Blackrock and Strategy entered 2026 controlling a massive share of bitcoin supply, highlighting accelerating institutional concentration as regulated ETFs and public companies tighten their grip on the world’s largest cryptocurrency.

Blackrock Starts 2026 Holding 774K Bitcoin While Strategy Pushes Holdings to 674K

Strategy Inc (Nasdaq: MSTR), and Blackrock’s Ishares Bitcoin Trust (IBIT) exchange-traded fund (ETF) entered 2026 holding a combined bitcoin balance that ranks among the largest concentrations of supply ever disclosed by public entities. Strategy filed a Form 8-K with the U.S. Securities and Exchange Commission (SEC) on Jan. 5, 2026, detailing new bitcoin purchases, equity sales, and reserve levels, while Blackrock released updated holdings data for its spot bitcoin ETF.

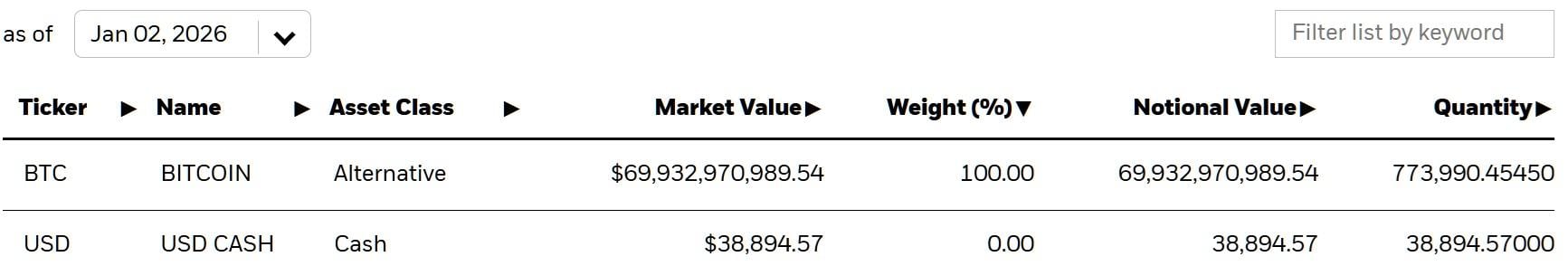

Blackrock, the world’s largest asset manager, reported that its Ishares Bitcoin Trust ETF held approximately 773,990 bitcoin as of Jan. 2. The position represented essentially the entirety of IBIT’s portfolio, carrying a market value near $69.93 billion with only a minimal cash balance.

The holdings snapshot was released with routine fund reporting, underscoring IBIT’s status as the largest spot bitcoin ETF by assets. With nearly 774K BTC, the fund alone accounted for a meaningful share of the circulating supply, underscoring the growing role of regulated exchange-traded products (ETPs) in absorbing bitcoin through traditional market structures.

IBIT’s rise reflects CEO Larry Fink’s shift on bitcoin, from massively criticizing it in 2017 to later calling it an “asset of fear” that can hedge against currency debasement and political instability. Last year, Fink said 2% to 5% sovereign wealth fund allocations could imply bitcoin prices of $500,000 to , and framed IBIT within a broader push toward tokenized markets rather than speculation.

Read more:

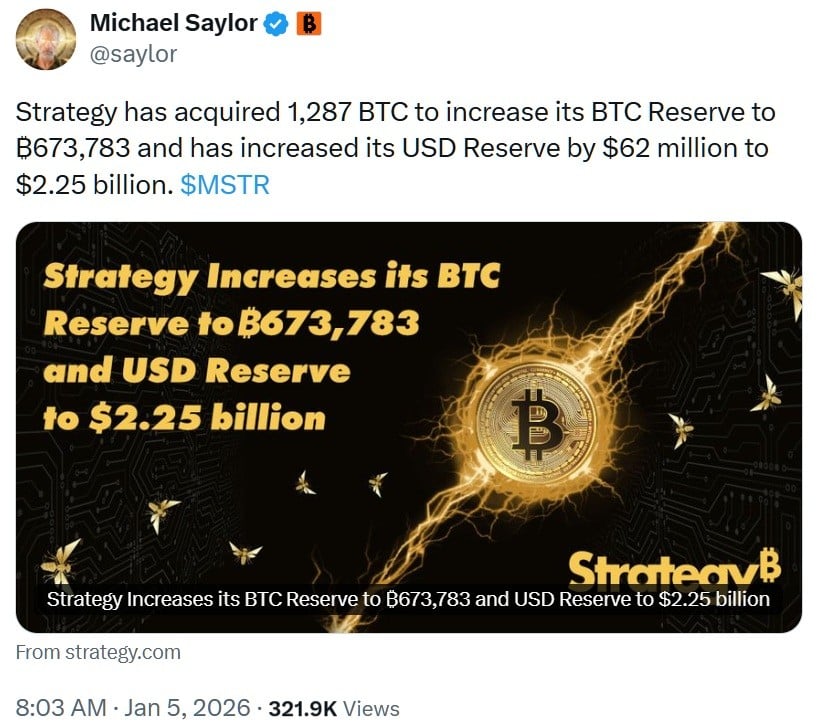

Strategy’s accumulation followed closely behind. Executive Chairman Michael Saylor disclosed on Jan. 5 that the firm recently acquired 1,287 bitcoin, lifting its BTC reserve to 673,783 and increasing its U.S. dollar reserve to $2.25 billion. The company reported that the purchases totaled approximately $116 million and were completed at an average price of about $90,391 per bitcoin, inclusive of fees and expenses.

The filing further shows that the purchases were funded through sales of Class A common stock under Strategy’s at-the-market program. Strategy sold 1,255,911 shares between Dec. 29 and Dec. 31 for $195.9 million in net proceeds and another 735,000 shares from Jan. 1 through Jan. 4 for $116.3 million, while preferred stock issuance programs remained unused. The report also outlined unrealized digital asset losses, deferred tax positions, and the maintenance of a $2.25 billion U.S. dollar reserve to support dividends and interest obligations.

Combined, Strategy and Blackrock’s IBIT began 2026 controlling roughly 1.45 million bitcoin, illustrating how large public companies and regulated ETFs continue to concentrate an increasing share of bitcoin supply.

FAQ 🧭

- Why does the combined bitcoin position of Strategy and Blackrock’s IBIT matter to investors? Together controlling roughly 1.45 million BTC, Strategy and IBIT highlight accelerating institutional concentration that can materially influence bitcoin liquidity, volatility, and long-term price dynamics.

- What does Blackrock’s IBIT holding nearly 774K BTC signal about ETF-driven demand? IBIT’s scale underscores how regulated spot ETFs are becoming a dominant channel for absorbing bitcoin supply through traditional capital markets.

- How is Strategy financing its continued bitcoin accumulation in early 2026? Strategy funded new purchases primarily through at-the-market sales of Class A common stock rather than debt or preferred equity issuance.

- What are the broader investment implications of this level of bitcoin concentration? Rising ownership by public companies and ETFs may tighten circulating supply, strengthen ’s institutional legitimacy, and amplify its role as a macro hedge asset.

Author: Kevin Helms

Source: Bitcoin

Reviewed By: Editorial Team