Analysts believe a bitcoin rally to $127,000 is possible if the cryptocurrency closes above the $120,000 mark with strong volume, but they warn of a potential retest of the $114,000 to $116,000 range if the rally is rejected.

BTC Enters ‘Wait-for-Confirmation’ Phase

Bitcoin (BTC) broke past the $122,000 mark late on Aug. 10, marking the first time it has tested that level since July 14. The top cryptocurrency’s surge, which has rekindled hopes of another milestone-setting rally, came just days after it briefly dropped below $113,000 for the second time in August.

Although it subsequently retreated to just above $120,000 a few hours later (7:18 a.m. EST on Aug. 11), some analysts believe BTC can still sustain a rally that will potentially reach a new all-time high. Digital asset platform Bitunix Analyst asserted that a top of $127,000 is possible, provided one key condition is met.

“ BTC is currently in a wait-for-confirmation phase. If BTC can break out with volume and close above 120k on the daily chart, the next targets will be 124,000 and 127,000. If it gets rejected at 120k or forms a long upper wick at highs, a retest of 116k–114k is possible,” the Bitunix analyst stated in the latest recommendation.

To prepare users for potential volatility, Bitunix advises setting a strict limit on potential losses for each individual position, with stop-losses kept within a predetermined range of 5% to 8% of their total capital. This strategy prevents a single unsuccessful trade from inflicting catastrophic damage on an entire portfolio. Investors are also encouraged to use scaled entries and apply trailing stops, which ensures losses are manageable and predictable.

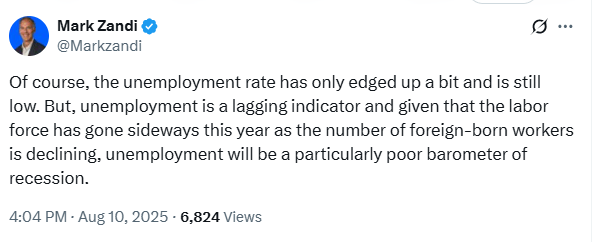

Meanwhile, Bitunix’s recommendation also urges investors to watch for the CPI data, which is set to be released on Aug. 12, and Moody’s follow-up reports. In a recent post on X, Mark Zandi, chief economist with Moody’s Analytics, repeated his warning about the U.S. economy being on the precipice of a recession but concluded by stating that “we are not there yet.”

The last CPI data, released by the Bureau of Labor Statistics (BLS), showed overall inflation had risen to 2.7% in June. The stronger-than-expected inflation data solidified the market’s view that the U.S. Federal Reserve would not cave in to President Donald Trump’s demand for an interest rate cut.

According to the Bitunix analyst, these events have the potential to shift market sentiment; hence, investors must be mindful of them.

“Closely monitor tomorrow’s CPI release and Moody’s follow-up reports, as sudden macro headlines could instantly shift market direction,” Bitunix stated.

Author: Terence Zimwara

Source: Bitcoin

Reviewed By: Editorial Team