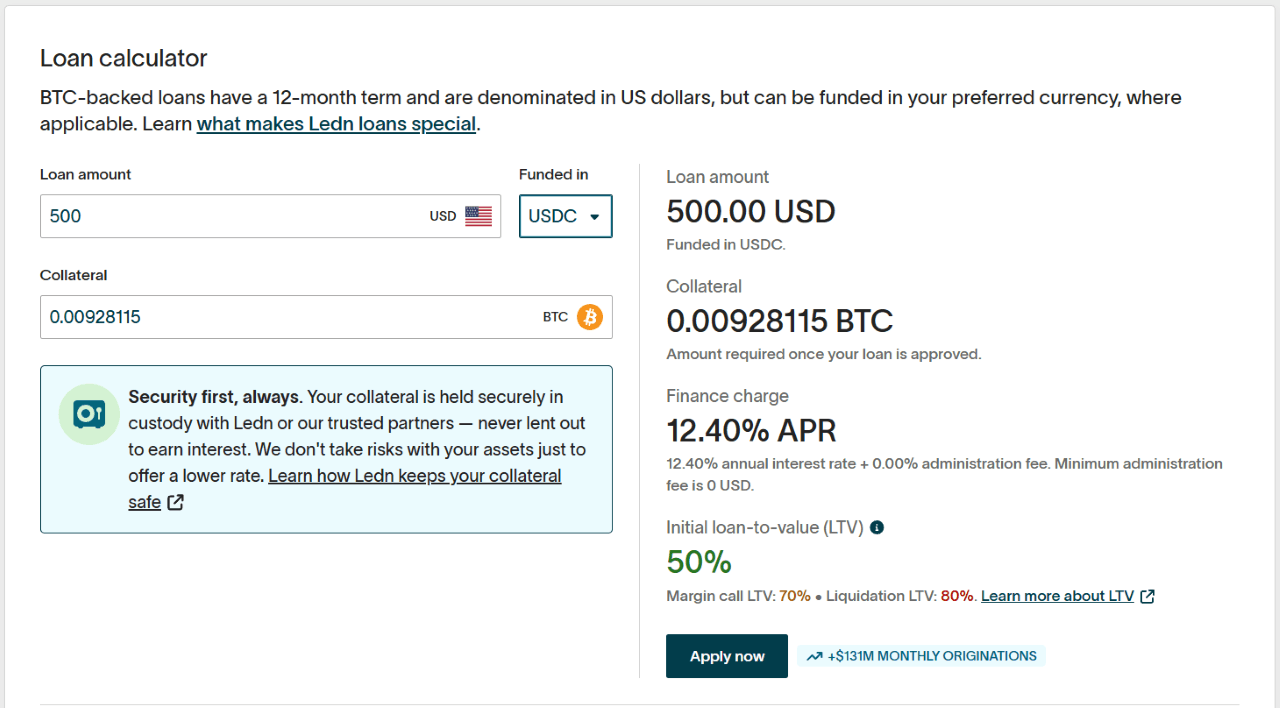

Ledn’s homepage currently displays a 12.40% annual percentage rate (APR) for its loans. It makes sense for an investor to borrow at that lower rate, rather than sell a high-yield asset such as which, as previously mentioned, returns about 80% per year. Potentially triggering a taxable event is another powerful deterrent against selling whenever cash is needed.

(Ledn’s standard LTV is 50%, which allows customers to borrow half the amount of their ’s dollar value / Ledn.io)

(Ledn’s standard LTV is 50%, which allows customers to borrow half the amount of their ’s dollar value / Ledn.io)

loans, including those offered by Ledn, tend to be over-collaterized, meaning the collateral is worth more than the borrowed amount. This protects Ledn from default in the event of a precipitous drop in price. Loan-to-value (LTV) is a ratio that divides the loan amount by the value of the collateral. Ledn’s standard LTV is 50%, which allows customers to borrow half the amount of their ’s dollar value. Over-collateralization also enables borrowers to take out loans with no credit check since the risk of default has already been significantly mitigated.

After reviewing terms such as APR and LTV, determining the desired currency, and adding a crypto address or bank account to receive proceeds from the loan, identity documents must be provided to satisfy know-your-client (KYC) requirements. A simple loan agreement can be submitted afterwards. The official turnaround time for approval is 1-2 business days, but often, a decision can be made within minutes.

Step 2: Depositing collateral

Ledn requires borrowers to deposit their collateral within ten days of receiving a loan approval. The process is simple and straightforward, especially when done with . is simply sent from a personal wallet to Ledn’s public address.

Step 3: Receiving loan funds

A loan shows up as “active” on Ledn’s dashboard once a user is in receipt of loan proceeds. The money is deposited in a bank account or crypto wallet depending on the type of currency selected during the first step. Some borrowers may also choose to deposit additional collateral to lower their LTV ratio.

Step 4: Loan repayment

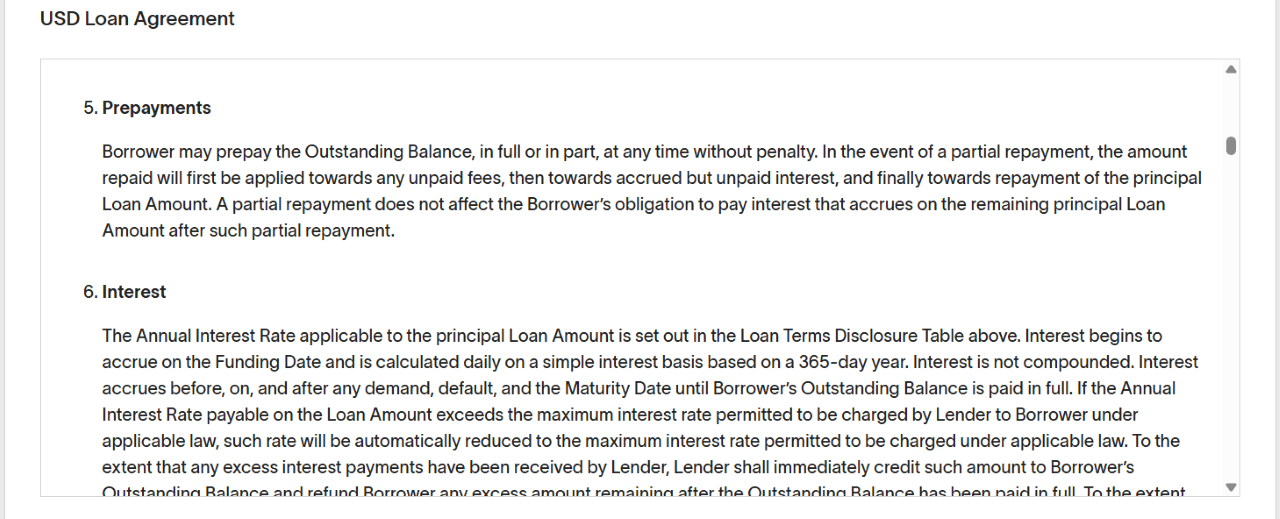

(Ledn does not penalize borrowers for early repayment / Ledn.io)

(Ledn does not penalize borrowers for early repayment / Ledn.io)

, USDC, or fiat can all be used to pay off an outstanding loan whenever the borrower decides. There’s no penalty for early repayment. If the loan hasn’t been fully paid off after the standard 12-month loan period, it can be renewed if it still meets the minimum criteria.

Conclusion

It may initially seem odd that a borrower would seek a loan worth half the value of collateral required, but is unique in that it boasts some of the highest returns of all time; returns that are higher than most borrowing costs. Add to that the relative ease and speed with which a Ledn loan can be processed, and the choice becomes a no-brainer.

Author: Frederick Munawa

Source: Bitcoin

Reviewed By: Editorial Team