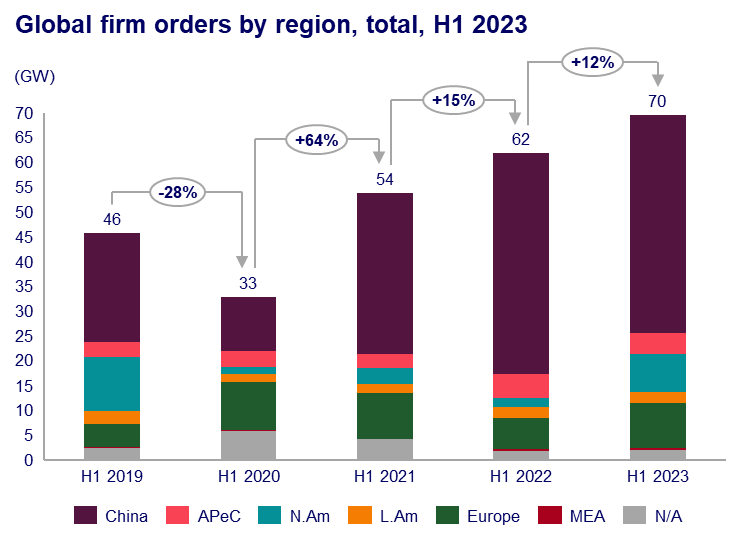

Global wind turbine order intake reached new highs in the first half of 2023 with 69.5 gigawatts (GW) of activity, a 12% increase year-over-year, according to new analysis from Wood Mackenzie.

Orders from outside of China, which saw more than 25 GW of order demand for a 47% increase year-over-year through the first half, were a big driver of this activity.

North America saw orders reach 7.7 GW, more than quadrupling the first half of 2022’s total of 1.9 GW, with two offshore orders accounting for 49% of the total. China overwhelmingly remains the largest market, with 44 GW of activity in the first half, but demand was flat year-over-year.

In total, global wind turbine orders accounted for $25.3 billion in the second quarter, and $40.5 billion in the first half of 2023.

“We’ve seen strong demand outside of China this year, which is really encouraging,” said Luke Lewandowski, vice president, global renewables research at Wood Mackenzie:

Supply chain challenges remain, but conditions have improved enough to spark procurement decisions. Momentum from the Inflation Reduction Act in the US has helped to motivate order activity, although increasing clarity and market certainty will drive an even larger volume.

China’s intake continues to be incredibly impressive as well, even with activity remaining flat through the first half of the year. Demand in the global offshore market, particularly in the US and Europe, has been one of the main drivers of this growth.

Offshore wind order intake increased 26% year-over-year in the first half to a record 12 GW of activity and 17% of all order capacity. Quarterly, offshore order capacity was up 48% year-over-year, totaling 9.1 GW, also setting a record.

Offshore wind developers like Ørsted and Siemens Gamesa are having some serious difficulties lately, but Lewandowski also noted:

We saw several really big deals officially reach a final investment decision in Q2, including orders of 2,640 MW and 1,176 MW in North America, which helped drive the record numbers and breathe some life into these markets.

The fact that these deals became firm during a difficult time for OEM financials and amid the cancellation of several offtake agreements for large projects is both encouraging and significant.

Despite its problems, the surge in offshore activity pushed Spanish-German wind giant Siemens Gamesa Renewable Energy (SGRE) to the top spot in new order capacity across both the onshore and offshore sectors – 5.9 GW – in the second quarter, as it set an offshore intake quarterly record with its SG 14.X DD turbine.

China’s Goldwind had the second-highest amount of total order intake activity in the second quarter with 4.9 GW, followed by China’s Windey, with 4.4 GW.

For the first half, the overall order intake leaders were China’s Envision at 9.7 GW, China’s Windey 8.7 GW, and SGRE at 8.2 GW.

Photo: Siemens Gamesa; Chart: Wood Mackenzie

If you’re considering going solar, it’s always a good idea to get quotes from a few installers. To make sure you find a trusted, reliable solar installer near you that offers competitive pricing, check out EnergySage, a free service that makes it easy for you to go solar. It has hundreds of pre-vetted solar installers competing for your business, ensuring you get high-quality solutions and save 20-30% compared to going it alone. Plus, it’s free to use, and you won’t get sales calls until you select an installer and share your phone number with them.

Your personalized solar quotes are easy to compare online and you’ll get access to unbiased Energy Advisors to help you every step of the way. Get started here. –ad*

Author: Michelle Lewis

Source: Electrek