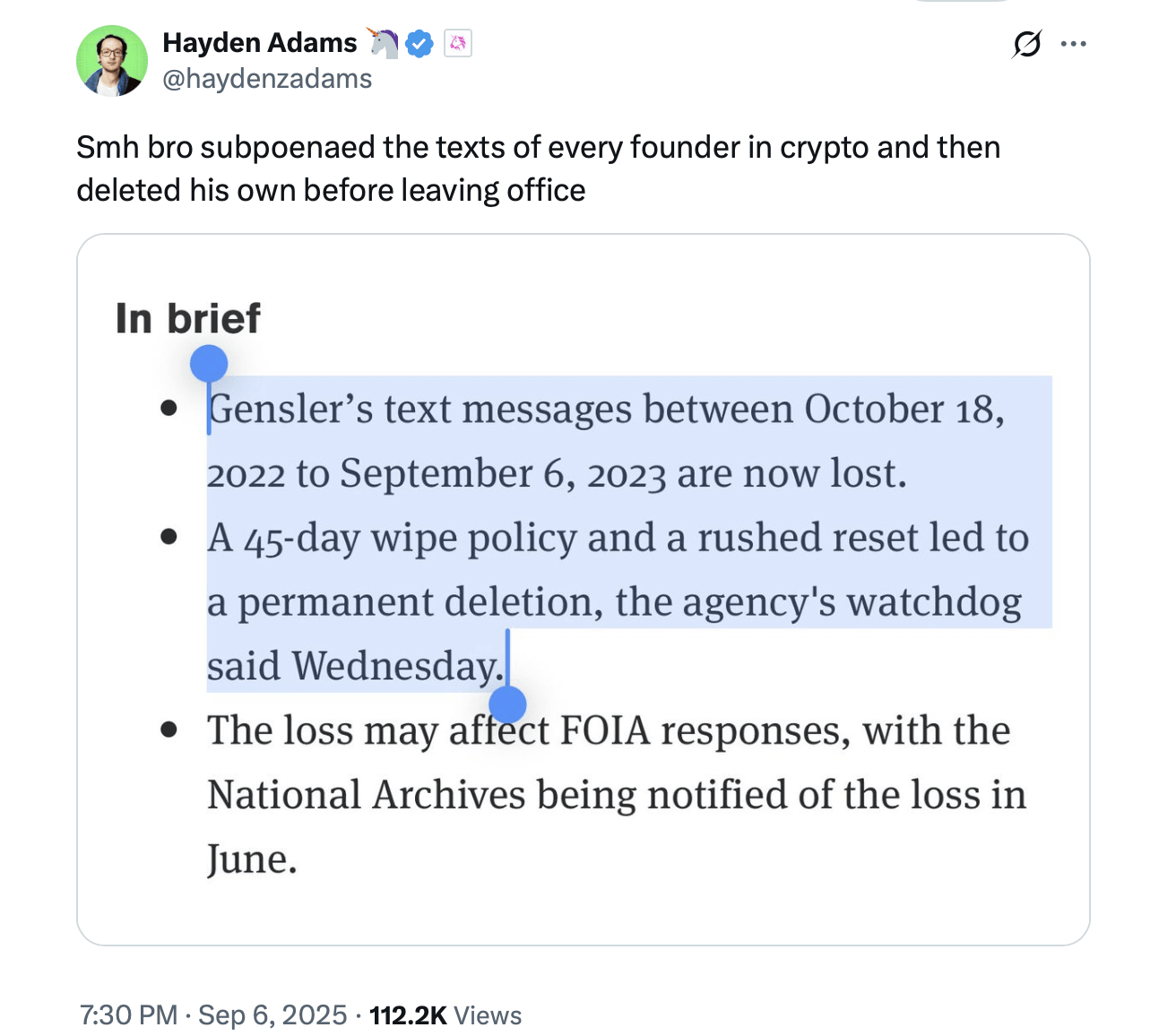

The crypto industry is denouncing the U.S. Securities and Exchange Commission after the agency’s inspector general said nearly a year of text messages from former Chair Gary Gensler’s government phone were irretrievably lost because of “avoidable errors.”

SEC Agrees to Fixes After Gensler Text Loss; Crypto Sector Sees Double Standard

The SEC’s Office of Inspector General (OIG) disclosed that texts were wiped amid technical and procedural failures inside the Office of Information Technology, spanning Oct. 18, 2022, to Sept. 6, 2023—an interval that overlapped with major crypto enforcement actions, litigation, and market events. The OIG detailed a chain of mistakes: a mobile-device sync failure flagged in July 2023, an automated “inactive device” wipe on Aug. 17, 2023, and a later factory reset that erased remaining data and logs. The official report was published Sept. 4, 2025.

The watchdog further said the problems reflected broader gaps in change management, backups, logging, and vendor coordination, including for “Capstone” officials whose communications are federal records. The SEC told the OIG it has since disabled agency texting with limited exceptions and put interim backups in place for senior officials. The agency also notified the National Archives and Records Administration in June 2025 and agreed to all five OIG recommendations with a target to complete changes by November.

Partial reconstruction efforts produced roughly 1,500 messages from matching processes, of which about 38% were “mission-related,” according to the report. The OIG said a portion of the unrecovered material likely qualified as federal records that should have been preserved indefinitely.

Reaction from crypto lawyers, executives, and advocates was swift. Critics argued the agency applied a double standard by penalizing financial firms more than $2 billion for failing to retain “off-channel” communications while losing the chair’s texts during an aggressive period of crypto enforcement. They said the deletions could impair Freedom of Information Act responses and discovery in ongoing matters, including high-profile cases against exchanges.

The OIG did not find evidence of deliberate destruction, characterizing the incident as preventable missteps rather than intent. Still, prominent industry figures used the report to renew calls for independent oversight of regulators’ communications and for clearer retention rules covering modern messaging tools used by senior officials.

The controversy comes against the backdrop of the FTX collapse, court rulings on crypto exchange-traded fund matters, and lawsuits involving major crypto platforms. With trust already strained, the disclosures have intensified friction between the Biden administration’s SEC and digital-asset firms that have long criticized what they describe as “regulation by enforcement.”

Author: Jamie Redman

Source: Bitcoin

Reviewed By: Editorial Team