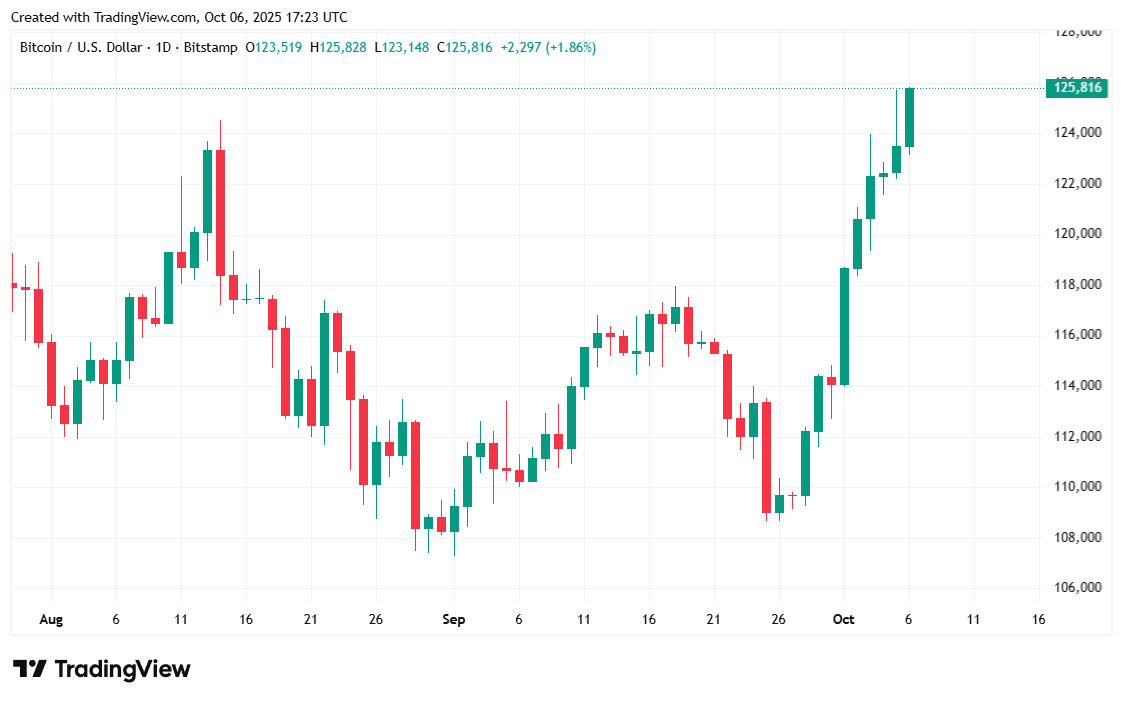

The cryptocurrency first rallied to a fresh all-time high of $125.5K early Sunday morning and set a new $125.8K record on Monday afternoon.

Is Bitcoin’s Rally Sustainable? Onchain Data Suggests It Is

Coinmarketcap data shows that ( ) quietly climbed past its previous high of $124,457.12 early Sunday morning and notched a fresh record of $125,559.21 without much fanfare. is now on track for a $126K record after Monday afternoon, and the relative lack of frenzy may be a sign of strong fundamentals, according to crypto data analytics firm Glassnode in its Market Pulse edition.

exchange-traded funds (ETFs) now hold $164.5 billion of the digital asset or roughly 6.74% of the entire market capitalization. Sosovalue.com shows that cumulative net inflows into exchange-traded funds (ETFs) exceeded $60 billion on Friday. Daily retail ETF demand on the same day was almost at $1 billion.

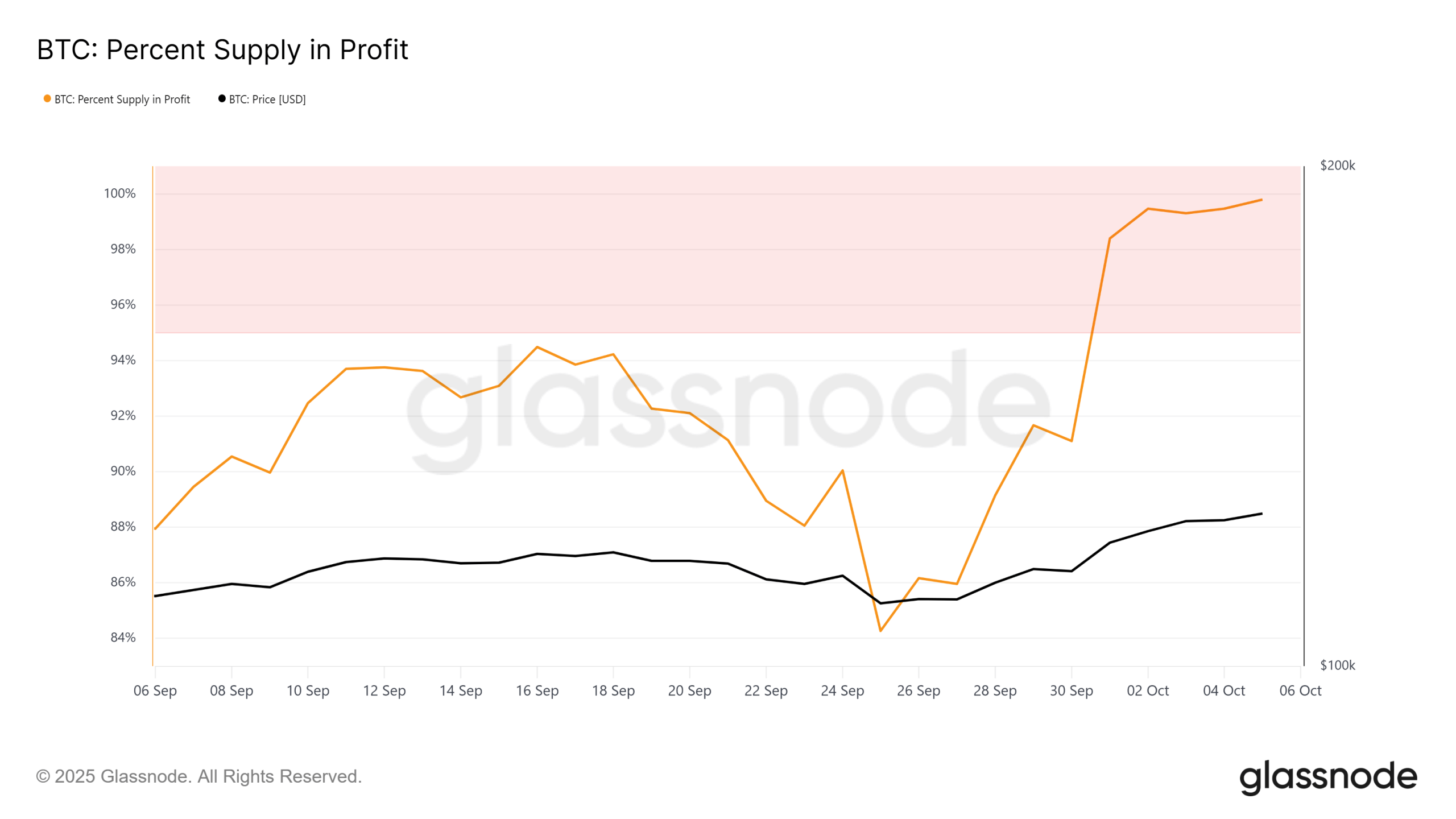

Glassnode data shows that on-chain activity is abuzz, with an 11% jump in active addresses. Almost every investor is in profitable territory should they decide to sell. The dollar value of all open futures contracts is nearing $100 billion. In other words, the dominant cryptocurrency is rallying, not because of mindless greed, but because its economic foundation is sound, at least for now.

(Almost all holders are currently sitting in a profitable position / Glassnode)

(Almost all holders are currently sitting in a profitable position / Glassnode)

“ ’s new all-time high is underpinned by a synchronized expansion across spot, derivative, and on-chain markets,” Glassnode explains. “Improving liquidity, robust ETF inflows, and rising onchain profitability highlight that this breakout is being supported by structural capital inflows and renewed investor participation, not speculative excess.”

Overview of Market Metrics

was trading at $125,282.56 at the time of reporting, up 1.83% in the last 24 hours and also up 9.87% over the past seven days, according to Coinmarketcap data. The digital asset traded as low as $122,526.45 and briefly surged past $126K on Monday afternoon, a new record.

( briefly topped $125.8K on Monday afternoon, a fresh all-time high / Trading View)

( briefly topped $125.8K on Monday afternoon, a fresh all-time high / Trading View)

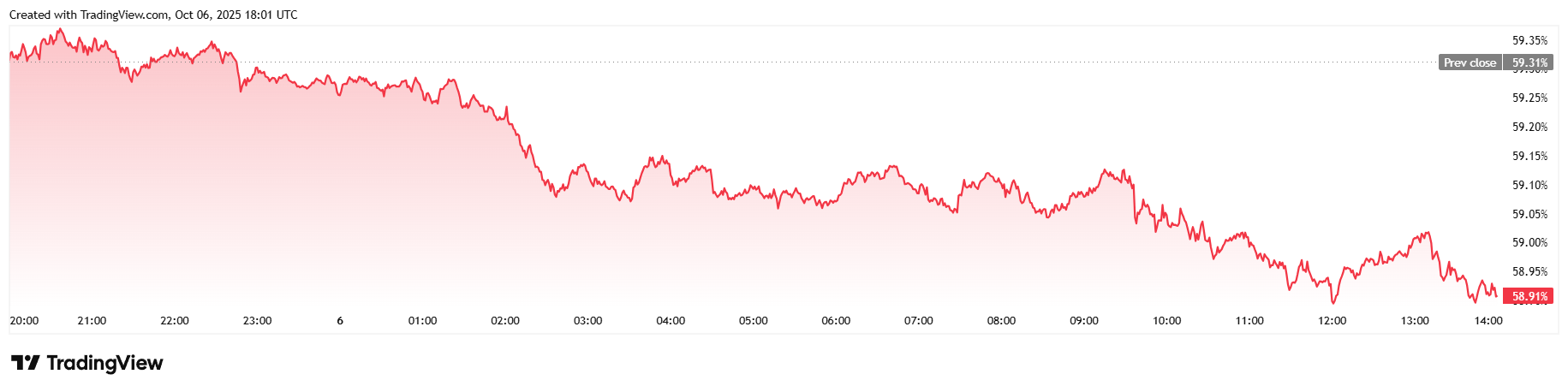

Surprisingly, twenty-four-hour trading volume dipped 7.22% to $64.35 billion on a day usually characterized by a post-weekend jump. The decrease in volume is likely due to the fresh high printed on Sunday, which subsequently triggered increased market activity yesterday. ’s market capitalization climbed 1.72% to $2.49 trillion, and dominance dipped 0.62% to 58.92%, suggesting a more pronounced rally in the altcoin market.

( dominance / Trading View)

( dominance / Trading View)

Total futures open interest soared to $95.34 billion, a 4% increase over 24 hours, according to Coinglass data. liquidations were relatively tame at $58.90 million, given the price rally seen over the past day. Predictably, short sellers bet the wrong way and were responsible for most of that liquidation total, losing $45.80 million. The remaining $14 million came from overzealous bulls who overextended their bets.

Author: Frederick Munawa

Source: Bitcoin

Reviewed By: Editorial Team