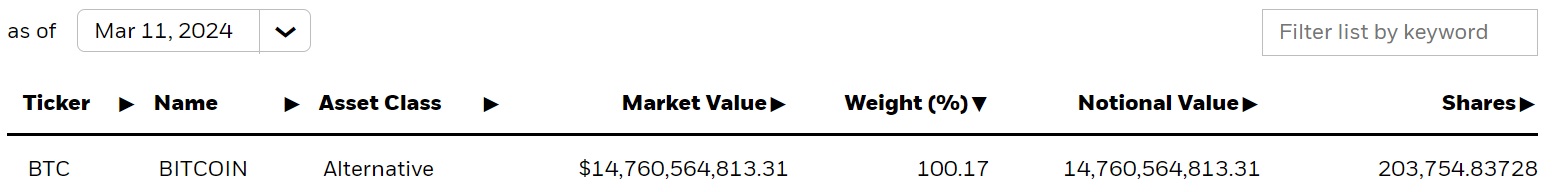

Blackrock, the world’s largest asset manager, has hit a significant milestone with its spot bitcoin exchange-traded fund (ETF), the Ishares Bitcoin Trust (IBIT). The fund’s crypto holdings have reached nearly 204K bitcoins, representing over $14.76 billion in assets under management (AUM).

IBIT’s Bitcoin Holdings Continue to Grow

Blackrock’s Ishares Bitcoin Trust (IBIT), the world’s largest asset manager’s spot bitcoin exchange-traded fund (ETF), has surpassed a staggering $14.76 billion in assets under management (AUM).

IBIT’s total bitcoin holdings as of March 11 were 203,755 BTC, worth $14.76 billion. The fund’s bitcoin holdings increased by 7,769.52 BTC from the previous trading day.

Ishares Bitcoin Trust received $562.9 million in inflows on Monday, making it the fourth-best day since its launch on Jan. 11. The only days with higher inflows were March 5, with $788.3 million, Feb. 28, with $612.1 million, and Feb. 29, with $603.9 million.

Blackrock remains the top performer in the spot bitcoin ETF market. On Monday, Fidelity’s Wise Origin Bitcoin Fund (FBTC) received $215.5 million in investments. The total inflow of all 10 U.S. spot bitcoin ETFs, which includes Grayscale’s Bitcoin Trust (GBTC), amounted to $505.5 million. However, GBTC experienced an outflow of $494.1 million.

The 10 spot bitcoin ETFs that launched on Jan. 11 are Blackrock’s Ishares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC), Ark 21shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), Invesco Galaxy Bitcoin ETF (BTCO), Wisdomtree Bitcoin ETF (BTCW), Vaneck Bitcoin Trust ETF (HODL), Franklin Bitcoin ETF (EZBC), Valkyrie Bitcoin ETF (BRRR), and Grayscale Bitcoin Trust (GBTC).

The price of bitcoin has soared over recent weeks, fueled by massive demand for spot bitcoin ETFs. Last week, Blackrock amended its prospectus, filed with the U.S. Securities and Exchange Commission (SEC), for the Blackrock Global Allocation Fund to potentially include investments in bitcoin exchange-traded products (ETPs).

Galaxy Digital CEO Mike Novogratz said last week that there is “runaway momentum” in spot bitcoin ETFs. Last month, reports indicated that Bank of America’s Merrill Lynch and Wells Fargo had begun offering spot bitcoin ETFs to clients. Moreover, a $30 billion investment platform for financial advisors, Carson Group, also approved four spot bitcoin ETFs on its platform, including IBIT.

Source: Bitcoin