Bitcoin kicked off October full of vim and vigor, blasting to a fresh all-time high above $126,000 as “Uptober” lived up to its hype—while a jittery U.S. economy and government shutdown added drama to the backdrop.

Bitfinex Analysts: October’s Seasonality Signals More Bitcoin Upside

This week, Bitfinex analysts that ’s blistering comeback saw it defend key support near $107,500 before vaulting 17% from September’s lows to a new record high on Bitfinex. The digital asset’s rebound was powered by exchange-traded fund (ETF) inflows—averaging $647 million daily—and cooling inflation, leaving the Federal Reserve leaning dovish and traders confidently back in buy mode.

The market strategists at noted that “seasonality now supports a bullish outlook for ,” adding that October has delivered positive returns in nine of the past eleven years, averaging gains of roughly 21%.

That track record isn’t just trivia—it’s tradition. “Owing to its strong correlation with traditional finance, the broader liquidity cycle, and options market seasonality, the cryptocurrency market has historically tended to rally in October following weak Septembers,” the analysts wrote in the latest Bitfinex Alpha Market Report.

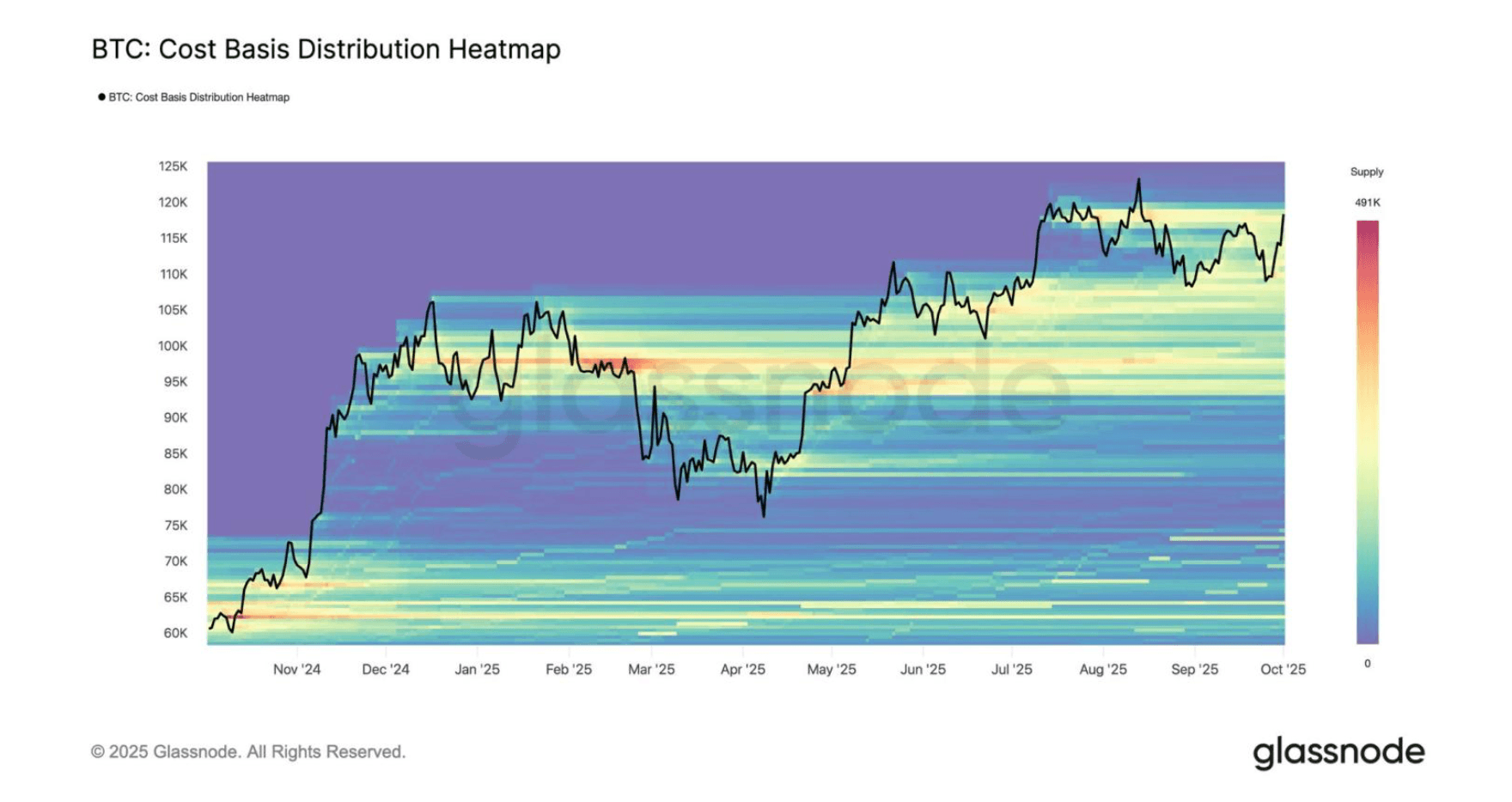

Cost Basis Distribution Heatmap via Glassnode. Source: Bitfinex Alpha Market Report.

Cost Basis Distribution Heatmap via Glassnode. Source: Bitfinex Alpha Market Report.

The pattern has earned October its “Uptober” nickname, and this year is following the script to perfection. The analysis also highlighted that Q4 has “consistently been ’s strongest quarter, with average returns of nearly 80%.” While minor corrections remain possible, Bitfinex analysts said “the broader context continues to favour a bullish fourth quarter,” with a dovish Fed, easing inflation, ETF inflows, and solid onchain support suggesting the market’s corrective phase “is likely behind us.”

Macro conditions, meanwhile, are wobbly. U.S. job openings held steady in August, but hiring plunged as small and mid-sized firms shed positions. The slowdown, paired with October’s government shutdown, risks further stalling economic momentum. Federal workers furloughed mid-month could push unemployment toward 4.8%, tightening consumer wallets even as equities cling to optimism.

Bitfinex analysts added that ’s strength “typically spills over to the broader market,” noting that while have shorter life cycles, ether has still averaged 22.29% Q4 gains since 2016. Together, they said, “cyclical liquidity, institutional inflows, and historical seasonality converge” to reinforce structural tailwinds for a stronger close to the year.

As of Oct. 7, has from its Sunday and Monday fireworks, slipping 2.7% to trade over $122,000 at 4:15 p.m. EST after briefly dipping to a low of $120,648. The pullback hardly dampens the broader “Uptober” mood, though—it looks more like a quick breather after the breakout, with traders eyeing whether the current footing can hold as the next launchpad for ’s fourth-quarter run.

With liquidity flowing, whales rebalancing, and “Uptober” still in full swing, the stage looks set for ’s next act.

Author: Jamie Redman

Source: Bitcoin

Reviewed By: Editorial Team