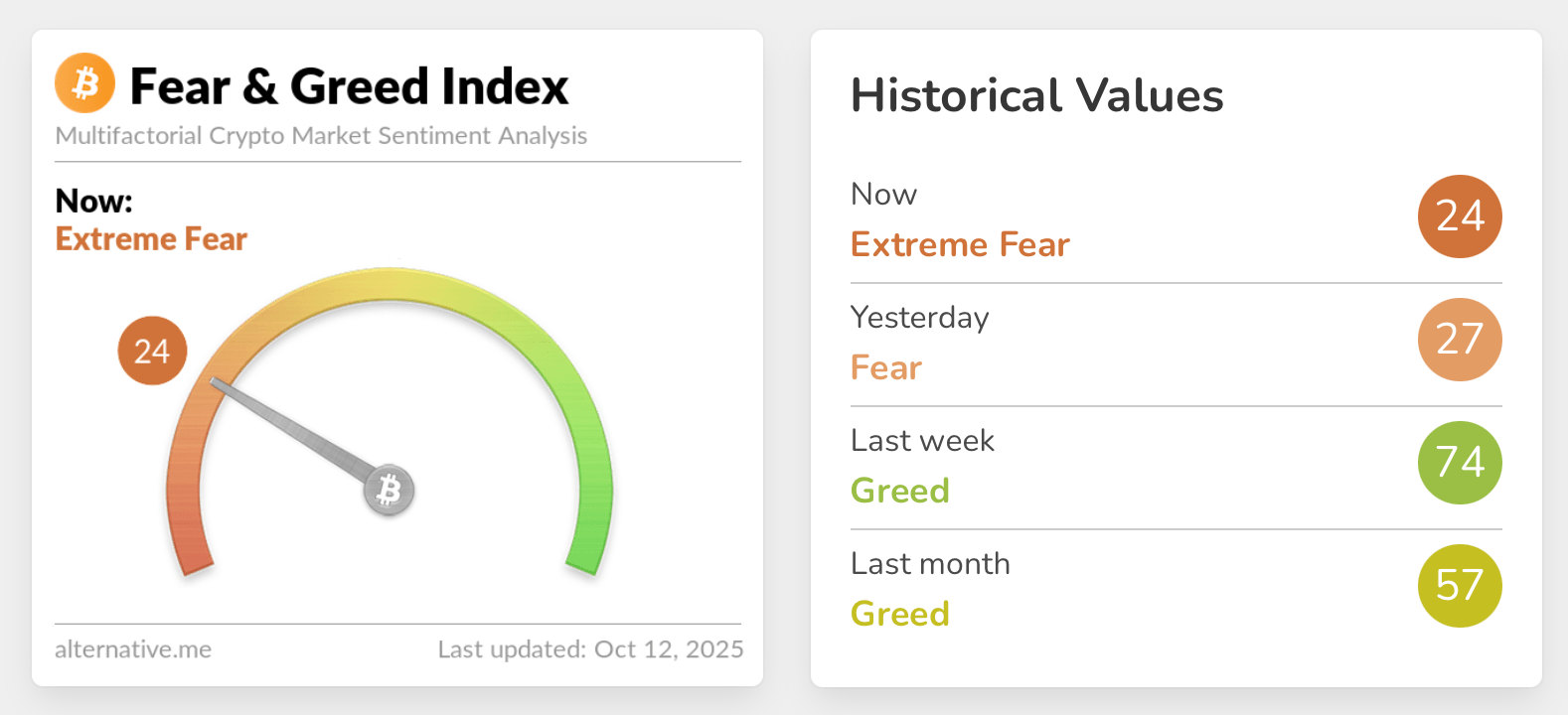

According to recent data, the Crypto Fear and Greed Index (CFGI) over at alternative.me has slid deep into the “extreme fear” zone, flashing a chilly 24 out of 100. Meanwhile, Coinmarketcap’s CMC Fear and Greed Index (CMC FGI) is clinging a little higher at 31 out of 100—still in “fear” territory. Translation? Panic hasn’t completely taken over yet, but it’s definitely lurking around the corner.

Crypto Traders Brace for Turbulence as Fear Levels Deepen Across Indexes

The ’s looking a bit healthier these days, but it’s still shy of the $4 trillion milestone—currently sitting at a cool $3.84 trillion. At the same time on Sunday afternoon, the fear and greed meters on coinmarketcap.com (CMC) and alternative.me hung low, signaling that traders still aren’t exactly brimming with confidence.

The and the serve as mood rings for the crypto crowd, measuring investor sentiment on a scale of 0 to 100. These two popular gauges track the balance between fear and greed, helping traders spot when the market’s trembling too hard—or getting a little too euphoric for its own good.

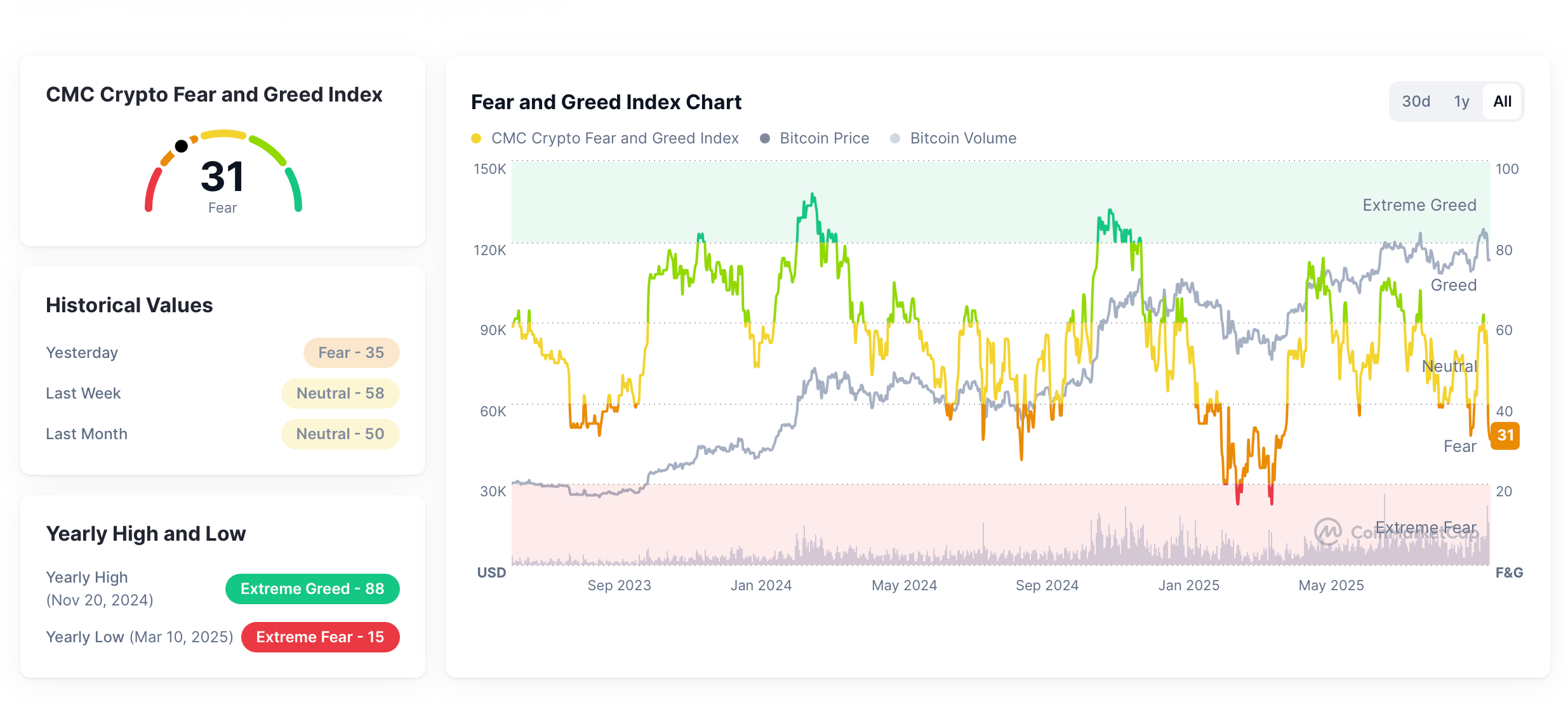

CMC Fear and Greed Index (CMC FGI).

CMC Fear and Greed Index (CMC FGI).

The CMC FGI measures the pulse of the crypto market by crunching several critical data points, including some of CMC’s own proprietary data. Meanwhile, alternative.me’s CFGI runs on a similar 0–100 scale but mixes things up with its own blend of weighted metrics to capture a slightly different flavor of market mood.

Right now, the two indexes are singing slightly different tunes — the CMC FGI sits at 31 on Sunday, while the CFGI trails behind at 24, offering a pair of perspectives on the crypto crowd’s current jitters. A score of 24 signals “extreme fear,” while 31 teeters just above it—still firmly planted in the “fear” zone, but not yet full-blown panic mode.

Crypto Fear and Greed Index (CFGI).

Crypto Fear and Greed Index (CFGI).

In times like these, fear can be both a warning and an opportunity. When sentiment dips this low, seasoned investors often see it as a sign that the market may be oversold—a potential setup for a rebound once confidence starts creeping back in. But that optimism isn’t automatic; with uncertainty still hovering and macroeconomic factors adding pressure, the road to recovery will likely be uneven.

For now, the indexes are telling a story of hesitation—a reminder that emotion continues to drive much of crypto’s wild rhythm. Still, market sentiment is a fickle thing. Just as fear can freeze trading activity, it can also lay the groundwork for fresh optimism when the tide turns.

Whether the next move is a cautious rally or another slide deeper into fear territory, one thing’s clear: these indexes don’t just chart data—they typically map the collective psychology of a market constantly testing its nerve. In the volatile world of crypto, that emotional pulse might be the most valuable signal of all. But like in the crypto trading world, they’re more than crystal balls.

FAQ 🧭

- What is the Crypto Fear and Greed Index (CFGI)? It’s a sentiment tracker that measures crypto investors’ emotions on a scale from extreme fear to extreme greed.

- Why are the CFGI and CMC FGI scores different? Each index uses its own data sources and weighting methods, giving slightly different readings of market mood.

- What does a score in the “extreme fear” zone mean? It suggests traders are highly cautious or bearish, often signaling potential buying opportunities for contrarian investors.

- How can investors use fear and greed indexes? By monitoring shifts in sentiment, traders can gauge when markets may be overheated or undervalued.

Author: Jamie Redman

Source: Bitcoin

Reviewed By: Editorial Team