Bitmine has crossed a notable threshold in corporate crypto accumulation, reporting ethereum holdings of more than 4 million tokens after a rapid buildup over the past several months.

Bitmine’s Ethereum Stack Tops 4 Million Tokens

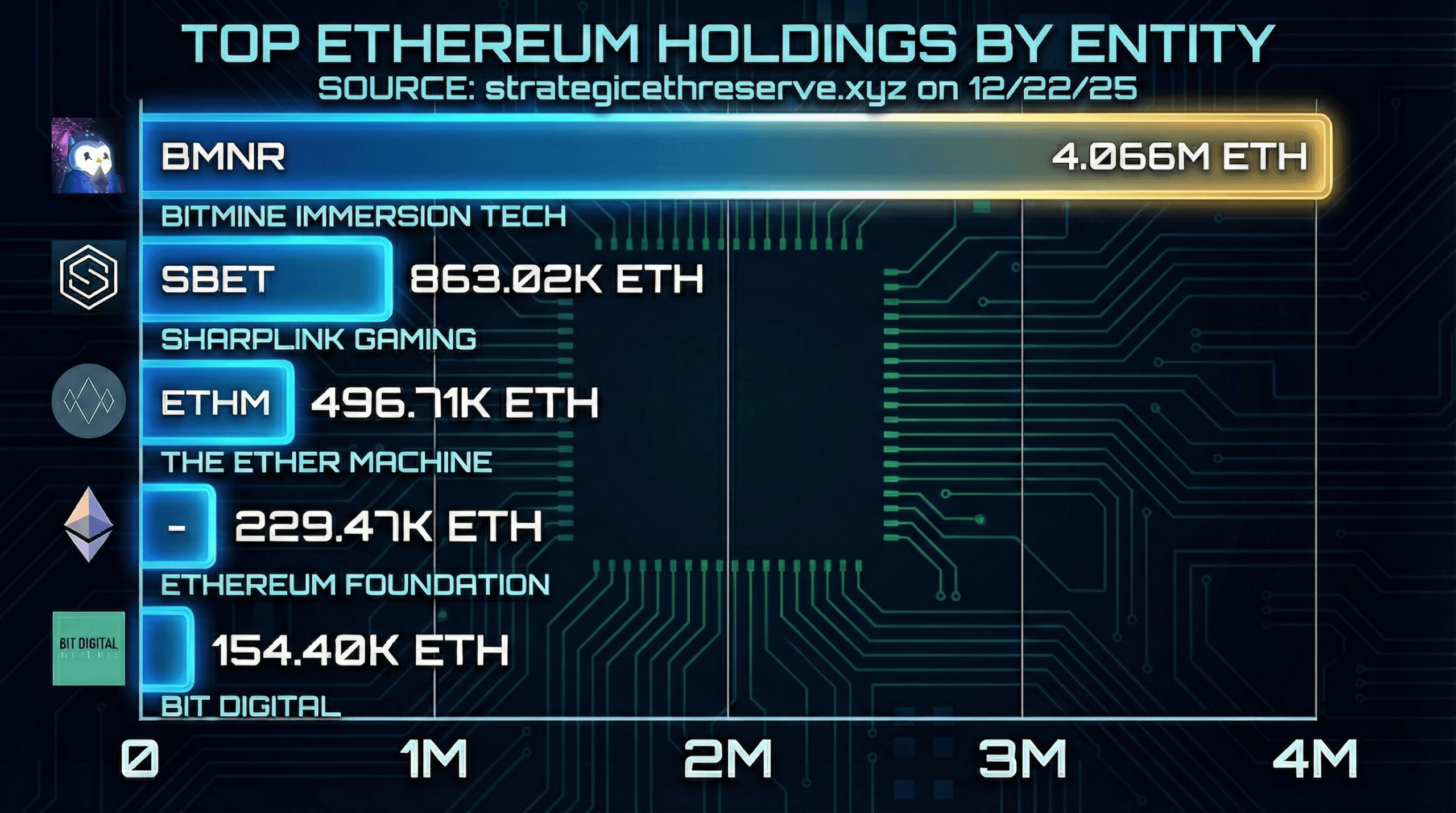

disclosed that it now holds approximately 4.066 million ethereum, representing about 3.37% of the network’s circulating supply, according to figures the company released on Dec. 22.

The disclosure places Bitmine among the largest known institutional holders of ether, a position typically occupied by exchanges, custodians, and early ecosystem participants rather than publicly traded companies.

The pace of accumulation stands out. Bitmine emphasized that it added nearly 99,000 ETH in the span of a single week and reached the 4 million mark roughly five and a half months after beginning its ethereum-focused strategy.

That speed may impress supporters, but it also raises familiar questions about concentration risk, liquidity, and how such large treasuries might behave during periods of market stress.

Company data show Bitmine’s combined crypto and cash holdings totaling about $13.2 billion, including $1 billion in cash and smaller allocations to bitcoin and other assets. Ethereum accounts for the overwhelming majority of that balance, making Bitmine’s financial profile closely tied to ETH price movements rather than diversified operational revenue.

In treasury rankings, Bitmine now claims the largest known holdings globally, trailing only in overall crypto treasury value due to Strategy’s sizable bitcoin position. The comparison highlights a growing split among crypto-focused public companies: some anchor their balance sheets to bitcoin, others to ethereum, with some focusing on other altcoin majors.

Also read:

Bitmine has also pointed to plans for staking infrastructure tied to its ETH reserves, targeting deployment in early 2026. While staking could generate yield, it also introduces operational and regulatory considerations that remain unsettled, particularly for firms holding assets at this scale.

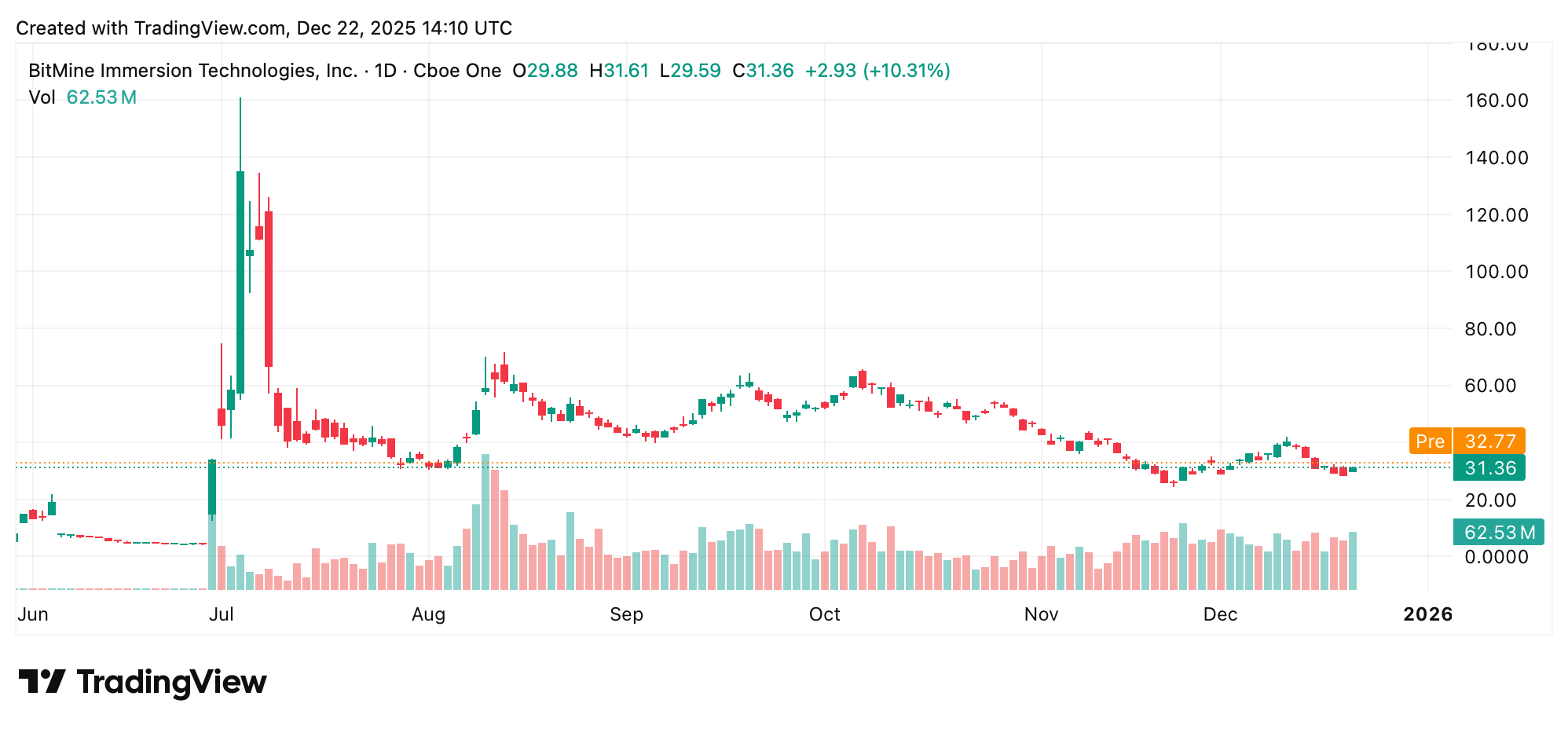

Bitmine’s have been riding the same choppy waves as the broader crypto downturn, even as the stock managed to post a tidy 10% gain at Friday’s close. Five-day data from NYSE American tell a less cheerful story, with BMNR down 18.55%, while the 30-day snapshot shows a milder 1.24% retreat. Still, zoom out far enough and the picture flips, as the stock is up an eye-catching 282% year-to-date.

For now, the milestone points to how quickly digital asset treasuries (DAT) can reshape ownership dynamics on major blockchains—whether that proves stabilizing or awkwardly lopsided is a question the market has not yet answered.

FAQ ❓

- How much ethereum does Bitmine hold? Bitmine reports holdings of about 4.066 million ETH.

- What share of ethereum’s supply is that? The holdings equal roughly 3.37% of ’s circulating supply.

- Does Bitmine hold other assets? Yes, including , cash, and smaller equity-style investments.

- Why does this matter? Large corporate holdings can influence , governance debates, and market perception.

Author: Jamie Redman

Source: Bitcoin

Reviewed By: Editorial Team